- US indices launched today's cash trading slighlty higher

-

FOMC minutes due at 7:00 pm GMT

-

Baidu (BIDU.US) stock surges on upbeat revenue figures and new share buyback program

The Dow Jones and the S&P 500 are hovering above the flatline, while the Nasdaq 100 rose slightly at the beginning of today’s session, as traders remain cautious ahead of the Federal Reserve's last meeting minutes, which could offer insight into the next move in interest rates. Mounting concerns that recent strong economic data will force the Fed to continue hiking rates spooked investors Tuesday and pushed stocks to their worst day of 2023. Also latest comments from FED Bullard capped upside potential. In his opinion the US economy is stronger than policymakers previously thought and the Fed should only slow down once it's got to the terminal rate. Bullard projects rates at 5.375%.

S&P 500 index stocks categorized by sectors and industries. Size represents market cap. Source: xStation5

Start investing today or test a free demo

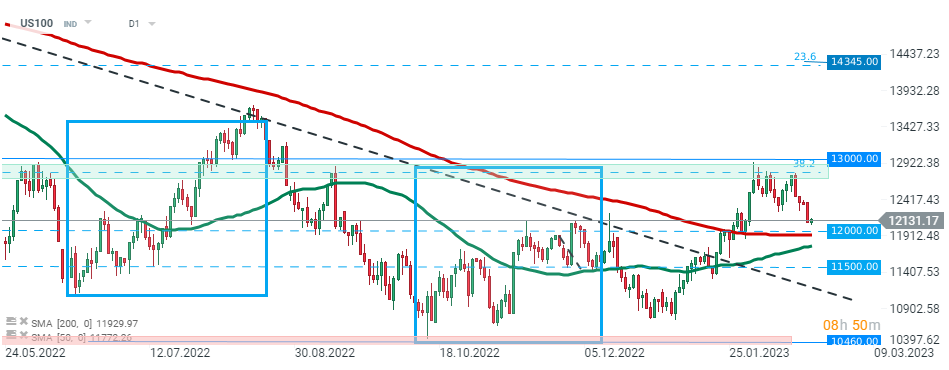

Open real account TRY DEMO Download mobile app Download mobile app US100 fell over 2.0% on Tuesday and is moving towards key support at 12000 pts, which coincides with 200 SMA (red line). As long as price sits above the aforementioned support another upward move may be launched towards the key resistance zone around 13000 pts, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, taking into account negative sentiment which prevails on the markets, another downward move cannot be ruled out. In this case, net support to watch is located around 11500 pts. Source: xStation5

US100 fell over 2.0% on Tuesday and is moving towards key support at 12000 pts, which coincides with 200 SMA (red line). As long as price sits above the aforementioned support another upward move may be launched towards the key resistance zone around 13000 pts, which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, taking into account negative sentiment which prevails on the markets, another downward move cannot be ruled out. In this case, net support to watch is located around 11500 pts. Source: xStation5

Company news:

Baidu (BIDU.US) shares surged 6.5% in off-hours trading after the Chinese search engine giant announced a new $5 billion stock buyback and reported better-than-expected revenue in the latest quarter.

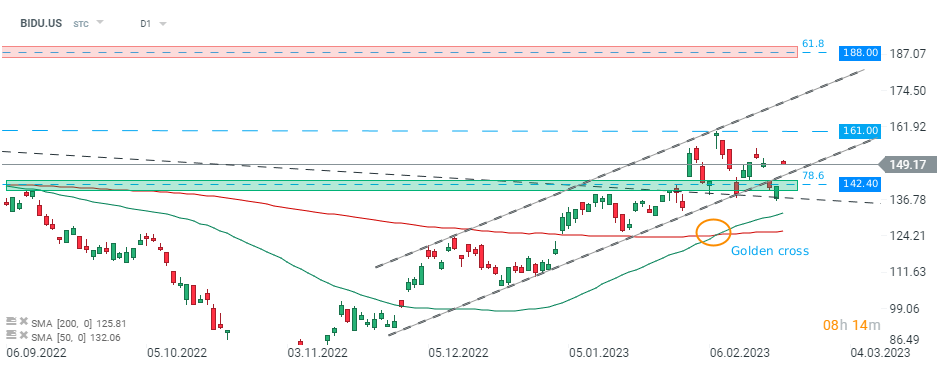

Baidu (BIDU.US) stock launched today's session with a bullish price gap as buyers managed to defend crucial support at $142.40, which coincides with 78.6% Fibonacci retracement of the upward wave started in March 2020. Currently the price is approaching a recent high at $161.00 and if bulls manage to uphold recent momentum, upward move may extend towards the next resistance at $188.0. Source: xStation5

Baidu (BIDU.US) stock launched today's session with a bullish price gap as buyers managed to defend crucial support at $142.40, which coincides with 78.6% Fibonacci retracement of the upward wave started in March 2020. Currently the price is approaching a recent high at $161.00 and if bulls manage to uphold recent momentum, upward move may extend towards the next resistance at $188.0. Source: xStation5

Coinbase (COIN.US) stock jumped over 1.0% in premarket after the cryptocurrency exchange posted a smaller-than-expected loss for the fourth quarter, while sales topped market estimates. Subscription and services revenue helped offset a quarter-over-quarter decline in trading volumes.

Palo Alto Networks (PANW.US) shares jumped nearly 10.0% after the cybersecurity company posted upbeat second quarter financial results and lifted its financial outlook.

Intel (INTC.US) stock dropped nearly 1% before the opening bell after the computer hardware manufacturer lowered its quarterly dividend to 12.5 cents per share. “Prudent allocation of our owners’ capital is important to enable our IDM 2.0 strategy and sustain our momentum as we rebuild our execution engine,” CEO Pat Gelsinger said.

Logitech (LOGI.US) stock fell 1% in premarket after UBS downgraded the computer peripherals maker to neutral from buy citing rising competition.