- US stock opened higher

- US CPI inflation in line with expectations

- Crowdstrike (CRWD.US) stock surges after Goldman upgrade

US indices launched today's session higher following release of the CPI inflation report which showed that price pressures in March increased to 8.5%, in line with analysts’ estimates while core reading came below expectations, and some investors believe this may be a sign that inflation could be peaking. Today's publication overshadowed recent war related news. According to RIA, Putin said peace talks are at a dead end while the “military operation” is going as planned. Investors now await the beginning of the Q1 earnings season, with some banks and airlines reporting earnings on Wednesday.

US100 fell sharply in recent days however sellers struggled to break below local support around 13910 pts. Additionally CPI data provided some fuel for the bulls and index is currently heading towards resistance at 14355 pts which is marked with 23.6% Fibonacci retracement of the upward wave launched in March 2020 and previous price reactions. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCompany news:

Crowdstrike (CRWD.US) stock jumped over 5.0% in premarket after Goldman Sachs upgraded the cybersecurity company to ‘buy’ from ‘neutral’. Bank believes that Crowdstrike is “well positioned in the sweet spot of demand.”

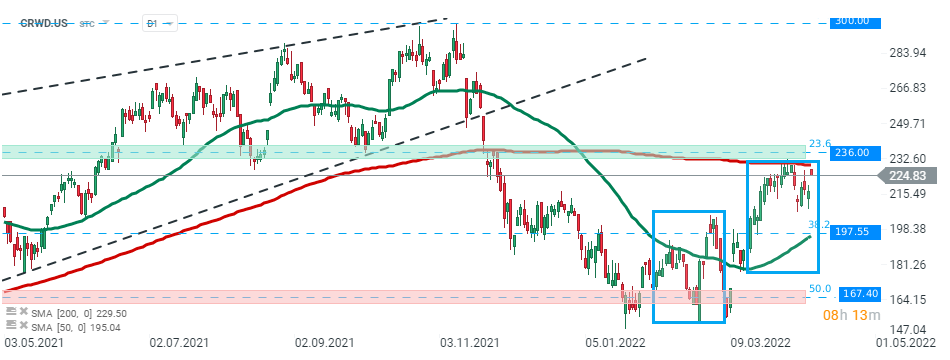

Crowdstrike (CRWD.US) stock launched today’s session with a bullish price gap and is heading towards major resistance zone around $236 which is marked with upper limit of the 1:1 structure, 23.6% Fibonacci retracement of the upward wave launched at the beginning of 2020 and 200 SMA ( red line). However if sellers will manage to regain control, then nearest support to watch lies at $197.55. Source: xStation5

Crowdstrike (CRWD.US) stock launched today’s session with a bullish price gap and is heading towards major resistance zone around $236 which is marked with upper limit of the 1:1 structure, 23.6% Fibonacci retracement of the upward wave launched at the beginning of 2020 and 200 SMA ( red line). However if sellers will manage to regain control, then nearest support to watch lies at $197.55. Source: xStation5

CarMax (KMX.US) stock fell more than 2.0% in the premarket after the auto retailer posted mixed quarterly results caused by lower sales volumes and higher than expected expenses.

Cisco (CSCO.US) stock plunged nearly 3.0% before the opening bell after Citigroup downgraded the technology company to ‘sell’ from ‘neutral’ as competition is expanding its market share.

Meta Platforms (FB.US) stock rose slightly in premarket after CEO Zuckerberg announced the social media giant will begin trial of selling items within its virtual reality platform Horizon Worlds.