- Wal Street opens Friday session with gains

- Lower-than-expected PCE inflation supported bullish sentiment

- Alphabet (GOOGL.US) shares try to defend the $100 level

- University of Michigan consumer sentiment index slightly below expectations

- Fed's Collins indicated that with weaker banks, the Fed must consider the risk of doing too much

Wall Street received a positive reading on PCE, the main measure of inflation watched by the Fed. PCE came in at 5% y/y vs. 5.1% and 5.4% previously, the monthly growth rate came in line with expectations. The core PCE came in at 4.6% although analysts had expected it to hold. Growth was helped by continued optimism in Europe, where increases continued from retail and consumer goods companies. Susan Collins of the Fed indicated that the data-although positive-did not surprise the Federal Reserve, but markets liked the commentary on weighing the risks of further policy against the uncertainty for banks. According to Collins, the economy is likely to feel the impact of Fed tightening in the coming weeks.

Despite the buyers' animus, a sizable portion of the market remains cautious. With inflation falling, markets' attention may shift to pricing of recession probability. Potential tightening of credit conditions will reduce the chances of a soft landing. Some stock valuations do not reflect the likely slowdown in revenues and profits in the event of a recession. Bank of America, based on data from EPFR reported a sizable shift by investors to cash ($60.1 billion this week). Inflows to cash in Q1 2023 totaled $508 billion.This is a quarterly record since Q1 2020.The BofA Bull&Bears sentiment index fell to 2.3 from 3.0 last week amid uncertain returns from the stock market and the situation of banks.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

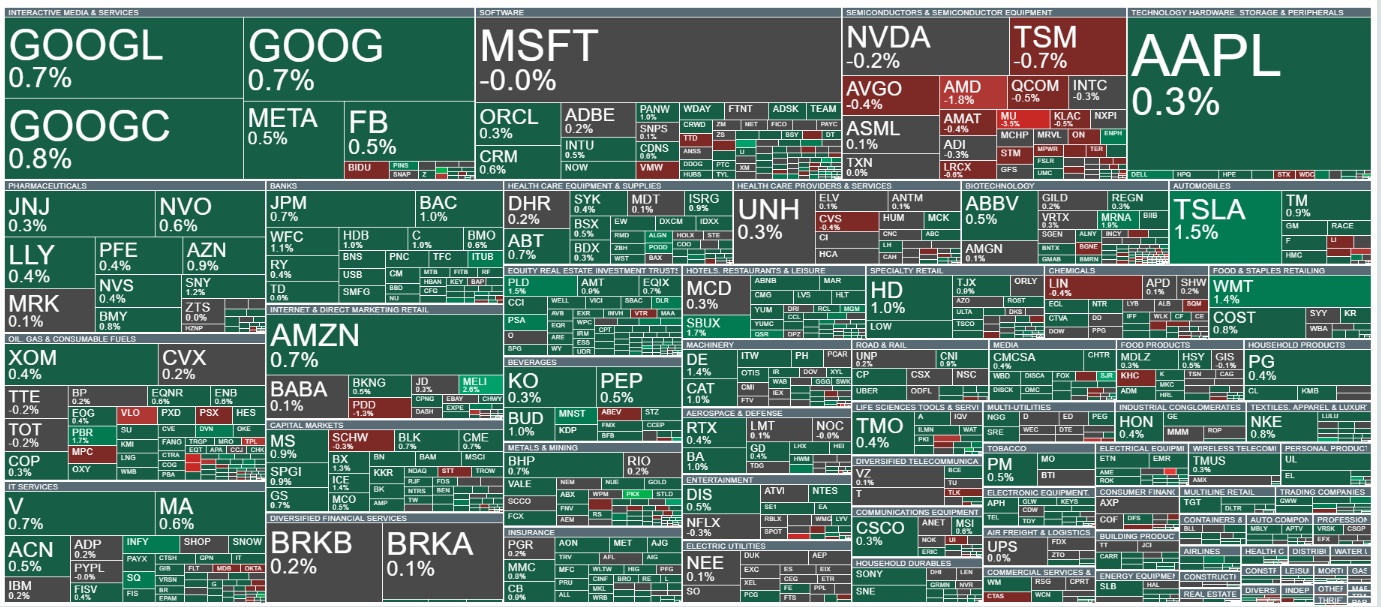

Stocks from the S&P500 index categorized by industry and sector. Volume reflects shares in the index. Shares from the semiconductor industry are losing because of China-US tensions. Source: xStation5

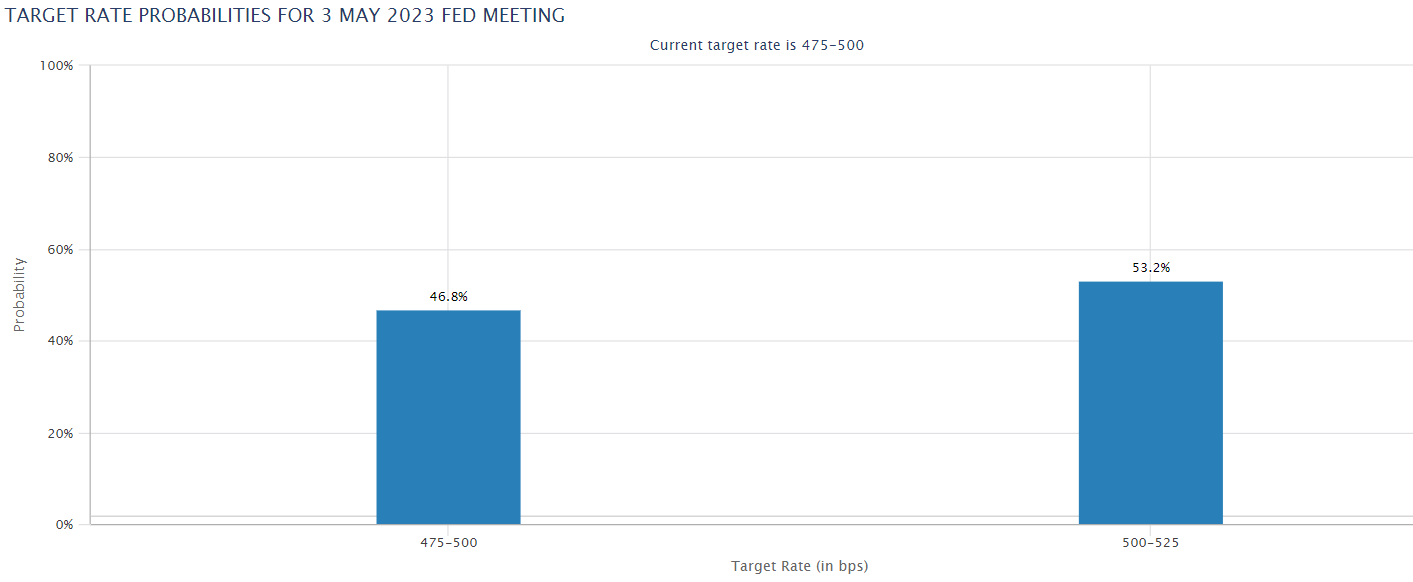

Lower-than-expected PCE inflation and yesterday's rather cautious comments by Fed members Kashkari, Barkin have raised expectations for no hike in May. Today, however, Susan Collins, head of the Boston Fed, indicated that the latest data did not significantly affect the Federal Reserve's point of view. Investors are pricing a May hike with a near 47% probability. Source: CME Group US100 opened Friday session with gains, and overcoming recent resistance could open a path for the bulls to the August 2022 highs at 13,800 points. xStation5

US100 opened Friday session with gains, and overcoming recent resistance could open a path for the bulls to the August 2022 highs at 13,800 points. xStation5

News from companies

Advance Auto Parts (AAP.US), a supplier of automotive parts, gains 1.5% on a rating upgrade by Barclays analysts. Recent readings of rising inflation in the used car sector, in the U.S., may herald better results for the company.

Alphabet (GOOGL.US) is gaining 2% despite analysts at Piper Sandler lowering their price target to $117 from the previous $120. Analysts cited growing competition in the AI market.

Blackberry (BB.US) gains more than 10% despite the cybersecurity company reporting weaker Q4 2022 results passing analysts' forecasts.

Generac Holdings (GNRC.US), a provider of residential and industrial power software and systems, loses more than 6% after BofA lowered its recommendation from 'neutral' to 'underperform'.

IonQ (IONQ.US), a quantum computer company, gains nearly 30% on the back of Q4 financial results that beat expectations and higher-than-expected annual revenue guidance.

Virgin Orbit (VORB.US), the satellite company is down nearly 42% as it announced the suspension of its operations. The company recently sought financing from private equity firms.