Bitcoin

Let's start today's analysis with Bitcoin chart. Looking at the D1 interval, one can notice that despite several attempts, the price did not manage to break above the key resistance at $25,000. If the current corrective move gains steam, then one should focus on the support at $22450, which is marked with the lower limit of the 1:1 structure and previous price reactions. In the case of larger sell-off, the next support to watch is located at $ 21,200.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

Bitcoin, D1 interval. Source: xStation5

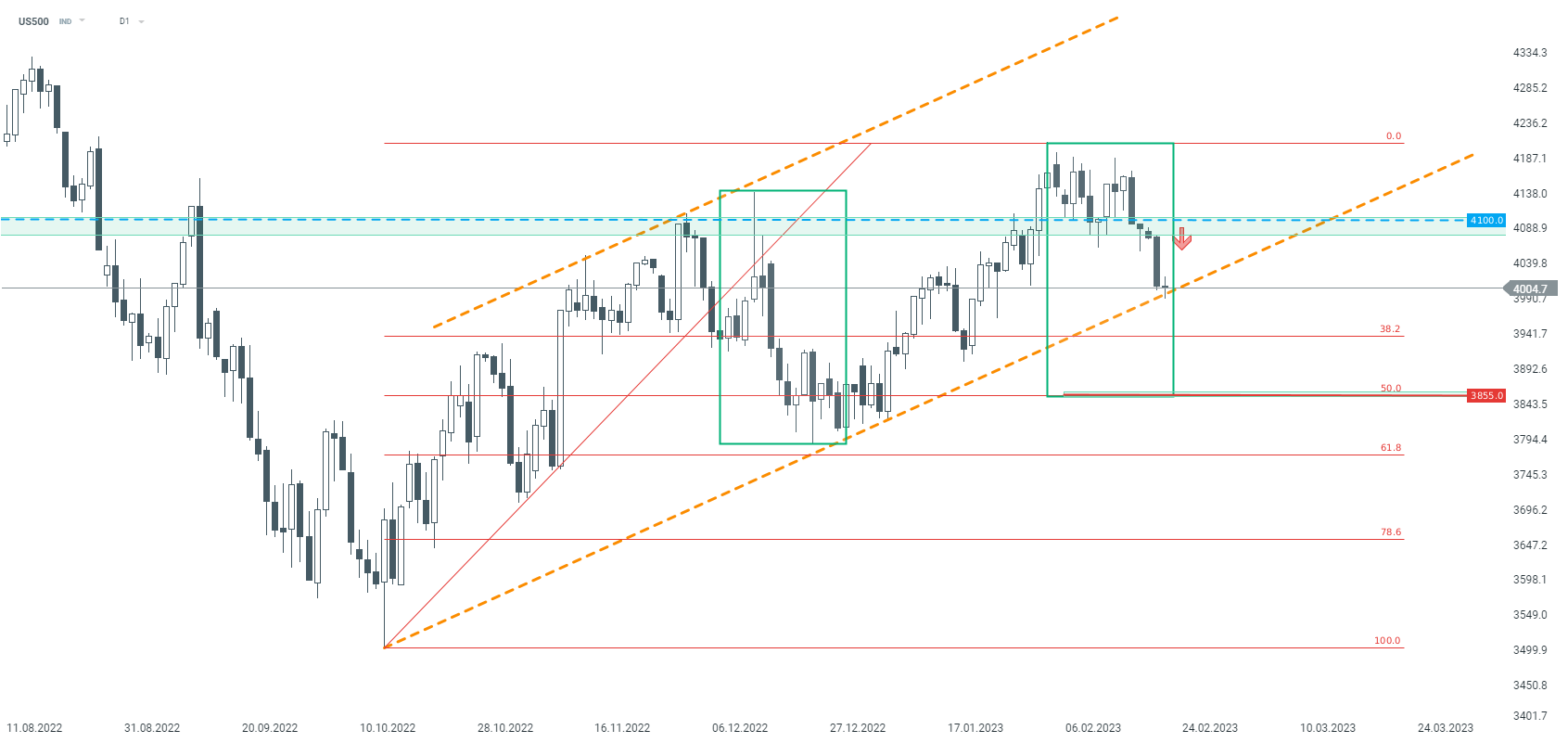

US500

The US500 index returned below the support zone at 4100 points, after which the downward move gained strength. We are currently observing a test of the upward trendline. If buyers manage to halt declines, then another upward impulse towards resistance at 4100 points may be launched. On the other hand, should a break below the 4000 pts occur, the downward move may deepen towards the next support at 3855 points, which is marked with the lower limit of the 1:1 structure.

US500, D1 interval. Source: xStation5

EURUSD

Finally, let's look at the chart of the most popular currency pair. On the D1 timeframe, the price has broken below the support at 1.0660, thus there is a risk of generating a larger downward correction. The nearest target for sellers can be found around 1.0570, which coincides with 100 EMA. The next support is located around 38.3% FIbonacci retracement of the last upward wave and previous price reactions.

EURUSD, D1 interval. Source: xStation5