- Weekly jobless claims fall to a pandemic low of 498k

- Dow Jones up for 4th day

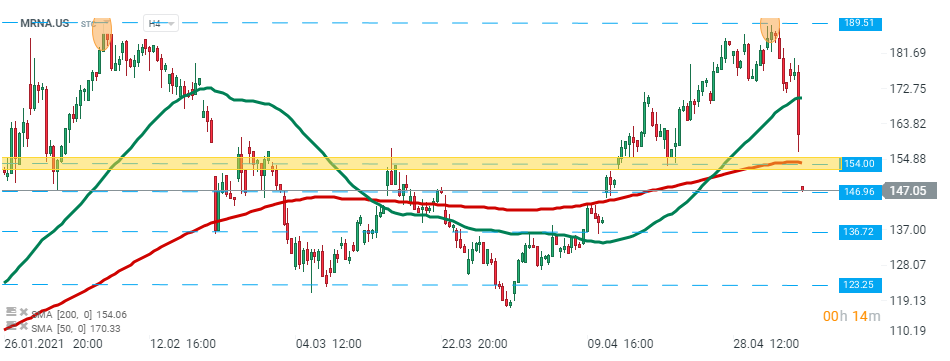

- Moderna (MRNA.US) stock plunged 9% after Biden commits to waiving vaccine patents

US indices launched today's session in mixed moods, with Dow Jones is trading near record highs while Nasdaq fell slightly, dragged down by shares of vaccine makers following U.S. President Joe Biden's decision to support a waiver of intellectual property rights for COVID-19 vaccines. On the data front, weekly jobless claims dropped more than expected to a new year low; planned layoffs in April were at the lowest level since 2000; and first-quarter labor productivity growth came in above market estimates.

US2000 pulled back after failing to break above the major resistance at 2248 pts which coincides with the upper limit of the descending channel and 200 SMA (red line). If the current sentiment prevails then downward move may be extended towards support at 2207 pts which coincides with the earlier broken upper limit of the triangle pattern. However, if bulls will manage to regain control, then another upward impulse towards resistance at 2305.3 pts may be launched. Source: xStation5

US2000 pulled back after failing to break above the major resistance at 2248 pts which coincides with the upper limit of the descending channel and 200 SMA (red line). If the current sentiment prevails then downward move may be extended towards support at 2207 pts which coincides with the earlier broken upper limit of the triangle pattern. However, if bulls will manage to regain control, then another upward impulse towards resistance at 2305.3 pts may be launched. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appModerna (MRNA.US) stock dropped more than 9.0% in premarket trading after the drugmaker posted mixed quarterly results. Earnings beat expectations however revenue fell short of forecasts. Moderna raised its sales forecast for its Covid-19 vaccine for 2021 by 4.3% to $ 19.2 billion. However, the company's shares along with other global vaccine makers fell after the U.S. President Joe Biden said it would support easing patent protections on coronavirus vaccines.

Moderna (MRNA.US) stock pulled back on Monday after painting at double top near $189.51 handle. Yesterday price broke below the 50 SMA and today, one can see that the upward move is being continued after US open. Moderrna stock is trading below the major resistance at $154.00 which coincides with 200 SMA ( redline). As long as price sits below it, further downward move is possible. Source: xStation5

Moderna (MRNA.US) stock pulled back on Monday after painting at double top near $189.51 handle. Yesterday price broke below the 50 SMA and today, one can see that the upward move is being continued after US open. Moderrna stock is trading below the major resistance at $154.00 which coincides with 200 SMA ( redline). As long as price sits below it, further downward move is possible. Source: xStation5

Etsy (ETSY.US) stock sinked more than 11.0% in premarket trading even despite upbeat quarterly figures. The online crafts marketplace earned $ 1.00 per share, which came in well above analysts estimates of 88 cents a share. Revenue also beat market estimates. However the company warned of slowing user growth and declined to provide full-year financial guidance.

Uber (UBER.US) stock fell nearly 4% in premarket after the ride-hailing company reported mixed quarterly figures. Company lost 6 cents per share, compared to market projections of a 54 cents a share loss. Revenue failed to beat Wall Street estimates. Uber indicated that it is willing to pay drivers more to get cars back in service as the economy rebounds.

Zynga (ZNGA.US) stock jumped 5% in premarket after the company reported quarterly earnings of 8 cents per share, a penny a share shy of estimates. Revenue beat market estimates. The mobile game producer lifted its full-year guidance on expectations of strong demand for its live gaming services.