Taiwan Semiconductor Manufacturing (TSM.US) shares dipped nearly 8% yesterday, after the market discounted disappointing expectations in the ASML (ASML.NL) report and the prospect of tighter technology transfer between China and the US. Oversold stocks from the semiconductor sector pushed the Nasdaq 100, which yesterday recorded its weakest session since December 2022. However, today after TSMC's Q2 report for the year, we see some recovery on pre-market. Due to concerns about tightening US technology exports to Asia, TSMC has erased more than $50 billion in market capitalization in recent days.

Yesterday, Donald Trump also conveyed that Taiwan will have to pay for its own protection because the U.S. interest is no different from an insurance company, and so far the island'gives nothing to America. As a result, this opened the door to speculation about the potential impact of such comments on the closely held U.S. business of TSMC, Asia's largest company and one of the world's largest, which today reported second-quarter results for the year. Earnings rose 36% year-on-year, and the business momentum leads investors to believe that TSMC is among the beneficiaries of the AI trend.

Following the results, TSMC's pre-market shares are already gaining more than 3%, with Nvidia (NVDA.US), Intel (INTC.US) and AMD (AMD.US) joining the gains

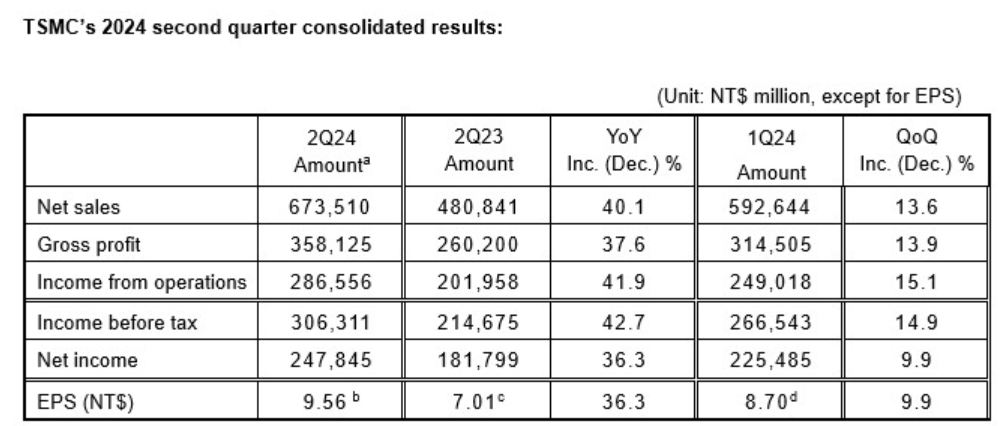

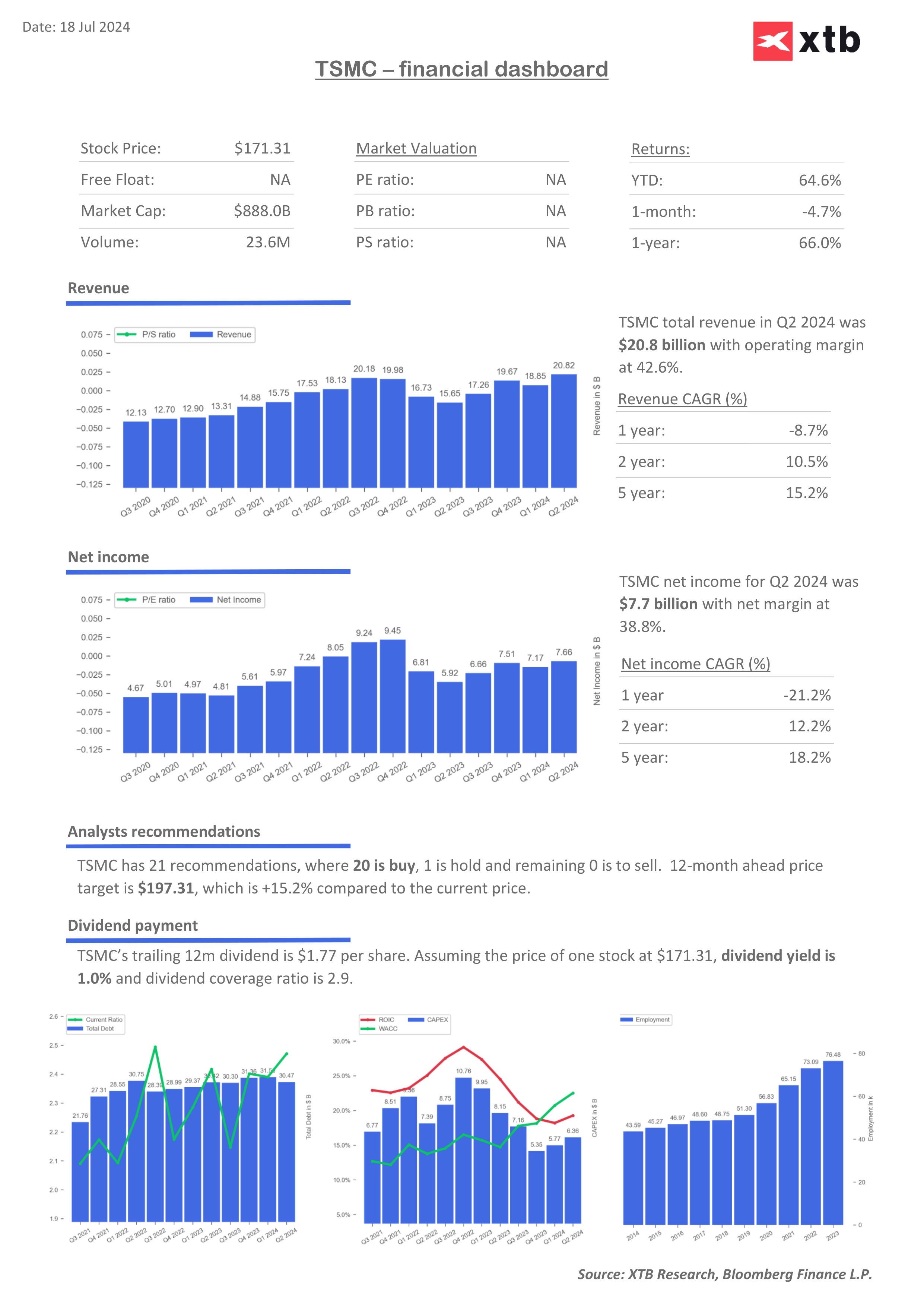

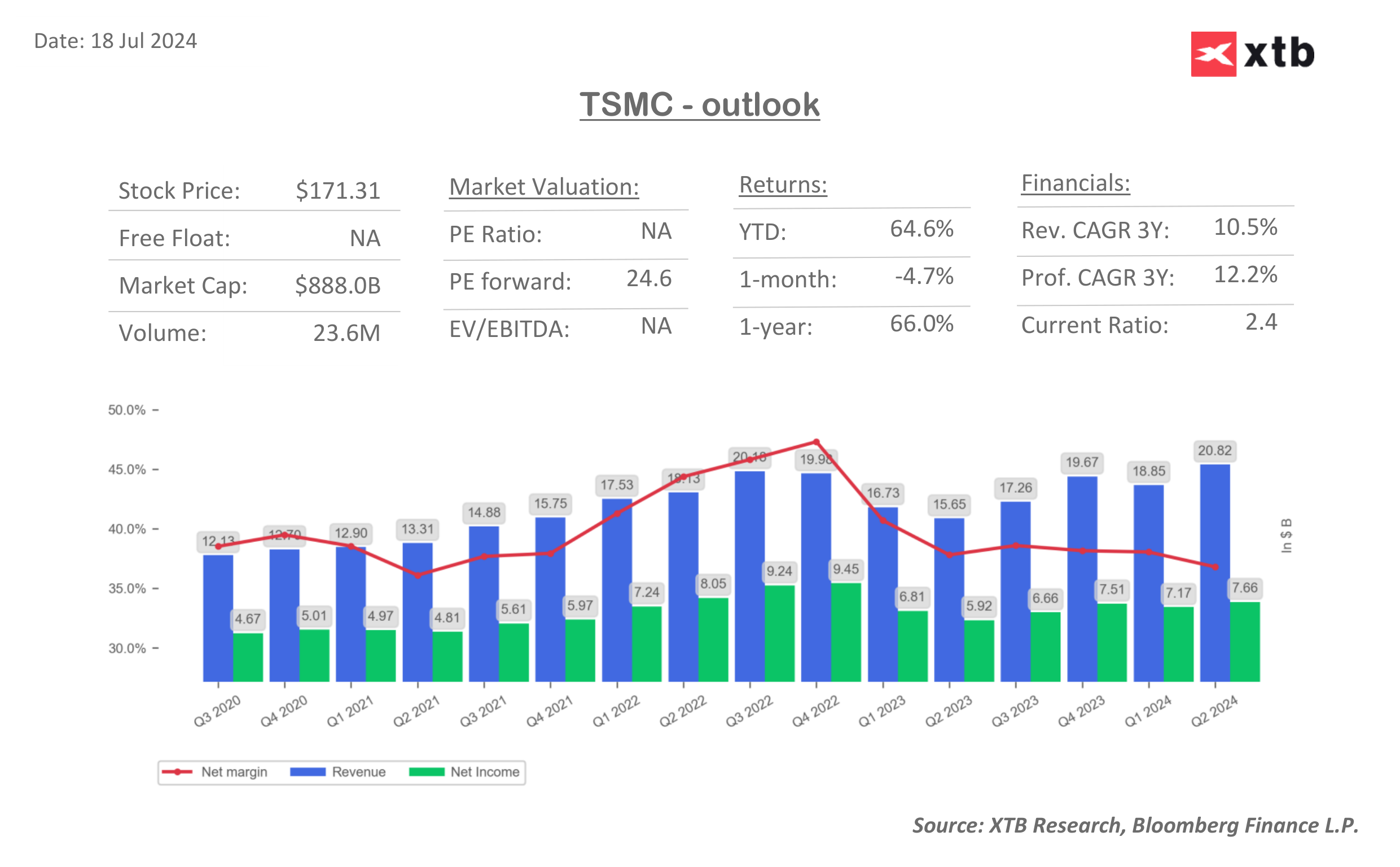

- Revenue: $20.82 billion while the company previously expected max. NT$20.4 billion (up 32.8% y/y and 10.3% k/k in U.S. dollars and 40.1% and 13.6% in Taiwanese currency NT$)

- Net income: NT$247.85 billion, vs. NT$238.8 billion LSEG forecasts (up 36.3% y/y and 9.9% k/k)

- Gross margin: 53.2%, operating 42.5%, net 36.8%

- Expectations: $22.4 to $23.2 billion in revenue for Q3 2024 ($17.2 billion in Q3 2024) and improved gross margins of 53.5 to 55.5%, with operating between 42.5% (current) and 44.5% (upper range)

Source: TSMC

Source: TSMC

Supply not keeping up with demand

Deliveries of 3nm chips accounted for 15% of total revenues, 5nm chips for 35%, and 7nm chips for 17% of revenues; together, the most advanced chips accounted for 67% of sales. According to the company, some pressure on sales and demand for 3nm and 5nm chips was imposed by seasonally lower demand for smartphones, but the company expects consistently high demand related to its largest customers' AI solutions.

- Counterpoint Research pointed out that the results prove that TSMC will be a significant beneficiary of the generative AI trend, thanks to its 3nm technology chips and superbly managed manufacturing processes. According to estimates by U.S. regulators, Taiwan accounts for 92% of the state-of-the-art chip market.

- TSMC's CEO indicated that the development process for 2nm AI chips is going well and they are expected to go into production in 2025, while the company's production is still lagging behind rising demand. The year 2024 is expected to be a record year for TSMC, with slowly rebounding smartphone demand in Q3 expected to add to the results.

- TSMC has increased its budget to $30-32 billion from $28-32 billion previously (70 to 80% will be used for technology development and possible conversion of 5nm to 3nm production). Counterpoint Research data shows that the company has increased its market share in global chip foundries to 62% from 59% a year earlier.

Taiwan Semiconductor Manufacturing (TSM.US, D1 interval)![]()

Source: xStation5

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street