Summary:

-

US stocks firmly lower ahead of cash session

-

Strong Santa Rally appears to be subsiding

-

US100 the worst hit and down by almost 2.5%

It’s been a soft start to the New Year for equities with a sea of red seen across Asian and European stock markets while US futures are trading heavily lower ahead of the opening bell. Disappointing manufacturing data from China has done little to help sentiment and after a strong rally at the tail-end of 2018 the markets have begun 2019 back under pressure.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

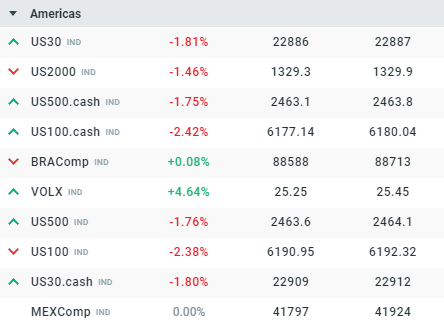

All US indices are in the red ahead of the cash open, with heavy declines of between around 1.5-2.5% seen. The VOLX has moved higher once more and is back above the 25 handle after rising over 4% on the day. Source: xStation

The Santa Rally between Christmas and New Years eve saw a strong push higher as the markets sought to recoup some of their heavy declines into year-end, but even after the gains the markets still posted large losses for the month. It is often overlooked that the large up days in stock markets occur during broader moves lower and despite the strong rally the markets overall remain in a downtrend. The US100 is regularly the most volatile of all US indices and after a stunning rally of 6% on boxing day, the market is faring the worst amongst its peers today and lower by almost 2.5%.

The rally just after Christmas saw price revisit the 8 period EMA, and although it has traded a little higher since then it has failed to get above the 21 EMA. These remain in a negative orientation (8 below 21) and for the time being at least, continue to indicate a downtrend. Despite a drop of almost 2000 points from the markets peak at the end of Q3, there is still little from a technical analysis point of view to suggest that a sustained recovery lies ahead and recent lows in the vicinity of 5827 remain a key reference point on the downside.

Despite the recent bounce the US100 remains in a downtrend according to the 8/21 EMAs. 5827 is an important level to watch on the downside while bulls will want a break back above 6400 to suggest the recent rise is something more than a dead cat bounce. Source: xStation