- Wall Street opens higher after Q4 banking earnings

- US500 eyes fresh all-time highs

- Delta Air slumps after earnings and looks towards double top neckline

Wall Street indices launched today's trading higher, following Q4 earnings reports from US banks. S&P 500 and Dow Jones gained 0.3% at session launch, Nasdaq traded 0.2% higher, while small-cap Russell 2000 jumped 0.9%. Economic calendar for the US session today is empty, with no noteworthy data releases scheduled. Traders, however, will be offered a speech from Fed Kashkari at 3:00 pm GMT.

Source: xStation5

Source: xStation5

Start investing today or test a free demo

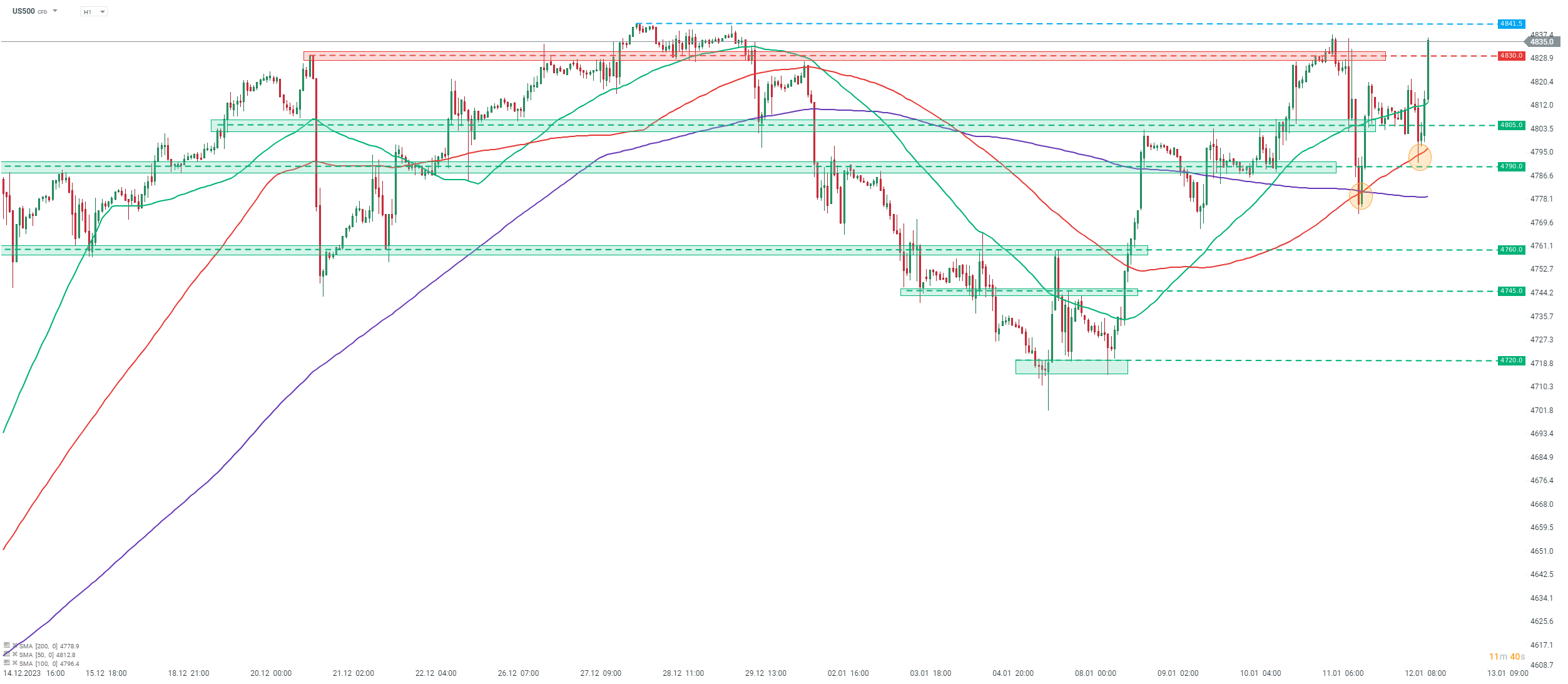

Open real account TRY DEMO Download mobile app Download mobile appS&P 500 futures (US500) are trading higher today. Index has once again managed to find support at the 100-hour moving average (red line) and defended the 4,800 pts area. An attempt is made to break above recent highs at press time. US500 bulls are clearing the 4,830 pts resistance zone after launch of the Wall Street cash session, with recent local high in the 4,835 pts area being in danger. A break above the 4,841.5 pts level would result in the index being traded at the fresh all-time highs.

Company News

Stock traders were offered Q4 earnings report from a number of Wall Street banks today before cash session open. A quick look at releases can be found in our earlier post. JPMorgan (JPM.US) gains 1.6%, Wells Fargo (WFC.US) drops 1.2%, Citigroup (C.US) adds 2% and BlackRock (BLK.US) trades flat.

Delta Air (DAL.US) is trading lower today, following release of Q4 2023 earnings report. Company reported adjusted revenue at $13.66 billion (exp. $13.53 billion), driven by 12% YoY jump in passenger revenue to $12.17 billion (exp. $12.06 billion). Cargo revenue declined 24% YoY to $188 million (exp. $168.7 million). Revenue passenger miles increased 14% YOY to 57.66 billion (exp. 58.10 billion). Adjusted net income dropped 13% YoY to $826 million (exp. 758 million) while adjusted EPS came in at $1.28 (exp. $1.16). Airlines expects Q1 2024 adjusted EPS to reach $0.25-0.50 (exp. $0.38).

UnitedHealth (UNH.US) drops following release of Q4 2023 earnings. Company reported adjusted EPS at $6.16 (exp. $5.97) and revenue at $94.43 billion, 14% higher than a year ago and above expected $92.11 billion). Revenue growth was driven by 33% increase in OptumHealth revenue and 21% YoY increase in OptumRx revenue. Medical care ratio came in at 85% (exp. 83.9%). Analysts noted that costs disappointed and were higher than expected.

Delta Air (DAL.US) launched today's trading with a bearish price gap, following release of Q4 earnings. Stock dropped below 200-hour moving average (purple line) and is approaching support zone in the $38.75 area, marked with the neckline of a double top pattern. A break below the neckline may trigger a plunge to as low as $35.00 area. Source: xStation5

Delta Air (DAL.US) launched today's trading with a bearish price gap, following release of Q4 earnings. Stock dropped below 200-hour moving average (purple line) and is approaching support zone in the $38.75 area, marked with the neckline of a double top pattern. A break below the neckline may trigger a plunge to as low as $35.00 area. Source: xStation5