-

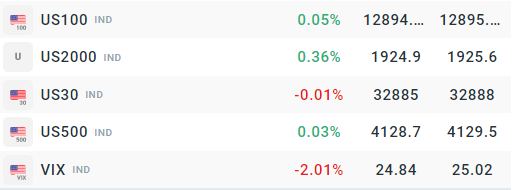

US stock market starts today's trading in mixed mood

-

No increase in US durable goods orders

Today's trading session on US trading floors starts in mixed mood. In addition to the reading of durable goods orders, investors' attention will also turn to signed house purchase contracts and the change in inventories of oil and petroleum products.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appThe market is now pricing in a near 67% chance of a 75 basis point rate hike at the Fed's September meeting. Source: Bloomberg

Source: xStation 5

Compiled charts of the US100 index and VIX on the D1 interval. The benchmark of technology companies starts today's session relatively flat. The VIX fear index is losing nearly 2.00% today. Source: xStation 5

News:

-

Nordstrom (JWN.US) shares are losing nearly 14% at the start of today's session due to a cut in earnings forecasts. Raging inflation has affected consumer spending, which has significantly reduced purchases. At the moment, the company is trying to aggressively cut inventory. Nonetheless, Q2 results came in better than expected.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

Source: Bloomberg

-

Peloton (PTON.US), which has partnered with Amazon (AMZN.US) to sell sports equipment, also posted sizable gains. Until now, the company has sold its products exclusively through its website and physical stores. The company's CCO stated that Peloton will seek to sign agreements with other companies as well.

-

Oil giants are gaining today on news of a possible reduction in oil production by OPEC.

-

Shares of Bed Bath & Beyond (BBBY.US) are gaining 16% today on a WSJ report that it has obtained a loan to support debt repayment.

News from US companies. Source: Bloomberg

News from US companies. Source: Bloomberg