- Wall Street gains, US100 leads with 1.4% rise

- Fed rate hike in line with expectations doesn't hold back the bulls

- Meta Platforms (META.US) results beat expectations, BigTech gains

- Strong Lam Research (LRCX.US) report lifts semiconductor sector higher

- Surprisingly strong GDP and labor market data in the United States

Indexes on Wall Street started today's trading with gains, with the Nasdaq rallying strongest, driven by technology companies. Meta Platforms results supported sentiment around AI companies and gave hope for a recovery in the advertising sector. Strong macro readings show that the U.S. economy remains resilient, and while this may herald a continuation of the Fed's hawkish narrative, as long as inflation is falling markets have reason to celebrate. A strong consumer and labor market may favor corporate performance in the current quarter. The Fed decided to raise rates by 25 bps but Powell, in line with forecasts, conveyed that the bank will respond to incoming data which may involve further increases.

On the other hand, however, if inflation shows satisfactory progress, the Federal Reserve chief conveyed that policy will become less restrictive, which supported expectations for rate cuts in 2024. On the performance side of the equation, euphoria was seen in Meta Platforms (META.US) shares - the company beat earnings per share and revenue forecasts, and also showed a significant increase in active users in apps and an improving ad market. The catalysts it can use in the coming quarters are mainly the development of AI language models, the release of Meta Quest 3 in the fall (VR) and Twitter's competing platform Threads.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appToday's macro readings from the US:

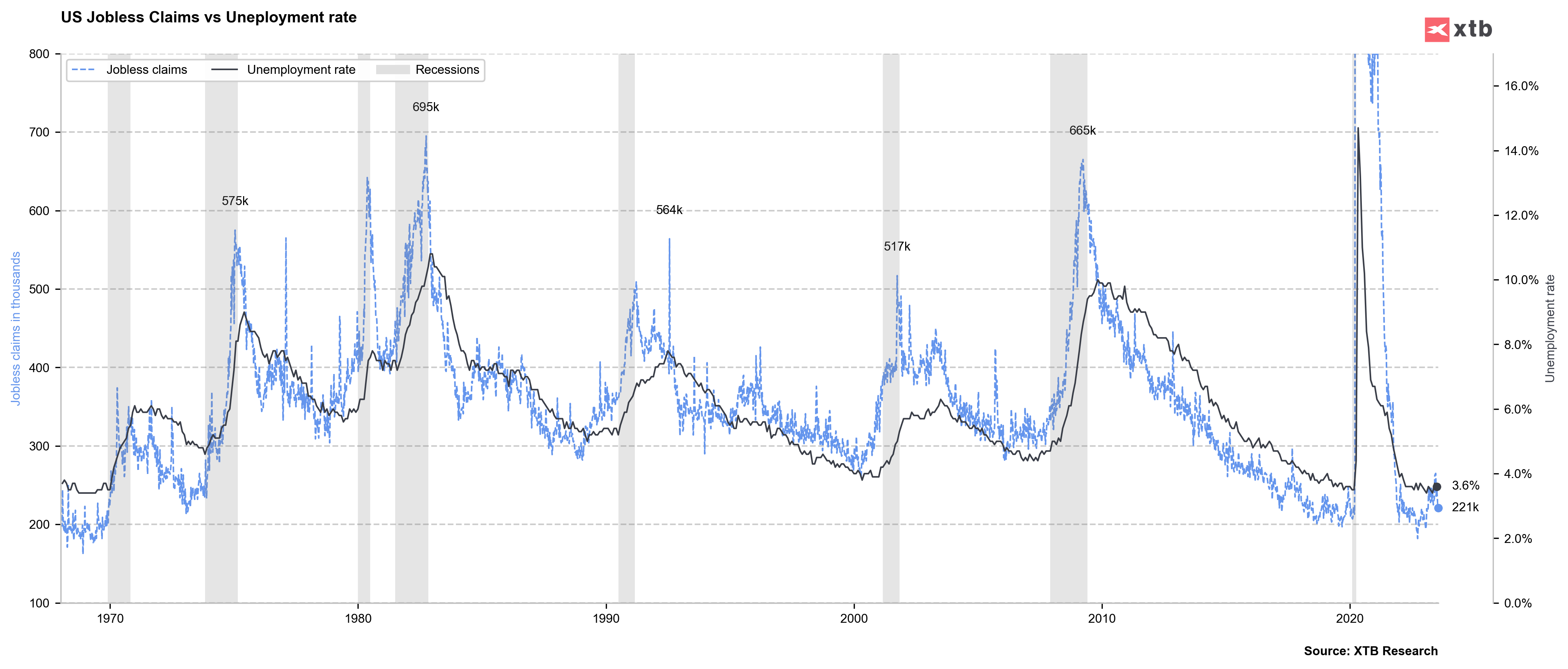

- Claims: 221k Expected: 235k Previous: 228k.

- Durable Goods Orders: Current: 4.7% m/m. Expected: 0.6% m/m. Previous: 1.8% m/m

- Excluding transportation Wednesday: 0.6% m/m. Expected: 0.1% m/m. Previous: 0.7% m/m

- US, trade balance for June: -$87, 84 billion. Expected: -$91.8 billion. Previous: -$91.13 billion

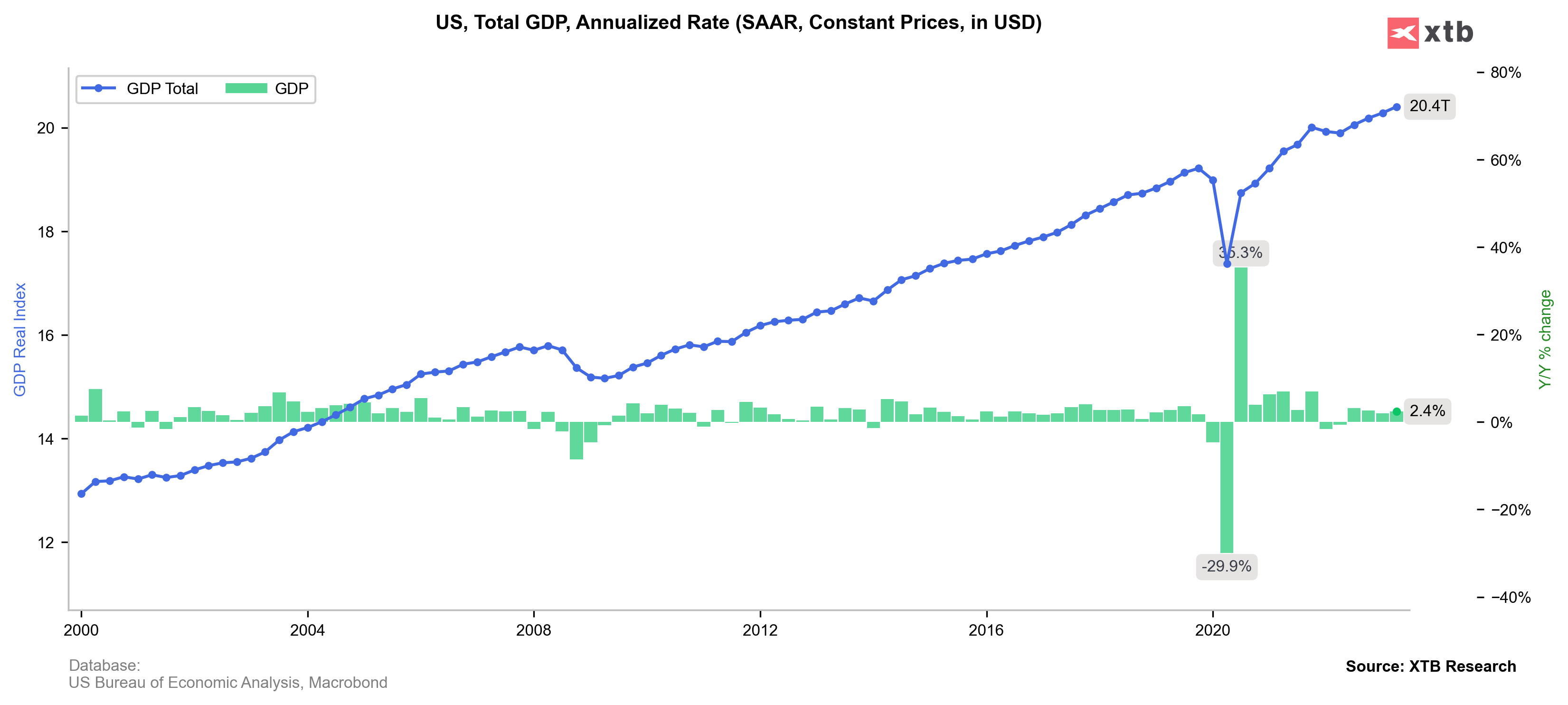

- GDP (annualized): 2.4% Expected: 1.7%. Previous: 2,0%

- Core PCE inflation. Current: 3.8% k/k. Expected: 4.0% k/k. Previously: 4.9% k/k

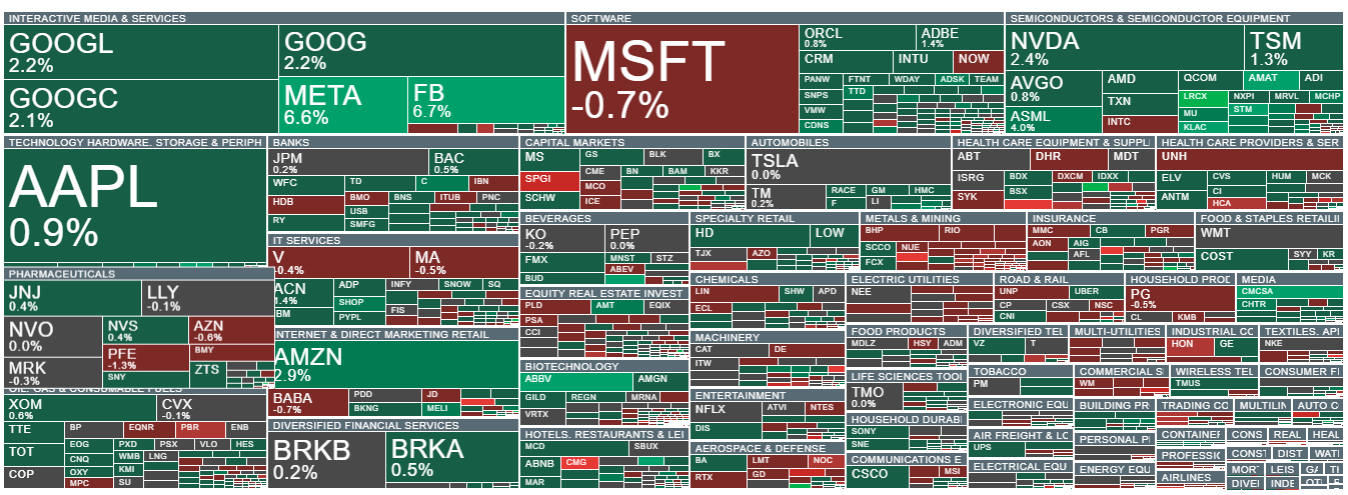

Lower core PCE inflation, lower claims and, on the other hand, a powerful surprise in the realm of durable goods orders and GDP data supported the bulls on Wall Street. It would be hard for investors to 'dream' better data despite the ongoing cycle of rate hikes. The most active stocks from the S&P500 index, BigTech consistently leads the way, with chipmaker stocks rallying. Source: xStation5

The most active stocks from the S&P500 index, BigTech consistently leads the way, with chipmaker stocks rallying. Source: xStation5

Bullish 'golden cross' on M30 interval - will it lead to further gains at new 2023 highs? Source: xStation5

Bullish 'golden cross' on M30 interval - will it lead to further gains at new 2023 highs? Source: xStation5

U.S. GDP readings and unemployment claims on the charts - 'resilient' macro data to the decline in inflation rights that fears of recession are slowly disappearing from the markets, favoring buyers.

Source: XTB Research

News from companies

- Boeing (BA.US) gains as Bank of America raised its recommendation on the aerospace company to buy from neutral.

- Boston Scientific (BSX.US) - share price rises as the robotics company reported adjusted earnings per share for the second quarter that topped analysts' average estimates. It also raised its full-year adjusted EPS forecast.

- Bristol-Myers (BMY.US) - shares are losing, the pharmaceutical giant lowered its full-year adjusted EPS forecast; the forecast missed analysts' average estimates.

- Chipotle Mexican Grill (CMG.US) - shares are retreating as the company reported second quarter sales growth below Wall Street forecasts. Many analysts have lowered their price targets on the stock, noting that sales forecasts were surprisingly lower.

- Ebay (EBAY.US) - Shares are losing as the e-commerce giant's third quarter earnings forecasts missed estimates. Analysts said better results in the second quarter were overshadowed by forecasts, and Jefferies expressed concern that growth initiatives could result in lower margins without gross merchandise volume and profit growth.

- Estee Lauder (EL.US) shares - The cosmetics maker's shares are losing because Jefferies downgraded the stock to "hold" from "buy" due to concerns about the recovery in China.

- Lam Research (LRCX.US) shares are already up 9% after the semiconductor equipment maker reported strong first-quarter revenue, prompting analysts to raise their price target on the stock. The company highlighted stronger demand from China.

- Mobileye (MBLY.US) shares are trading flat although the maker of hardware and software for automobiles reported Q2 results that beat expectations and raised its full-year adjusted operating profit forecast.