- US stock opened lower

- Tech stocks under pressure

- Oracle (ORCL.US) stock plunges following acquisition news

US indices launched today's session sharply lower, extending yesterday's declines as investors continue to get rid of tech stocks, a day after losses in this sector dragged down the rest of the market. Dow Jones fell 1.25%, and both the S&P and the Nasdaq dropped about 1%. All major US indices erased all of the post-FOMC jump as investors assess a shift in global monetary policy from major central banks. Also both rising inflation and the spread of the omicron Covid variant weigh on market sentiment.

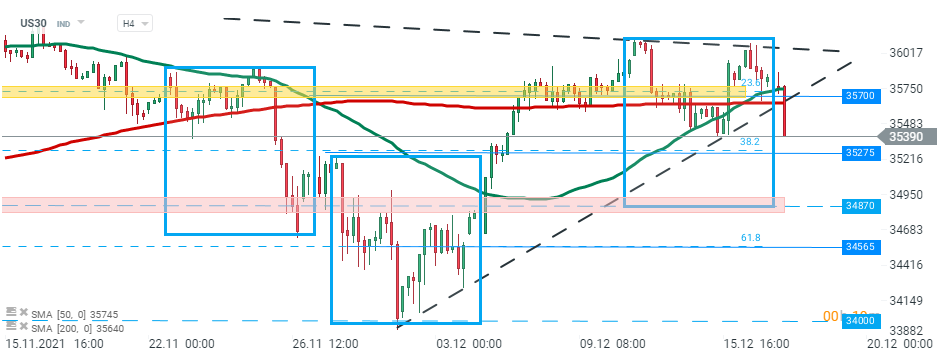

US30 launched today's session sharply lower and broke below upward trendline. If current sentiment prevails downward impulse may test major support at 35275 pts which is strengthened by 38.2% Fibonacci retracement of the upward wave launched in October 2020. Should a break below this level occur, the next target for bears is located at 34870 pts and is marked with a lower limit of the 1:1 structure. Source: xStation5

US30 launched today's session sharply lower and broke below upward trendline. If current sentiment prevails downward impulse may test major support at 35275 pts which is strengthened by 38.2% Fibonacci retracement of the upward wave launched in October 2020. Should a break below this level occur, the next target for bears is located at 34870 pts and is marked with a lower limit of the 1:1 structure. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCompany news:

Oracle (ORCL.US) stock lost more than 5.0% in premarket after news that the software company may have to pay even $30 billion in order to buy Cerner (CERN.US), an electronic-medical-records company, according to Wall Street Journal. Cerner shares surged 16%.

Oracle (ORCL.US) stock has been trading in an upward trend since March 2020. Recently the price even managed to break above the upper limit of the ascending channel and hit a new all-time high at $105.90. However this move turned out to be short-lived and price pulled back. Stock launched today's session lower following acquisition news and if current sentiment prevails, downward move may accelerate towards local support at $90.75 which coincides with 23.6% Fibonacci retracement of the upward wave launched back in March 2020 and lower limit of the ascending channel. Source:xStation5

Oracle (ORCL.US) stock has been trading in an upward trend since March 2020. Recently the price even managed to break above the upper limit of the ascending channel and hit a new all-time high at $105.90. However this move turned out to be short-lived and price pulled back. Stock launched today's session lower following acquisition news and if current sentiment prevails, downward move may accelerate towards local support at $90.75 which coincides with 23.6% Fibonacci retracement of the upward wave launched back in March 2020 and lower limit of the ascending channel. Source:xStation5

Darden Restaurants (DRI.US) stock dropped over 3.5% in premarket despite the fact that company posted upbeat quarterly figures. The owner of Olive Garden, Longhorn Steakhouse and other restaurant chains earned $1.48 per share while analysts expected $1.43 per share and revenue that also beat market estimates. Company issued an upbeat forecast. However moods worsened after Darden announced the planned retirement of CEO Gene Lee.

Rivian (RIVN.US) stock plunged over 8% in premarket after the electric vehicle maker recorded $1.23 billion loss in Q3 stemming from expenses to begin production of its electric pickup truck.

FedEx (FDX.US) stock jumped more than 5.0% before the opening bell after the delivery company posted solid quarterly figures and reinstated its original fiscal 2022 guidance yesterday.

U.S. Steel (X.US) stock fell over 4.0% in the premarket after the steel maker released a disappointing current-quarter fiscal outlook, with higher expenses and cautious customer buying patterns offsetting improved steel pricing.