Most U.S. indices are slightly gaining after the US market opening. US100 trades up 0.15%, driven by a drop in bond yields and another very good performance from Tesla (TSLA.US), which add 5% after yesterday rally. The U.S. macro data suggest that the U.S. economy is slowly entering a slowdown, while the labour market remains still relatively resilient to it. After much weaker than expected ISM data, ISM chair, Miller, pointed out that June Services PMI indicates the overall US economy is contracting for the first time in 17 months. Yields on 10-year U.S. Treasury bonds are down more than 9 percentage points today, to 4.34%. Such a scenario allows Wall Street to increase bets on Federal Reserve rate cuts in early fall, this year.

- ISM services data came in well below forecasts at 48.8 vs. 52 expectations; employment and new orders indexes fell sharply. However, the price component still showed relative resilience with a reading above 56 versus 58 previously

- Data from the labour market suggest that this one is still quite robust and cooling off very slowly. Benefit claims came in above forecasts, private market employment change according to ADP came in slightly higher - supported by seasonal demand for work. Challenger's lay-offs report today was quite a bit lower than last month's

- Tesla will unveil its Robotaxi model on August 8 and report detailed financial results for the second quarter of the year on July 23

- Mining companies are posting strong gains on a rebound in precious and industrial metals prices. Rio Tinto (RIO.US), BHP Billiton (BHP.US) and Vale (VALE.US) stand out.

- In the semiconductor sector, increases are dominated by TSMC (TSM.US), and Europe's ASML (ASM.NL), which received a higher recommendation today at Stifel

US100 (M30 interval)

Nasdaq 100 (US100) futures are gaining less than 0.2% today; buying volume prevails. The first reaction to weaker ISM data was positive. Source: xStation5

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appMacro data from the US

- US unemployment claims: 238k Forecast: 235k Previously: 233k (Continuing claims rose to 1.858 million vs. 1.84 million forecast and 1.839 million previously

- ADP private sector employment change: Current: 150,000; forecast 163,000; previous: 152,000 (136k in services vs 14k in good-producing jobs)

- Callenger's report indicates that U.S. companies planned to lay off nearly 48.79k workers in June, compared to 63.82k in May

- ISM PMI services index for June: 48.8 Forecast: 52.6 Previously: 53.8 (prices paid 56.3 vs. 56.7 forecast and 58.1 previously)

- Durable goods orders (m/m) for May: 0.1% Forecast: 0.1% Previous: 0,1%

- Factory orders (m/m): Value for May: -0.5% Forecast: 0.2% Previous: 0,7%

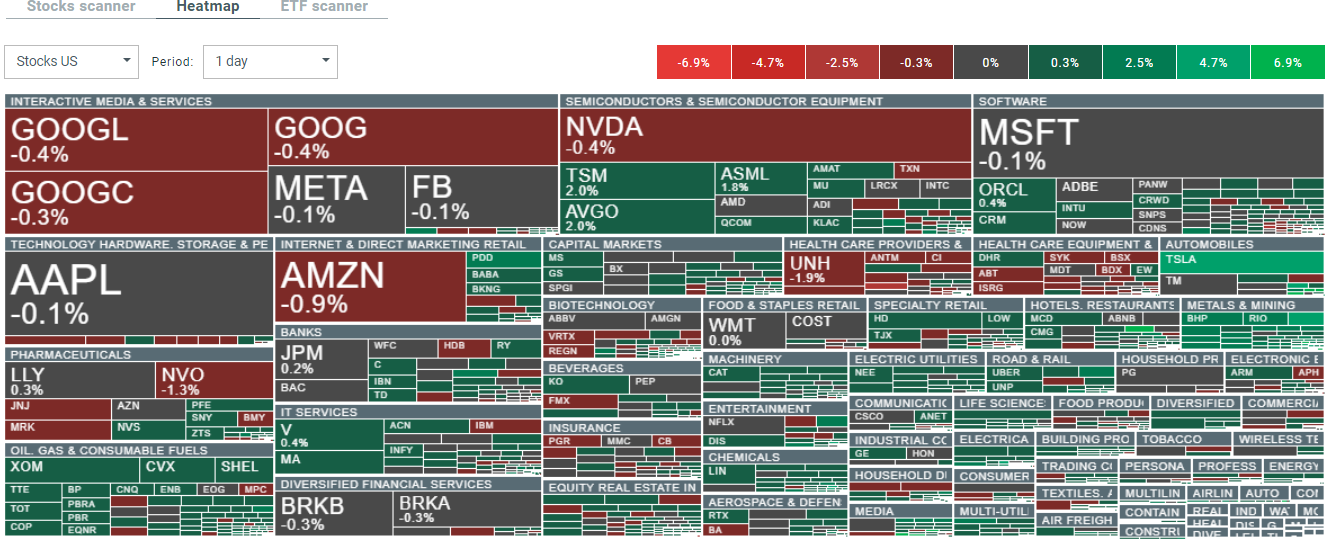

Today, clearly better sentiment is seen among companies in the mining and semiconductor sectors. Source: xStation5