Summary:

-

Intel (INTC.US) reinforced its full-year outlook at the end of the previous week

-

Reports surfaced at the beginning of this week saying a delay of launch of Intel’s new product may be shorter than previously expected

-

Company’s executives said company is on its way to the third record year in a row

-

Intel looks more profitable but also less liquid than its major peers

-

Share price surged and tested 200-session moving average

A number of reports boosted sentiment towards Intel (INTC.US) in the past couple of days after the stock found itself under pressure earlier this year. The company may be on its way to tackle supply and production problems it has encountered recently. In this analysis we take a look at reasons why sentiment improved, the latest earnings report as well as compare Intel with its major peer in the CPU industry.

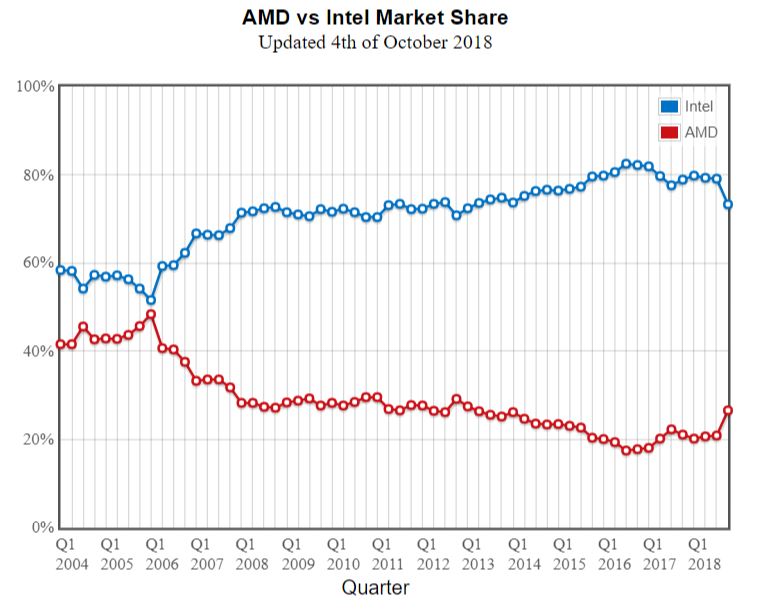

Intel was outperforming AMD when it comes to the CPU market share by a large margin but situation began to change recently. Source: CPUbenchmark

Intel was outperforming AMD when it comes to the CPU market share by a large margin but situation began to change recently. Source: CPUbenchmark

In order to precisely describe what caused the outlook on Intel stock to improve in the recent days we will first explain what caused it to deteriorate earlier this year. Intel struggled with number of problems ranging from management changes (Brian Krzanich resigned from the CEO post in June after 5 years in office, no permanent CEO has been named since) to production delays. It was the latter issue that resulted in the biggest hit for Intel as the company was said to delay launch of its 10nm transistors into late-2019 or even 2020 due to supply constraints. In turn investors and analysts began to be more well-disposed towards Advanced Micro Devices (AMD.US), one of Intel’s major rival chipmaker, as the launch of AMD 7nm transistors would occur one full year earlier than the launch of Intel’s 10nm transistors. Given that smaller transistors are viewed as superior due to their higher speed and efficiency, such a big difference in launch times could cause Intel to lose significant part of its market share.

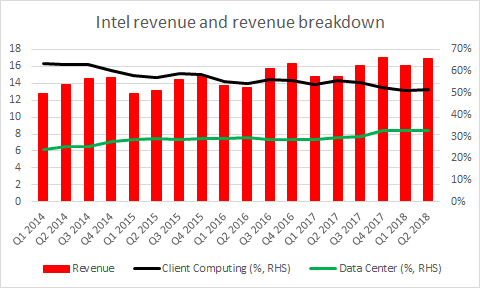

Significance of the data center segment for Intel has been growing at the expense of the client computing segment in the past couple of years. Source: Bloomberg, XTB Research

Significance of the data center segment for Intel has been growing at the expense of the client computing segment in the past couple of years. Source: Bloomberg, XTB Research

However, much has changed since last week. The company reinforced its full-year outlook on Friday. Bob Swan, Intel’s CFO and interim CEO, explained to investors that supply constraints resulted from a sudden growth in PC TAM (total addressable market) and that exerted pressure on Intel’s factory network. To tackle this problem Intel decided to boost its capital expenditure to a record $15 billion in 2018 ($1 billion increase against schedule from the beginning of the year). Swan eased investors’ concerns saying that current supply should be enough to at least meet 2018 full-year projections. However, Intel stock price received even greater tailwind on Monday when BlueFin Research Partners report surfaced. In the paper equity research firm pointed to the potential upside to analysts’ revenue estimates given early second-half production figures. Moreover, the research company said that Intel’s suppliers think that the production of 10nm transistors could begin even before the end of first half of 2019. Such a situation would be desired by the company as usually the last four months of the year are the busiest period for Intel therefore the company would be able to leverage benefits of this seasonality with a new product launch. Additionally, Hewlett-Packard (HPE.US), a company responsible for around 10% of Intel’s revenue, announced its outlook for the fiscal year 2019 on Wednesday and it expects further growth.

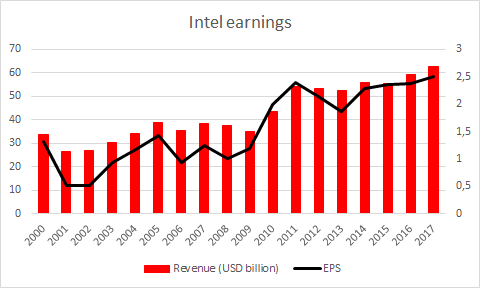

Intel experienced rapid earnings and revenue growth in the post-crisis years but the pace of growth eased since then. Source: xStation5

Intel experienced rapid earnings and revenue growth in the post-crisis years but the pace of growth eased since then. Source: xStation5

Intel reported its second quarter earnings on July 26. The company managed to top median estimates in almost every category. Net income reached $4.94 billion (expected $4.63 billion) while revenue increased to $16.962 billion (expected $16.792 billion). In turn company provided EPS of $1.04 against forecasted $0.964. On the other hand, company slightly missed both EBIT and EBITDA estimates. Nevertheless, Intel issued third quarter guidance that exceeded market consensus at that time. However, while all of these are definitely reasons to cheer the company’s share price plunged following the release. Announcement of the supply shortages we wrote about in the earlier paragraphs made investors grow concerned of Intel’s long term prospects and its competition with AMD. Nevertheless, the company’s executives said that Intel is on its way to achieve third record year in a row. Intel will publish its third quarter earnings report on October 25. Since the release of the second quarter report analysts’ estimates greatly converged towards guidance issued by the company. Market consensus expects third quarter EPS to reach $1.153 (guidance $1.15) while revenue is forecasted at $18.123 billion (guidance $18.1).

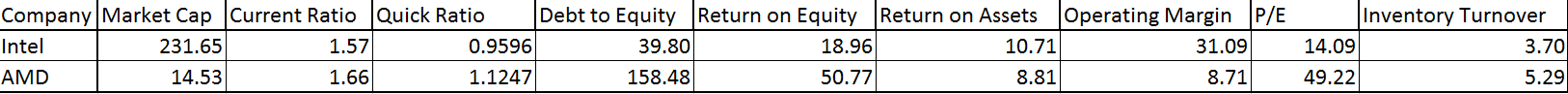

Comparison of selected financial data of Intel and AMD. Data at the end of the second quarter 2018 Source: xStation5

Comparison of selected financial data of Intel and AMD. Data at the end of the second quarter 2018 Source: xStation5

Before we turn to comparing particular ratios between Intel and AMD it should be noted that companies differ significantly in size. Intel had a market cap of over $230 billion at the end of June 2018 while AMD was valued at just $14.5 billion. Having said that, Intel may be better positioned in the industry due to the economies of scale. Taking a look at the table above one can see that AMD outperforms Intel when it comes to liquidity as the stock has both, current and quick, ratios higher than Intel. The same can be said about inventory management as higher turnover ratio point at more efficient inventory management at AMD. Nevertheless, when it comes to operating margin one can see a striking difference between the two with Intel’s margin being significantly higher. Given such discrepancies in the margin figures one may question how come that AMD has such high RoE in comparison to Intel. To answer this question we have to look at debt-to-equity ratios. AMD is significantly more indebted and leveraged than Intel and because of that it can achieve better return on shareholders’ capital. To try to achieve comparability in the profitability of both stock we can take a look RoA. In this case Intel looks to be more profitable than its CPU industry peer. Higher PE ratio of AMD may suggest that investors expect this company to develop more rapidly in the future. However, it should be highlighted that AMD turned profitable in 2017 after five years of consecutive losses while Intel was showing net profit year after year since 1986.

Intel (INTC.US) had a stellar first half of the year. The stock climbed to $57.57 in June, the highest level since dot-com bubble. However, weakness surfaced later on. The company still trades below levels saw before the second quarter earnings release (gap resulting from release marked by orange circle on the chart above). Nevertheless, latest developments resulted in a surge in share price and a test of the 200-session moving average (purple line on the chart above). Source: xStation5

Intel (INTC.US) had a stellar first half of the year. The stock climbed to $57.57 in June, the highest level since dot-com bubble. However, weakness surfaced later on. The company still trades below levels saw before the second quarter earnings release (gap resulting from release marked by orange circle on the chart above). Nevertheless, latest developments resulted in a surge in share price and a test of the 200-session moving average (purple line on the chart above). Source: xStation5