Textron (TXT.US), a US industrial conglomerate with a strong presence in the aircraft industry, is one of the best performing members of the Russell 1000 index today (index of 1000 biggest, public US companies). Stock trades 5% higher with NetJets deal driving the share price higher.

Textron announced that it has reached a fleet agreement with NetJets for an option to purchase up to 1,500 additional Cessna Citation business jets. Deliveries could be made over the next 15 years. To put this figure into context let us note that Cessna Citation is one of the largest families of business jets with more than 7,500 jets being delivered over the past 50 years!

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe option is an extension of NetJets existing fleet agreement and while no financial details were disclosed it is said that it may be worth up to $30 billion over 15 years.

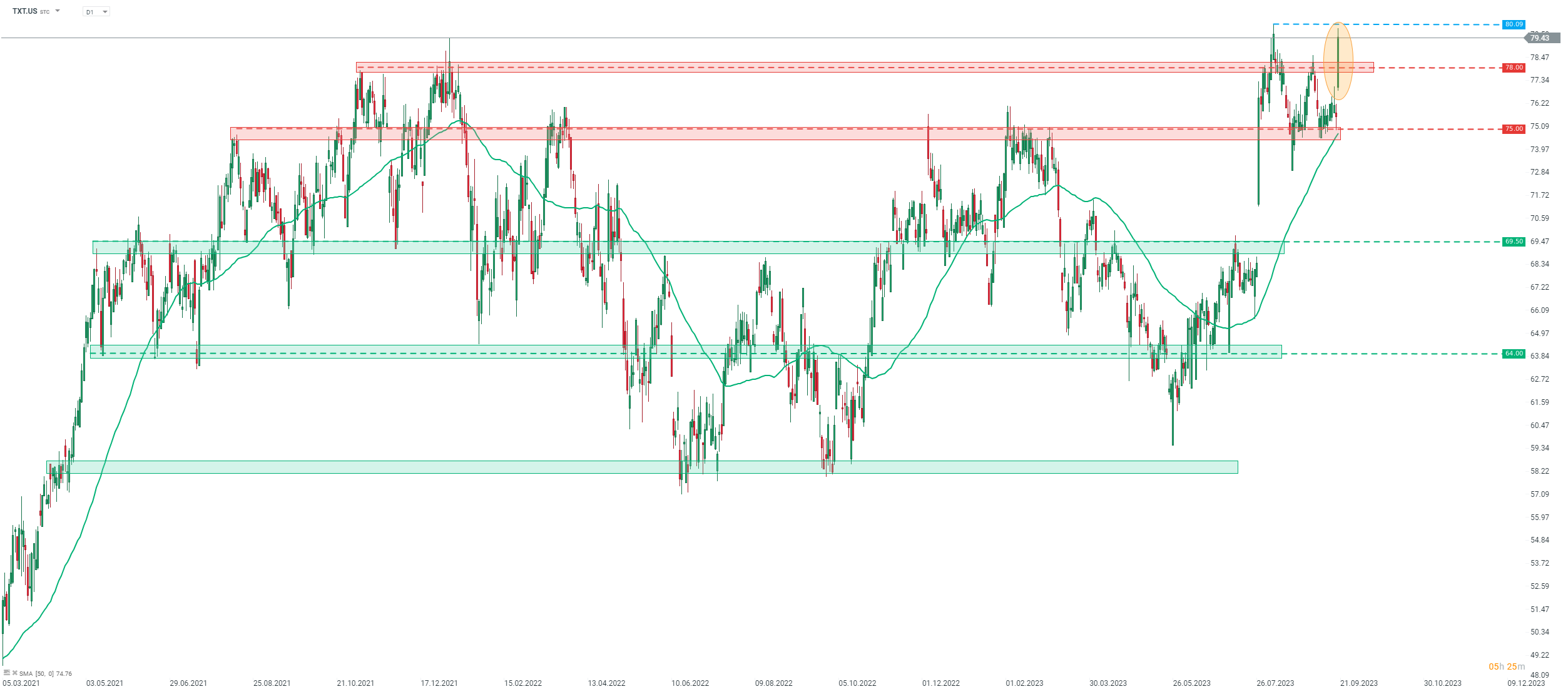

Taking a look at Textron (TXT.US) chart at D1 interval, we can see that the stock launched today's trading with a bullish price gap and continued to move higher during the session. Stock climbed above the $78 resistance zone marked with 2021 highs and is looking towards the $80 area where all-time highs can be found. A close above $79.60 would be the highest on the record for the stock!

Source: xStation5