- First Republic Bank (FRC.US) is in freefall after Q1 earnings

- Share price slumped 50% on Tuesday and another 30% on Wednesday

- FRC saw 41% plunge in deposits in Q1 2023

- Asset sales needed to repay debt and reduce duration mismatch

- US government unwilling to intervene

- Private bailout may be the only option for FRC

- Shares trade at record low, 95% lower year-to-date

First Republic Bank (FRC.US) returned to the spotlight this week following the release of Q1 earnings report on Monday evening. Release showed a scope of damage done to the bank amid recent US banking turmoil and highlighted that the bank has not yet fend off a risk of collapse. This has triggered an around-50% plunge on Tuesday alone! Let's take a closer look at what's going on with this mid-sized US lender.

Deposits slump after US banking turmoil

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appEarnings reports from US banks released during the first two weeks of the Wall Street earnings season for Q1 2023 have been rather upbeat and helped boost confidence towards the sector following recent SVB-triggered turmoil. However, this has changed this week following release from First Republic Bank - one of banks that was hit the most by US banking turmoil but has managed to stay afloat.

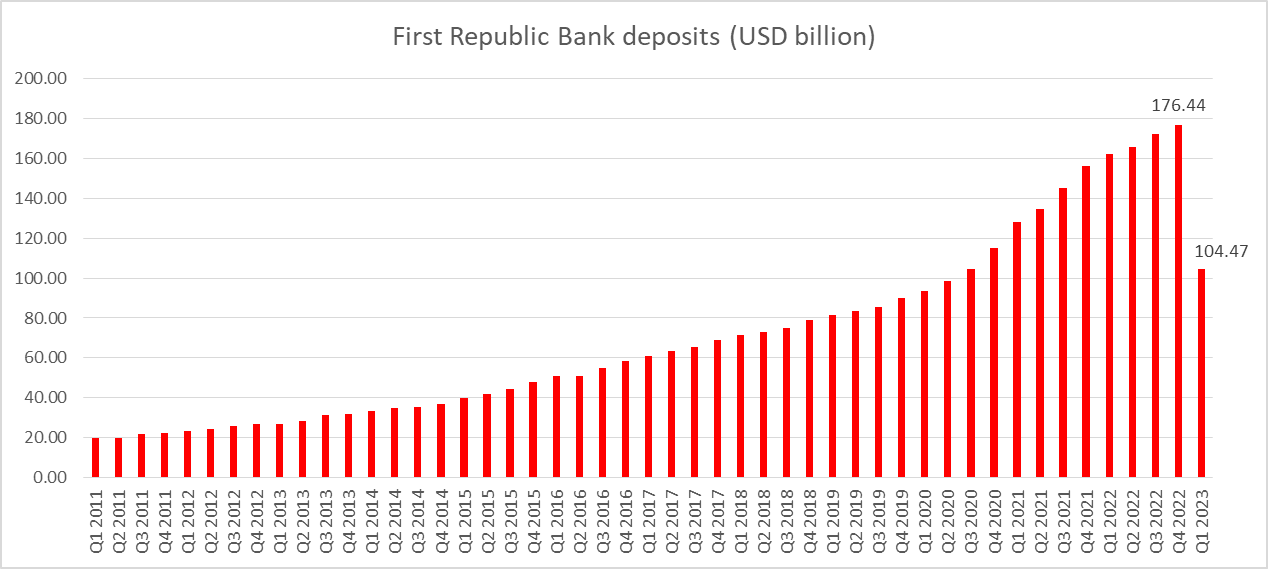

First Republic Bank reported a 41% drop during the first quarter of 2023, from $176.4 billion to $104.5 billion, and reached the lowest level since the second half of 2020. This is a result of deposit flight from small- and mid-sized US banks in the aftermath of recent US banking turmoil. While 41% plunge in deposit during a single quarter looks massive, one should remember that actual deposit flight was even larger - after all, First Republic Bank received $30 billion in deposits from 11 large US banks with an aim to stabilize the situation. This means that actual deposit flight was closer to $100 billion or around 57%!

First Republic Bank saw a 41% slump in deposits in Q1 2023. Source: Bloomberg, XTB

Collapse risk lingers

Given such a massive deposit outflow, one should not be surprised by a massive plunge in First Republic Bank share price on Tuesday (-50%) and yesterday (-30%). Bank's management refused to take and answer questions from analysts during a Q1 earnings call, which caused concerns to mount and surely did not help the stock.

Bloomberg reported on Tuesday that First Republic Bank is exploring a sale of $50-100 billion in long-dated securities, like for example mortgages. The move is reasoned with a need to bring the duration of its assets and liabilities more in-line. Duration mismatch - failure to immunize portfolio and hedge interest rate risk - was one of the prime reasons behind SVB collapse as unrealized losses on its bond portfolio mounted in the aftermath of Fed's aggressive policy tightening. Unless First Republic Bank manages to better align duration between assets and liabilities, it may be risking troubles should interest rate volatility persist - while Fed rate hike cycle is likely to be paused soon, deteriorating macroeconomic picture means that risk of rate cuts should not be underestimated.

Need to sell assets worth billions also has other reason - debt repayment. First Republic Bank has massively increased borrowing in the first quarter of 2023. Total debt jumped from around $16.8 billion at the end of Q4 2022 to almost $107 billion at the end of Q1 2023! Moreover, $80 billion out of those is made up of short-term debt - liabilities that need to be repaid within 12 months!

First Republic Bank saw a massive spike in borrowing in Q1 2023 adding over $70 billion in new short-term debt that needs to be repaid within 12 months. Source: Bloomberg, XTB

First Republic Bank saw a massive spike in borrowing in Q1 2023 adding over $70 billion in new short-term debt that needs to be repaid within 12 months. Source: Bloomberg, XTB

First Republic Bank saw an over-40% drop in deposits during Q1 2023. However, loans increased by 3.9% during the quarter, resulting in a big mismatch between the two. Source: Bloomberg, XTB

What's next?

Question 'what's next?' for First Republic Bank is tricky to answer. It looks like First Republic Bank will be unable to make a turnaround all by itself. It will need help from outside. The aforementioned $50-100 billion in assets that the bank wants to sell is not a toxic asset portfolio - it is said to comprise mostly of high-quality loans. However, given the steep rise in interest rates, selling those assets at current market price would most likely mean realizing a big loss. This, in turn, could mean more troubles for the bank - recall that hasty sale of bond portfolios by SVB to service liquidity needs punched a multi-billion hole in its balance sheet and ultimately led to its downfall. Having said that, First Republic will attempt to sell those assets at above-market prices.

Now one can wonder why someone would want to overpay for those securities. Situation is more complex than it seems.

Government unwilling to intervene, FRC needs private bailout

First Republic Bank's share price collapse reignited fears over the banking crisis in the United States but recent media reports suggest that the US government does not seem to care, at least not yet. CNBC reported that the US government was unwilling to intervene and rejected the FRC proposal for the government to buy its securities at above-market prices. It was also reported that the US Treasury is unwilling to engage in a costly bailout similar to SVB and Signature Bank when it insured all of the deposits regardless of their size, owner or FDIC insurance threshold.

This means that rescue may have to come from private banks. However, as we have already said, in order to save First Republic Bank, its assets would need to be bought at above-market prices - in other words to a detriment of the buyer. Politico reported that no one is willing to buy those assets at such prices without obtaining government guarantees for the deal. However, it cannot be ruled out that a group of US banks will actually agree to purchase those securities as it may be a wise decision from a business point of view. Why? It may come down to a simple decision:

- Purchase $100 billion asset portfolio at above-market prices (and incur a loss on it)

- Risk around $30 billion in additional FDIC insurance premiums should First Republic Bank fail

While trying to predict how the situation ends would be a guessing game, it looks likely that both sides - government and private banks - will back down a little. It looks highly unlikely that the US government will simply let FRC fail and risk launching another domino effect in the process. It looks probable that a group of banks will purchase FRC assets and the US government would provide them with some kind of guarantee. It should be noted that $30 billion parked by 11 large US banks at FRC in March are uninsured deposits - FRC failure would therefore make those funds hard to access. On the other hand, withdrawing them now does not seem possible either as it would be a final straw that breaks the camel's neck and triggers an ultimate collapse of the bank.

Source: xStation5

Source: xStation5