- Wall Street opens higher after NFP report

- Nonfarm payrolls increased by 187000 in July

- Amazon gains 9% at the market open

Investors reacted positively to a mixed jobs report with Wall Street experiencing a reversal from recent trends. Stocks are gaining with the S&P 500 halting a three-day drop, rising 0.11% and Nasdaq is up by 0.07%. Meanwhile, Treasury 10-year yields fell by seven basis points to 4.1%, sliding from the highest level since November. The dollar also weakened against all of its developed-market peers. This reaction came as traders saw an opportunity to unwind the week's moves, with the mixed labor-market figures leaving bets on the outlook for Federal Reserve policy largely unchanged.

The U.S. labor market report for July presented a complex picture, leading to mixed interpretations. Nonfarm payrolls increased by 187,000, which was somewhat less than forecasted and lower than the 200,000 mark for the first time since December 2020. On the other hand, average hourly earnings were up 0.4% from June and 4.4% from a year earlier, both stronger than anticipated, and the unemployment rate dropped to 3.5%. These figures signaled both softening in job growth and a solid rise in wages. Several economists commented on the implications, indicating that the Fed might pause at the next meeting in mid-September due to the labor market slowing down. However, others emphasized that the report was not a gamechanger, and further fed funds rate hikes could still be on the table later this year based on incoming data.

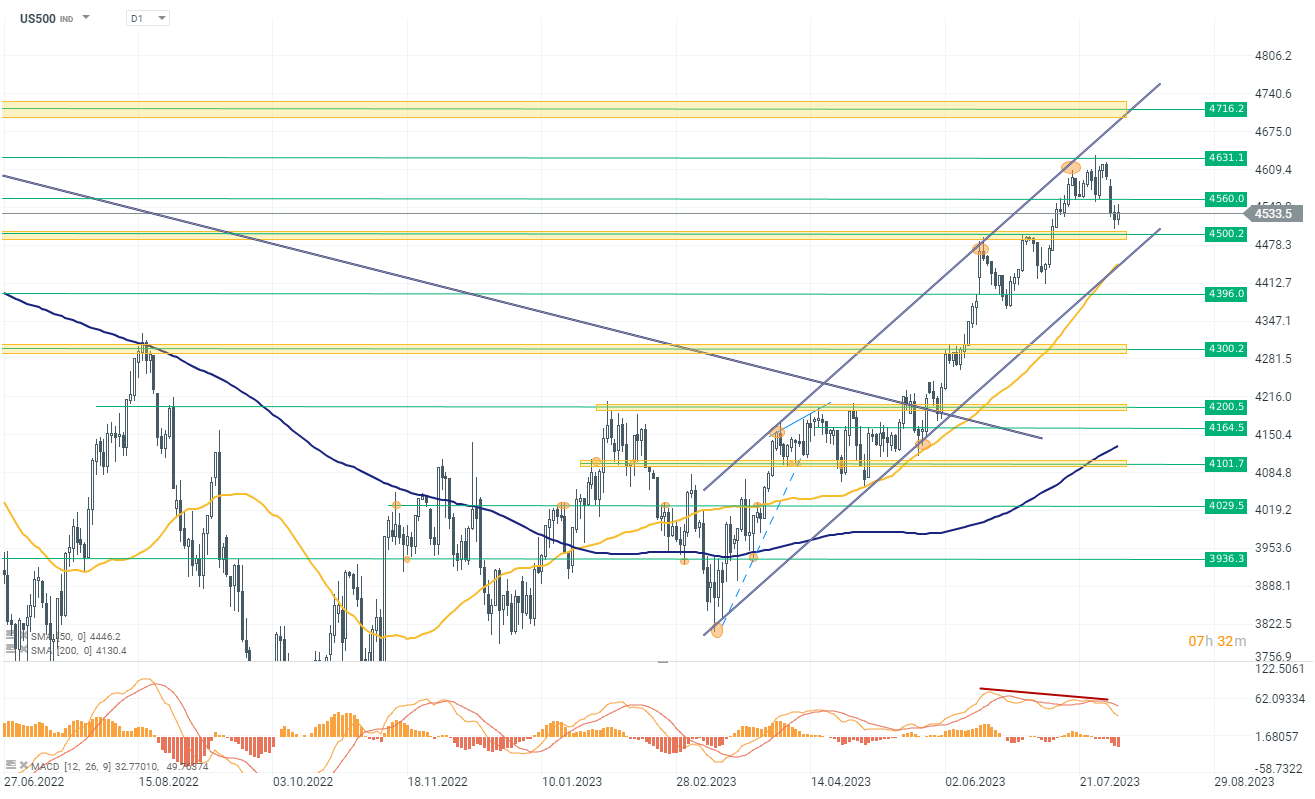

The SP500 CFD index (US500) is currently trading at 4530, marking an increase of +0.15% for the day. This uptrend comes in reaction to a mixed NFP report, prompting the market to react positively and open higher, snapping a four-day losing streak.

The SP500 CFD index (US500) is currently trading at 4530, marking an increase of +0.15% for the day. This uptrend comes in reaction to a mixed NFP report, prompting the market to react positively and open higher, snapping a four-day losing streak.

However, a bearish divergence on the MACD is indicating a potential slowdown in bullish momentum, a sign that the upward movement might not be sustained for long. Traders should keep a close watch on the next support level at 4500, a breach here could signal a further correction. On the upside, the resistance level to observe is at 4560 points. This could be tested if the current positive sentiment continues. Overall, the mixed signals from technical indicators recommend a cautious approach to the US500 index at this juncture.

Company News:

-

Apple's (AAPL.US) shares fell by 3.15% reflecting worries over a potential slowdown in demand for iPads and Macs in what is typically a challenging quarter for the company. Despite the overall revenue for the third quarter being in line with expectations at $81.80 billion, a decline of 1.4% year-on-year, certain segments such as iPad revenue dropped by a significant 20%. The company's fourth-quarter outlook, coupled with Rosenblatt Securities downgrading Apple to neutral from buy, has fueled concerns over a sluggish phase for the tech giant. Although some analysts remain optimistic, pointing to strengths in services and the expected release of the iPhone 15 series, the mixed quarter results and uncertainties surrounding future product success are leaving investors cautious.

-

Amazon's (AMZN.US) second-quarter results have driven an 10.2% jump in its share price in US premarket trading, beating expectations with a positive forecast that sparked optimism. The earnings highlight showed signs of stabilization in Amazon's cloud-computing business, AWS, with analysts expecting growth to pick up again and upgrading their ratings and price targets. The company reported net sales of $134.38 billion, an 11% increase year-over-year, with AWS net sales at $22.14 billion, up by 12%. Alongside the improvements in operating efficiency in the fulfillment network and the upbeat outlook from management, Amazon provided a forecast for the third quarter, expecting net sales between $138.0 billion to $143.0 billion. This strong performance seems to have alleviated past concerns regarding growth, particularly in AWS, and reflects a positive momentum in both its retail and cloud sectors.

-

Airbnb's (ABNB.US) share are gaining 1.20% after the second-quarter results beats expecttions. The revenue for the quarter was $2.48 billion, an 18% increase year-over-year, beating estimates of $2.42 billion. Although the 115.1 million nights and experiences booked marked an 11% rise from the previous year, it was the slowest growth rate since the pandemic shutdowns and fell short of the expected 117.8 million nights. Analysts regarded the results as solid overall, recognizing the better gross bookings and highlighting a slowdown in room nights growth. Despite some concerns, the third-quarter forecast sees revenue between $3.3 billion and $3.4 billion, exceeding the Bloomberg consensus estimate of $3.22 billion, and reflecting an ongoing positive trend for the company.

Airbnb (ABNB.US), H1 interval, source xStation 5

Airbnb (ABNB.US), H1 interval, source xStation 5

-

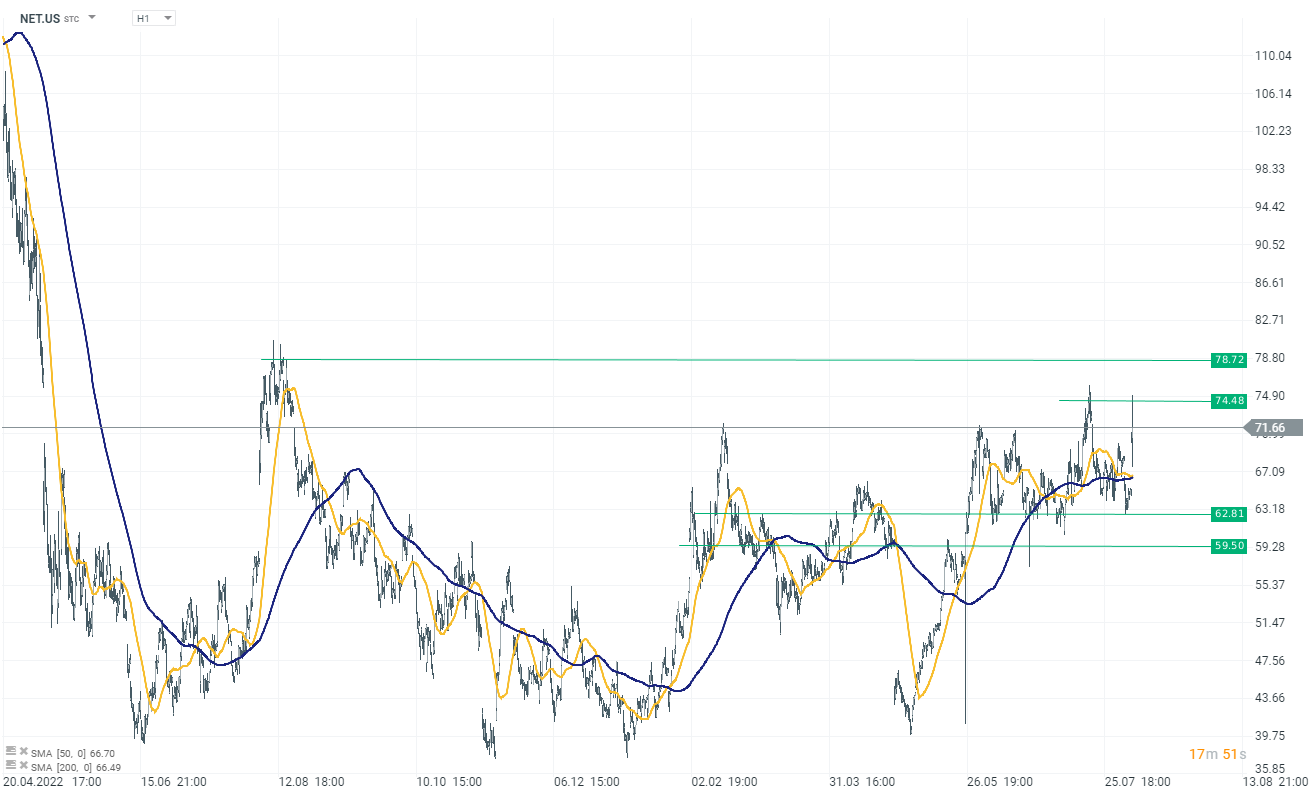

Cloudflare (NET.US), the cybersecurity company, saw its shares rally by more than 9.5% following the announcement of its second-quarter earnings that exceeded Wall Street expectations. Despite reporting a loss of $94.5 million or 28 cents per share, the adjusted net income was 10 cents a share, compared to a break-even in the same period last year. Revenue increased to $308.5 million from $234.5 million, beating the analysts' forecast of $305.6 million. Furthermore, Cloudflare's outlook for the third quarter and full year surpassed estimates, with the CEO expressing confidence in the company's positioning to become a leader in AI inferencing.

Cloudflare (NET.US), H1 interval, source xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report