- The dollar is strengthening again, causing slight declines in indices.

- Somewhat hawkish comments from Fed bankers have unsettled the markets.

- TripAdvisor (TRIP.US) is gaining after quarterly results.

- Alteryx (AYX.US) is up nearly 20% after better-than-expected results.

The second day of this week brings a slight rebound in the markets. Hawkish comments from FOMC members remind investors that the Fed has not yet finished the cycle of interest rate hikes. Recall that last week's gains were indeed driven by these speculations. At the opening, the main Wall Street indices are trading at relatively flat levels. In the forex market, we are observing a significant strengthening of the dollar, which is the reason for more violent movements on pairs such as USDJPY or EURUSD. The yields on 10-year U.S. bonds have strengthened slightly this week to 4.60%, although they are losing ground today. Gold and other precious metals are losing, following the rest of the markets.

This week, many Fed members have various speeches planned, including Fed Chairman Jerome Powell. This will be an opportunity for the markets to learn the opinions of the main bankers after the latest labor market data and changes in market expectations for further monetary policy. Already the first comments today showed that the Fed does not intend to change its policy. Bankers' comments aiming to cool the euphoric mood in the markets last week, reminded that the current tightening cycle has not yet been completed.

Today, so far, two bankers have expressed their opinions - Kashkari, president of the Minneapolis Fed, and Goolsbee, president of the Chicago Fed. The overall tone is neutral to hawkish. Goolsbee pointed out that the labor market is reaching a more balanced level, and inflation continues to be on a downward trend. Future decisions will depend on incoming data, but the "golden" path is still on the table. Kashkari was slightly more hawkish. The banker noted that the economy does not show significant signs of weakening, and the labor market remains strong. He added that there is currently no discussion in the Fed about any rate cuts.

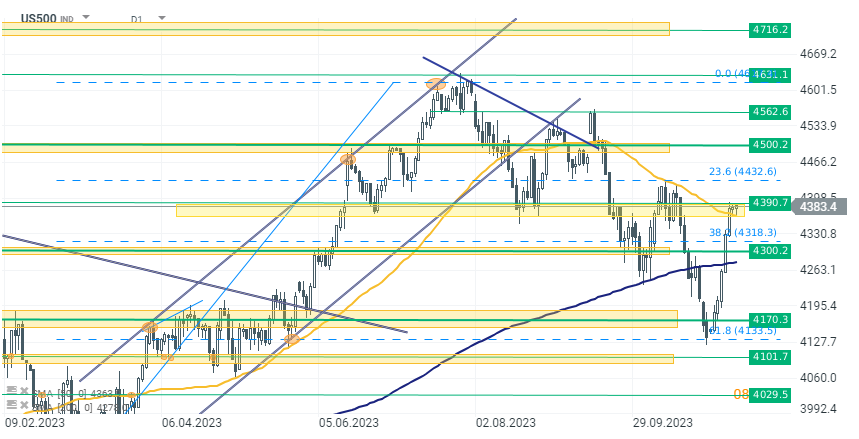

US500

The US500 is losing slightly at the opening of the cash session on Wall Street. Nevertheless, the index is consolidating at the peaks after the recent strong gains. If we look at the chart from a technical side, the increases have slowed in the resistance zone between 4370-4400 points. These levels were an effective barrier for bears in the second half of June and August this year. It is possible that we may experience a slight correction from these levels. However, if the bulls manage to overcome this level, the next range for the upward movement could be 4430 points, being the next Fibonacci retracement, and then 4500 points.

Company News

Alteryx (AYX.US) is gaining over 20% in the premarket trading after the company reported strong financial results for Q3 2023, with an 8% increase in revenue to $232 million and improvements in both GAAP and non-GAAP profitability. Gross profit margins remained steady at 85% GAAP and 89% non-GAAP, while operational losses decreased significantly from the previous year. Net loss per share improved, and non-GAAP net income per share turned positive, indicating progress. Cash and investments rose notably to $682 million. The company achieved a 21% year-over-year increase in ARR and saw a dollar-based net expansion rate of 119%. Key executive appointments were made, new Alteryx AiDIN innovations announced, and partnerships expanded, including with Google Cloud. Additionally, Alteryx completed a workforce reduction plan to streamline operations, mainly affecting sales and marketing, and provided an optimistic financial outlook for Q4 and the full year 2023.

Source: xStation 5

Tripadvisor's (TRIP.US) stock has seen a 9% premarket increase, but doubts persist about its long-term potential. The company reported a 16% year-over-year revenue growth and there are expectations for higher growth rates in Q4 and Q1 2024. However, skepticism remains due to the company's valuation and its history of share repurchases. Despite this surge, which may suggest a positive trend, Tripadvisor's seasonal business model and recent cash flow trends prompt questions about the sustainability of this momentum. The valuation may limit the upside for new investors, and while the company has announced share buybacks, its financial performance, particularly in terms of free cash flow, does not unequivocally support a strong growth narrative. Management's previous actions temper the optimism around Tripadvisor's trajectory towards growth and value creation.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report