- US indexes lose at the opening of the cash session

- NY Fed regional index performs very poorly

The second day of the week starts with worse moods in the stock markets. Today, the dollar is the strongest among the G10 currencies, exerting pressure on riskier assets. Yields on 10-year bonds are also rising, returning above the 4.00% level. Investors are adjusting their expectations regarding the Federal Reserve's interest rate cuts this year. Recent comments from bankers indicate that markets were too aggressively pricing in the first cuts this year. After the publication of higher CPI data from the USA last week, this scenario seems even more unlikely.

NY FED

In December 2023, business activity in New York State experienced a decline, as indicated by the Empire State Manufacturing Survey. The general business conditions index dropped significantly to -14.5, with new orders and shipments both falling for the third consecutive month. Unfilled orders continued to decrease markedly, and delivery times shortened notably, reaching their lowest in several years. Employment levels and the average workweek saw a modest decline. Although the pace of input price increases slowed, selling price increases remained steady. Despite a slight improvement in future business conditions, overall optimism among firms remained low, with expectations for only modest increases in new orders, shipments, and employment over the next six months. Investment plans also continued to be weak.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appUS500

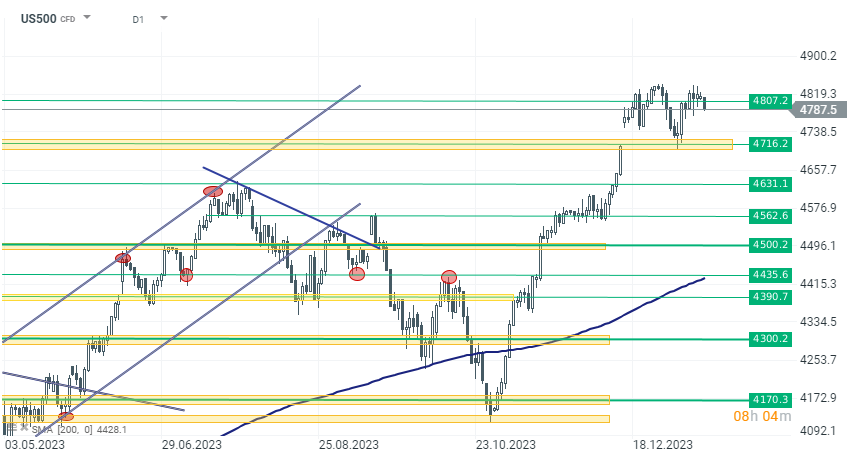

At the time of publication, the US500 is down by 0.50%. Despite the worse sentiment, the index's quotes still maintain around 4800 points. Levels worth monitoring are, of course, the ATH at 4830 and the nearest support zone around 4700 points. Source: xStation 5

Company News

Goldman Sachs (GS.US) and Morgan Stanley (MS.US) published quarterly earnings that were mostly in line with the expectations. Banks largely derive their profits from investment activities. Stocks are trading up a modest 1.0-1,5% today in pre-opening trade.

Barclays has updated its investment approach to focus on the "second wave" of artificial intelligence, leading to upgraded ratings for several tech and semiconductor companies, including Coherent, NXP Semiconductors (NXPI.US), Western Digital (WDC.US), Camtek, AMD (AMD.US), and Marvell Technology (MRVL.US). The team of analysts, headed by Tom O'Malley, anticipates significant growth in this sector by 2025, despite current market conditions presenting few immediate opportunities.

Oil companies operating the Kashagan field, including Exxon Mobil, Shell, TotalEnergies, and Eni, are nearing an agreement with the Kazakhstan government to resolve a conflict over a potential $5 billion environmental fine. As reported by Bloomberg, the proposed settlement would halt the government's pursuit of environmental fines and involve a commitment from the companies to invest approximately $110 million in social projects over two years.

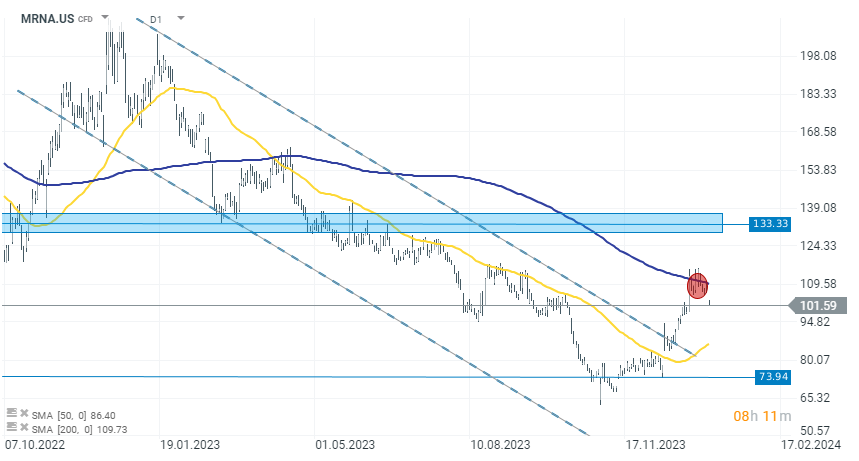

Today, Moderna (MRNA.US) is the worst-performing stock in the S&P 500. Shares are losing over 6%, approaching the $100 level. The rise in the stock was effectively halted by the 200-day Simple Moving Average (SMA200) a few sessions ago.

Source: xStation 5