-

US indices launched today's trading lower

-

Dow Jones drops and approaches 35,100 pts support zone

-

Qualcomm and Etsy plunge after earnings

Wall Street indices launched today's cash session lower, following a mixed Asia-Pacific session and amid a downbeat trading in Europe, where major indices trade 1% lower. Drops on Wall Street at the beginning of the session were smaller than data but still - S&P 500 and Nasdaq opened around 0.5% lower, Dow Jones dropped 0.3% and Russell 2000 slumped 0.8% at session launch.

Economic calendar for the US session today is light and all important readings that could impact stocks were released already. Final services PMI for July was released at 2:45 pm BST and came in at 52.3 - slightly below 52.4 in flash reading. Services ISM was released at 3:00 pm BST and was expected to show a drop from 53.9 to 53.0 in July. Actual data showed a slightly deeper drop to 52.7, driven by plunge in Employment subindex. EIA will release weekly report on natural gas inventories at 3:30 pm BST but it should not have any impact on equities.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

Dow Jones was halted on its way back towards all-time highs. Index is pulling back for another day in a row and is closing in on the 35,100 pts support zone, marked with a 78.6% retracement of a drop launched in early-2022. However, even a break below would not change a technical picture, at least for now. The lower limit of a local market geometry can be found around 34,730 pts and a break below would signal a bearish trend reversal. Until then, trend remains bullish and current pullback should be perceived as a correction.

Company News

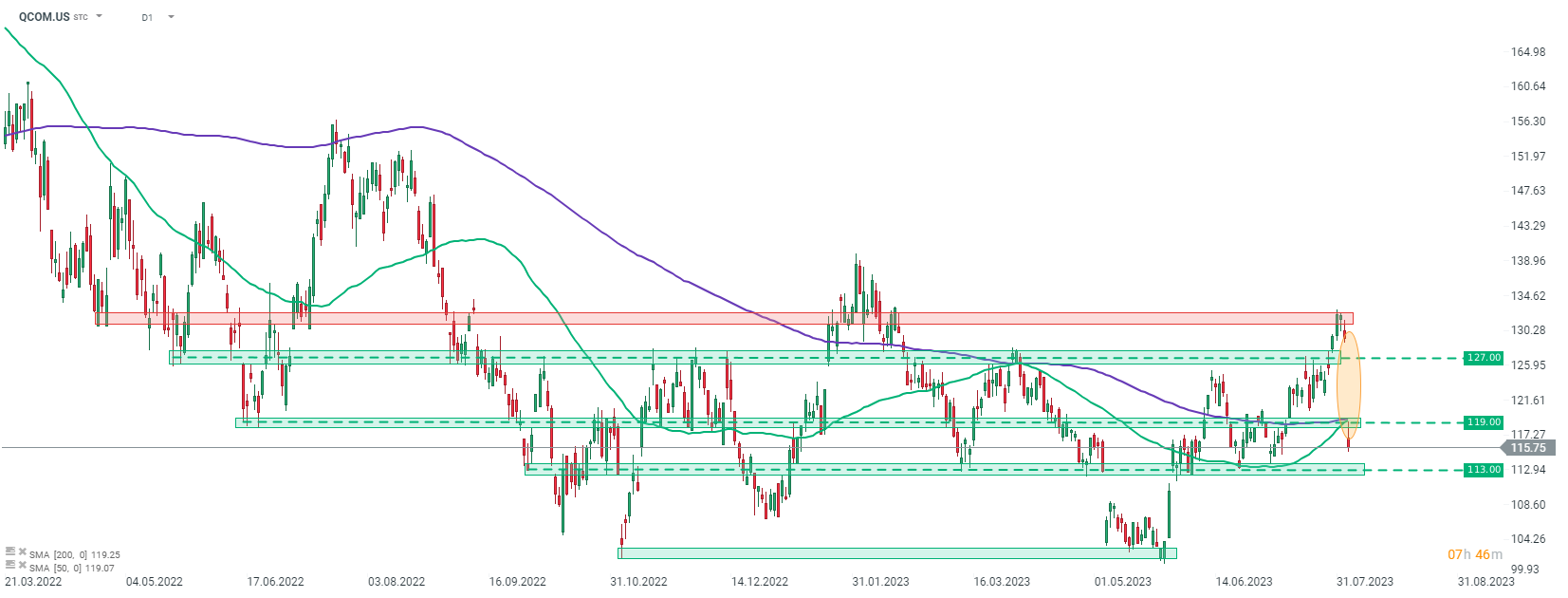

Qualcomm (QCOM.US) reported fiscal-Q3 (April - June 2023) revenue at $8.44 billion (exp. $8.50 billion) as well as adjusted EPS at $1.87 (exp. $1.81). Company said that it expects $1.80-2.00 EPS in fiscal-Q4 as well as $8.1-8.9 billion in sales. Midpoints show that this was slightly weaker forecast than $1.91 EPS and $8.7 billion in revenue expected by the market. Company said that it continues to expect handset shipments to decline high-single digit this year amid slow recovery in China.

Moderna (MRNA.US) gained following the release of Q2 earnings. Company reported revenue of $344 million (exp. $320 million) and $3.62 loss per share (exp. $4.04). This is a massive plunge from $4.75 billion in sales report in Q2 2023 and was driven by a 94% drop in Covid vaccine sales. Net loss of $1.38 billion was reported in Q2 2023, compared to net income of $2.2 billion a year ago. Nevertheless, stock gains as the company said it expects $6-8 billion in Covid vaccine sales this year, up from previous forecast of $5 billion.

Etsy (ETSY.US) shares slumped after online retailer reported Q2 earnings yesterday after close of market session. Company reported $629 million in sales (exp. $619 million) and adjusted EPS of $0.45 (exp. $0.42). Gross merchandise sales reached $3.01 billion and were higher than $2.98 billion expected. While company managed to beat Q2 expectations, forecasts for Q3 2023 disappointed. Company expects gross merchandise sales to reach $2.95-3.10 billion (exp. $3.08 billion) and revenue to reach $610-645 million (exp. $632 million).

Warner Bros Discovery (WBD.US) reported Q2 2023 revenue at $10.36 billion, below $10.44 billion expected by analysts. Loss per share amounted to $0.51 and was deeper than $0.38 loss expected. While net loss reached $1.24 billion, it was a significant improvement compared to $3.42 billion loss in Q2 2022 ($1.50 per share). Global streaming subscribers dropped by almost 2 million compared to end-Q1 and reached 95.8 million (exp. 96.7 million). Nevertheless, shares gained as the company announced a tender offer to pay down $2.7 billion in debt.

Qualcomm (QCOM.US) slumps over 10% after giving weak guidance for the current quarter. Stock plunged below 50- and 200-session moving average in the $119 area and continues to move lower. The next support zone in-line can be found in the $113 area - slightly more than 2% below current market price. Source: xStation5

Qualcomm (QCOM.US) slumps over 10% after giving weak guidance for the current quarter. Stock plunged below 50- and 200-session moving average in the $119 area and continues to move lower. The next support zone in-line can be found in the $113 area - slightly more than 2% below current market price. Source: xStation5