- Wall Street opens lower ahead of FOMC minutes

- US500 tests drops to 2-week low

- Avalanche of new recommendations for US stocks

Wall Street indices launched today's trading lower, following a downbeat trading in Asia-Pacific and Europe earlier today. Markets are in risk-off mode at the beginning of 2024 with USD gaining and equities pulling back. Escalating tensions in the Middle East, disruptions to shipping in the Red Sea as well as concerns over how much monetary easing will be delivered this year are driving the sell-off.

Traders will be offered 3 top-tier releases from the United States today. Manufacturing ISM for December and JOLTS report for November will both be released at 3:00 pm GMT, while FOMC minutes from December 12-13, 2023 meeting will be published at 7:00 pm GMT. Those may shed some more light on whether cuts are imminent or the Fed has comfort to continue with its wait-and-see data approach.

Source: xStation5

Source: xStation5

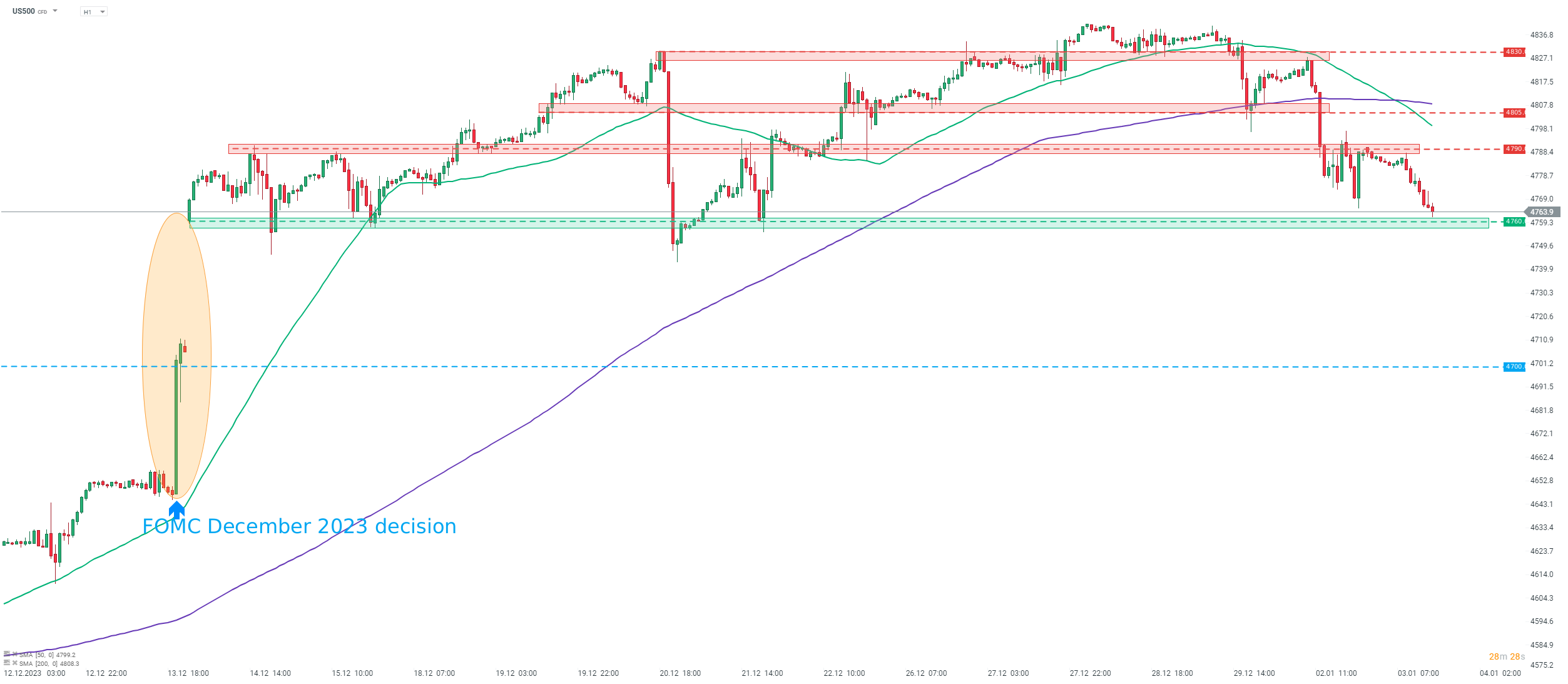

S&P 500 futures (US500), as well as other US indices, are trading lower today. US500 broke below yesterday's lows this afternoon and trades at the lowest level since December 21, 2023. Index is testing the 4,760 pts support zone at press time. A break below will set US500 on the way to fill the bullish price gap that came after FOMC December 2023 rate decision. The first major support zone to watch can be found in the 4,700 pts area, which saw some price reactions in the November 2021 - January 2022 period.

Company News

S&P Dow Jones Indices announced yesterday after the close of the Wall Street session that Pure Storage (PSTG.US) will replace Patterson Cos. (PDCO.US) in the S&P MidCap 400 index, effective prior to session opening on January 5, 2024. In turn, Patterson will move to S&P SmallCap 600 index and replace Chico's FAS (CHS.US) in the index.

Analysts' actions

- Verizon Communications (VZ.US) upgraded to 'overweight' at KeyBanc. Price target set at $45.00

- Discover Financial (DFS.US) upgraded to 'overweight' at Piper Sandler. Price target set at $129.00

- Exxon Mobil (XOM.US) downgraded to "neutral" at Mizuho Securities. Price target set at $117.00

- Occidental Petroleum (OXY.US) downgraded to 'neutral' at Mizuho Securities. Price target set at $64.00

- PBF Energy (PBF.US) upgraded to 'buy' at Mizuho Securities. Price target set at $52.00

- SoFi Technologies (SOFI.US) downgraded to 'underperform' at KBW. Price target set at $6.50

- Ambarella (AMBA.US) downgraded to 'equal-weight' at Wells Fargo. Price target set at $65.00

- MaxLinear (MXL.US) downgraded to 'equal-weight' at Wells Fargo. Price target set at $25.00

- Wendy's (WEN.US) downgraded to 'equal-weight' at Barclays. Price target set at $21.00

- Yum! Brands (YUM.US) upgraded to 'overweight' at Barclays. Price target set at $146.00

Pure Storage (PSTG.US) launched today's trading over 5% higher, following an announcement from S&P Dow Jones Indices. Stock opened at the highest level since December 19, 2023, and is trading around 3% below $38 resistance zone. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?