- Wall Street loses at the end of the week. Sell-off of technology companies continues

- US100 loses 1.2% and is trying to hold 15,000 pt support zone

- Weak PMI reading - relatively strong services but considerable deterioration in manufacturing

- Bostic's somewhat dovish statements from the Fed point to an increasingly weak US economy

- All BigTech companies are down today - Nvidia (NVDA.US) and Microsoft (MSFT.US) are the strongest losers

- Huge lawsuit against Chevron (CVX.US) and Exxon Mobil (XOM.US)

Wall Street opens lower. The market fears a further deterioration of the US economy in view of the ongoing Fed tightening cycle. Mary Daly of the Federal Reserve indicated today that two more rate hikes are not certain, and Bostic maintains that rates should stay at current levels until the end of the year.The US500 is currently losing nearly 0.6% against a 0.5% drop in the US30. BofA data indicated general outflows from the stock market including the highest outflows from technology companies in 10 weeks and record capital inflows into the financial sector ($1 billion) in 10 weeks.

US, PMI indexes for June.

Manufacturing.Currently:46.3 Expected: 48.5 Previous: 48,4

Services. Current: 54.1.Expected: 54.0 Previous: 54,9

The reading indicated relatively strong services although a slowdown is evident here as well. Of more concern, however, is manufacturing, which showed a significant drop in activity in the face of an expected slight improvement. Companies in the services sector reported faster price growth at the end of the second quarter. Companies said higher wages put further pressure on business spending. The overall strength in services may please but short-term because it means the economy is still doing well. At the same time, in the longer term, the services expansion may prompt the FOMC to make more hikes, which will eventually reduce the strength of the labor market and thus services.

Looking at the chart of the US100 on the H1 interval, we see that the benchmark is approaching the oversold zone, with the RSI indicating 35 points. Over the past few days, the index has failed to stay below the SMA200 - a key short-term support, which has now become resistance - the area around 15,100 points may prove crucial for further momentum. Source: xStation5

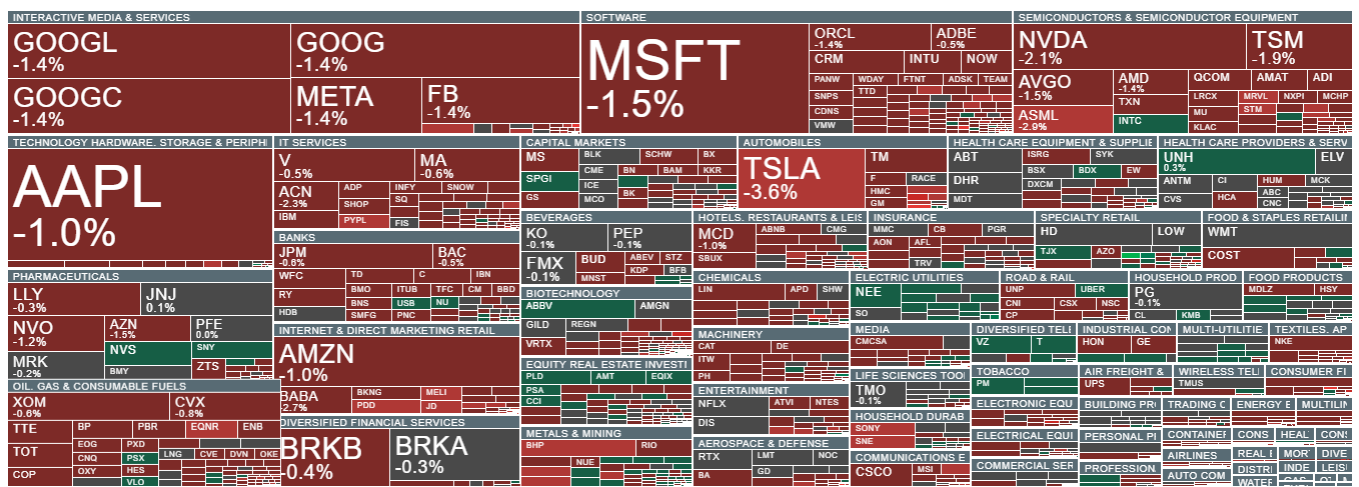

Stocks from the S&P 500 index by sector and industry. Size represents market capitalization. The sell-off in the largest technology companies is weighing on index sentiment. Losers include Amazon, Apple, Google, Meta and Nvidia. Source: xStation5

Company news:

- Amgen (AMGN.US) is losing as several states have joined an FTC lawsuit to halt its $27.8 billion acquisition of Horizon Therapeutics. California's attorney general described the acquisition as unsafe for the market due to monopolization and most importantly, for patients;

- According to people familiar with the matter quoted by Bloobmerg, Ford (F.US) intends to launch another round of layoffs of US employees - the final number is not clear. Stocks are trying to erase opening declines;

- BlackRock (BLK.US) is gaining as the giant announced layoffs that are expected to affect about 1% of its workforce. The company's new round of job cuts followed a business review process. At the same time, the number of asset management employees will be higher at the end of 2023 than at the beginning of the layoffs. The market received the news positively - the fund is cutting costs;

- Blackstone (BX.US) loses, the company is considering selling a portfolio of unsecured loans worth about €2 billion. Most of these are part of a €10 billion portfolio that Blackstone acquired from Santander as part of the bailout of bankrupt Banco Popular in 2017

- Boeing (BA.US) will invest $100 million in infrastructure and pilot training programs in India. The deal is related to a signed contract with AirIndia - the giant will supply the company with several hundred aircraft;

- Chevron Corp (CVX.US) and Exxon Mobil Corp (XOM.US) have received a $50 billion lawsuit from an Oregon county that accuses the conglomerates of driving climate change and withholding information about harmful activities from the public;

- Moderna (MRNA.US) has filed an application with the FDA for approval of a vaccine against COVID-19 targeting the XBB.1.5 subvariant. The manufacturer pointed to promising preliminary clinical data. Still, the stock is losing nearly 2%;

- Nasdaq (NDAQ.US) intends to sell $5.07 billion worth of debt to finance the purchase of software company Adenza, from Thom Bravo.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈