- US indices muted at the start of Q1 earnings season

- Goldman Sachs (GS.US) shares rose 2% on upbeat earnings report

- JetBlue Airways (JBLU.US) stock jumped 3% after analysts upgrade

US indices launched today's session in mixed moods as the first quarter earnings season kicks off. JPMorgan Chase, Goldman Sachs and Wells Fargo all posted better than expected figures. On the data front, import prices rose 1.2 % MoM in March, after 1.3 % increase in February and slightly above analysts’ estimates of 1 %. Exports prices increase 2.1 % from a month earlier in March , following a 1.6% advance in February and way above Wall Street estimates of 1.0 % increase. Fed Chair Jerome Powell is also scheduled to speak later in the day at the Economic Club of Washington.

US30 yesterday reached a new all-time high, however the index quickly pulled back to the lower limit of the ascending channel. Should a break lower occur, then downward move may be extended to the 33293 pts level. However, if buyers will manage to halt declines here, then another upward impulse towards 33278 pts could be launched. xStation5

US30 yesterday reached a new all-time high, however the index quickly pulled back to the lower limit of the ascending channel. Should a break lower occur, then downward move may be extended to the 33293 pts level. However, if buyers will manage to halt declines here, then another upward impulse towards 33278 pts could be launched. xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appJPMorgan (JPM.US) stock fell 0.70% in premarket despite the fact that the biggest US bank posted upbeat quarterly figures. JPMorgan earned $4.50 per share well above analysts’ expectations of $3.10 per share. Revenue of $33.12 million also beat market expectations of $30.52 billion aided by superb performance of its trading desks and rising investment banking fees. Fixed income trading produced $5.8 billion in revenue, a 15% increase that exceeded analysts’ estimates by more than $800 million. Equities trading revenue surged 47% to $3.3 billion, a full $1 billion more than estimates.

Goldman Sachs (GS.US) stock rose nearly 2% in premarket after one of the largest US banks posted upbeat first-quarter earnings. Goldman earned $18.60 per share well above analysts' expectations of $10.22 per share. Revenue of $17.7 billion also beat market estimates of $12.6 billion as Wall Street's biggest investment bank capitalized on record levels of global dealmaking activity. “We have been working hard alongside our clients in preparation for a world beyond the pandemic and a more stable economic environment,” CEO David Solomon said in the earnings release. “Our businesses remain very well positioned to help our clients reposition for the recovery, and that strength is reflected in the record revenues and earnings achieved this quarter.”

Wells Fargo (WFC.US) also posted better-than -expected first-quarter figures. The financial services company earned $1.05 per share, beating Wall Street projections of 70 cents a share. Revenue of $18.06 billion also topped estimates of $17.5 billion partially thanks to a net benefit of $1.05 billion from reserve releases. Banks increased their credit loss reserves last year as the pandemic dragged the US economy into a fierce recession, but financial firms began releasing those reserves as the recovery unfolded.

JetBlue Airways (JBLU.US) stock jumped 3% in premarket after JPMorgan upgraded company to “overweight” from “underweight” as it believes that the JetBlue will continue to focus on cost controls in the wake of the pandemic, and noted that the current valuation is attractive.

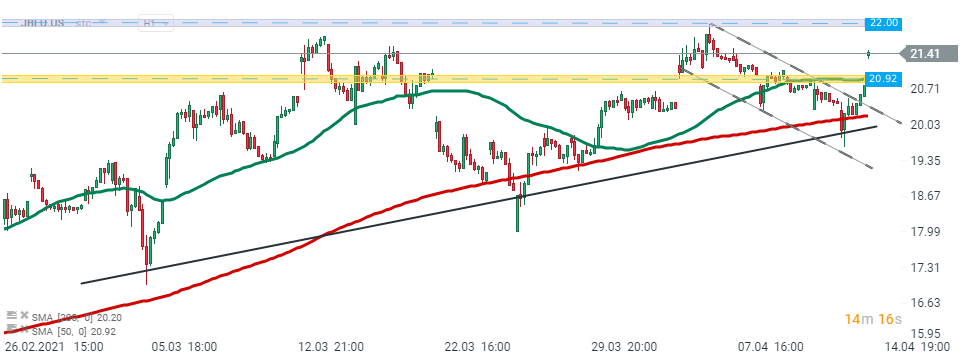

JetBlue Airways (JBLU.US) stock launched today’s session with a 3% bullish price gap If current sentiment prevails upward move may be extended to the local resistance at $22.00. On the other hand, if sellers will manage to regain control, then nearest support lies at $20.92 Source: xStation5

JetBlue Airways (JBLU.US) stock launched today’s session with a 3% bullish price gap If current sentiment prevails upward move may be extended to the local resistance at $22.00. On the other hand, if sellers will manage to regain control, then nearest support lies at $20.92 Source: xStation5