- US stocks opened higher

- Powell's speech at 6:00 pm BST

- Jobless claims above expectations

- American Airlines (AAL.US) and Tesla (TSLA.US) shares surge on upbeat earnings

US indices launched today's session sharply higher as investors welcomed upbeat earnings from Tesla and United Airlines while looking ahead to a speech from Fed Chair Powell and his view on FED's policy outlook and global economy. On the data front, weekly jobless jumped to 184k last week, slightly above market estimates of 180k. The Philadelphia Fed Manufacturing Index fell to 17.6 in April from 27.4 in March, below market expectations of 21, and pointing to a slowdown in manufacturing activity.

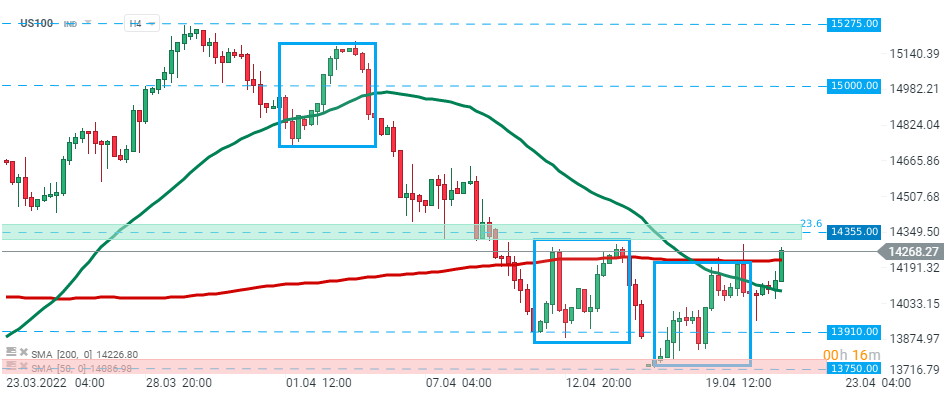

US100 launched today’s session higher and broke above 200 SMA (red line) and upper limit of the 1:1 structure. If current sentiment prevails, resistance at 14355 pts may be at risk. On the other hand, if sellers manage to regain control, nearest support to watch lies at 13910 pts. Source: xStation5

US100 launched today’s session higher and broke above 200 SMA (red line) and upper limit of the 1:1 structure. If current sentiment prevails, resistance at 14355 pts may be at risk. On the other hand, if sellers manage to regain control, nearest support to watch lies at 13910 pts. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCompany news:

American Airlines (AAL.US) shares jumped over 10.0% in premarket after the company posted a quarterly loss which was smaller compared to analysts estimates and expected profitability for the current quarter.

Tesla (TSLA.US) stock surged 9.5% in premarket after the biggest electric car manufacturer posted a record quarterly profit.

Equifax (EFX.US) shares plunged 11% before the opening bell after the consumer credit reporting agency forecast a sharp slowdown in mortgage credit enquiries over the rest of the year.

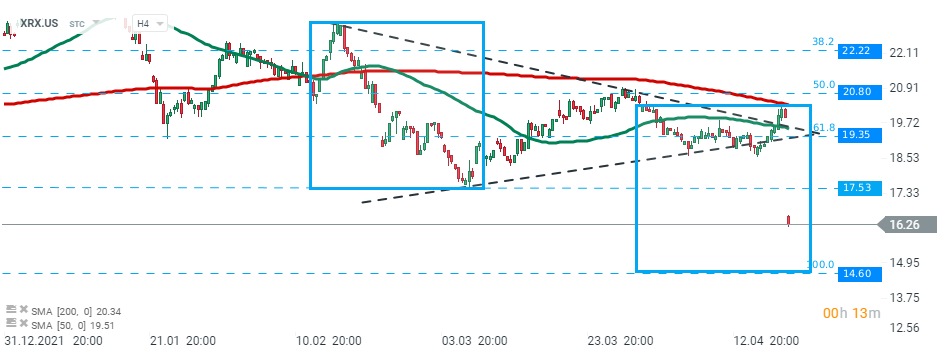

Xerox (XRX.US) stock fell more than 15.0% in the premarket after the office equipment producer reported an adjusted quarterly profit of 12 cents per share, slightly below analysts’ estimates of 11 cents per share as inflation pressures and supply chain issues negatively affected the company's performance. Xerox (XRX.US) stock launched today’s session with a massive bearish price gap and if current sentiment prevails downward move may accelerate towards support at $14.60 which is marked with the lower limit of the 1:1 structure and lows from July 2020. Source:xStation5

Xerox (XRX.US) stock launched today’s session with a massive bearish price gap and if current sentiment prevails downward move may accelerate towards support at $14.60 which is marked with the lower limit of the 1:1 structure and lows from July 2020. Source:xStation5