Spanish telecom company Telefonica (TEF1.ES) stock surged 10.0% after the company announced that it will sell its mobile phone masts in Europe and Latin America to US-based telecom infrastructure operator American Towers (AMT.US) for 7.7 billion euros ($9.41 billion).

Telefonica's subsidiary Telxius Telecom will hand over more than 30,000 mobile phone masts in Spain, Germany, Brazil, Peru, Chile and Argentina to American Towers which will then lease the phone masts back to Telefonica. The sale is the biggest ever by Telefonica, which expects to book a capital gain of around 3.5 billion euros and cut its net debt by about 4.6 billion euros. As a result of the transaction, Telefonica will only own tower assets in Britain.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appFor American Tower the deal gives access to the European market, which has become more attractive thanks to the implementation of 5G, especially in Germany where its competitor Cellnex (CLNX.ES) is still absent.

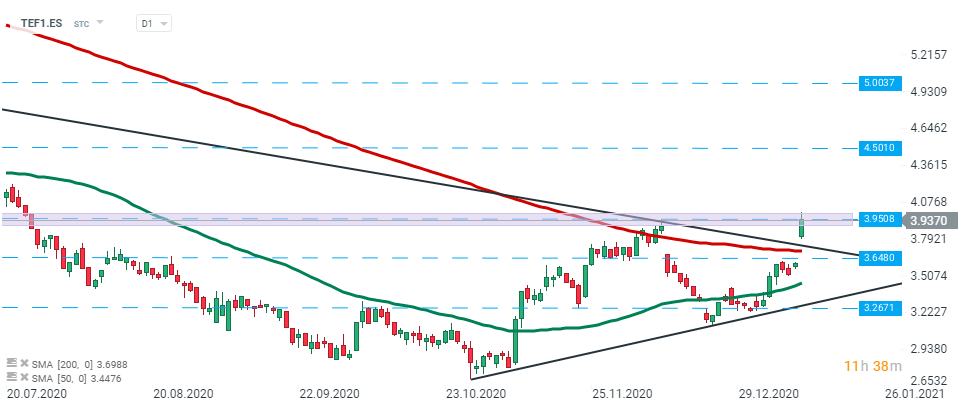

Telefonica (TEF1.ES) stock launched today’s session higher and broke above the downward trendline and 200 SMA (red line). Currently price is testing major resistance at €3.95. Should a break above occur, upward move may accelerate towards next resistance at €4.50. On the other hand, should the sellers halt an upward move here, another downward swing may start. Local support lies at €3.64. Source: xStation5

Telefonica (TEF1.ES) stock launched today’s session higher and broke above the downward trendline and 200 SMA (red line). Currently price is testing major resistance at €3.95. Should a break above occur, upward move may accelerate towards next resistance at €4.50. On the other hand, should the sellers halt an upward move here, another downward swing may start. Local support lies at €3.64. Source: xStation5

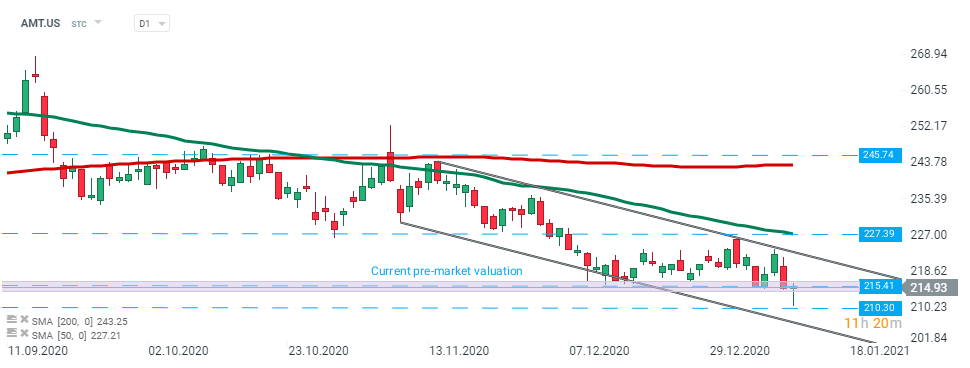

American Towers (AMT.US) stock saw a relatively small reaction to today’s news. Yesterday price bounced off the local support at $210.30, however only break above the upper limit of the descending channel and major resistance at $227.39 may pave the way for a bigger upward move. Source: xStation5

American Towers (AMT.US) stock saw a relatively small reaction to today’s news. Yesterday price bounced off the local support at $210.30, however only break above the upper limit of the descending channel and major resistance at $227.39 may pave the way for a bigger upward move. Source: xStation5