US100

Let’s start today’s analysis with the US tech index - Nasdaq (US100). Looking at the H4 interval, we can see that the price surged to fresh all time high yesterday. Should buyers maintain current momentum, the move towards 14,380 pts looks possible. This level is marked with a potential target of a wide head and shoulders formation. On the other hand, if the price returns below the support at 13,900 pts, marked with previous high, downward correction may be on the cards.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appUS100 H4 interval. Source: xStation5

OIL

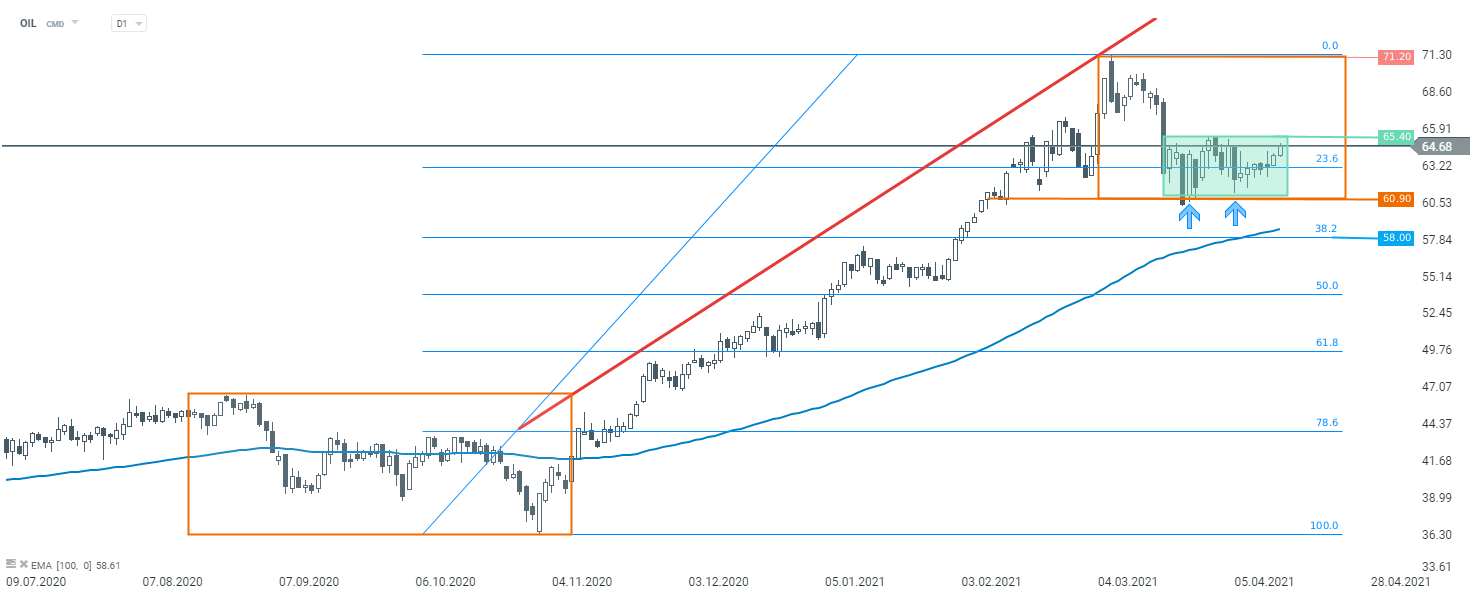

Oil market has been trading in an upward trend for a long time. However, downward correction started after a local high was reached on the 8th of March. Buyers manage to halt declines at the key support, which is marked with the previous price reactions and the lower limit of the wide 1:1 structure ( the biggest correction during the whole upward move started in April 2020). According to the Overbalance methodology, as long as the price sits above the $60.90 support, one should expect continuation of the upward move. However, taking a look at the commodity at a lower interval, we can see that the price remains stuck in the $60.9 - 65.4 range and a potential breakout could be a trigger for a bigger move.

OIL D1 interval. Source: xStation5

OIL D1 interval. Source: xStation5

DE30

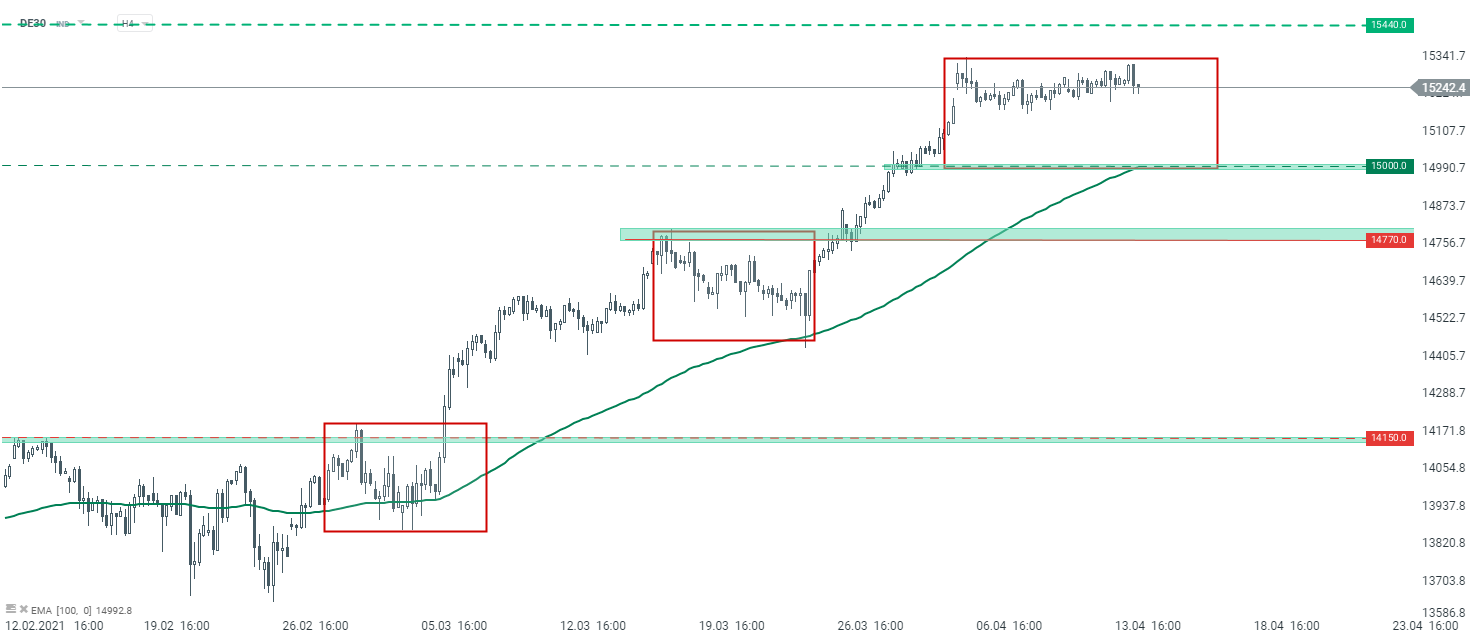

Last but not least, let's take a look at the German DAX (DE30), which has been stuck in a local sideways channel near all time highs for some time. Looking at the H4 interval, we can see that price is trading in a consolidation range. Should the downward correction start, the nearest key support to watch lies near the 15,000 pts handle, where the lower limit of 1:1 structure as well as 100 - period moving average are located. On the other hand, should bulls maintain an upward trend, the 15,440 pts level could be the next potential target for buyers (127.2% exterior Fibonacci retracement of February-Mar).

D30 H4 interval. Source: xStation5

D30 H4 interval. Source: xStation5