-

Wall Street earnings season is just around the corner

-

Airlines start to cancel 737 MAX orders as take-off may be delayed further

-

Alphabet (GOOGL.US) may release 5G smartphone ahead of Apple (AAPL.US)

World is focused on the resumption of trade talks between China and the United States. In such a landscape it is easy to forget about another major event - Wall Street earnings season! The marathon will begin next week. As always, major US banks will be the first to report their quarterly earnings. What are companies expected to show for the July-September period?

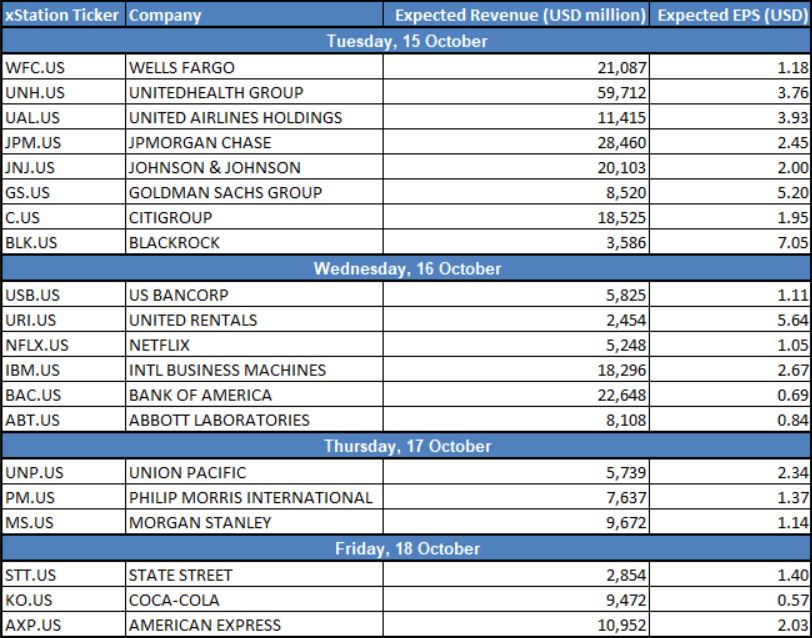

Major companies scheduled to report earnings during the first few days of the season. Source: Bloomberg, XTB Research

Major companies scheduled to report earnings during the first few days of the season. Source: Bloomberg, XTB Research

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appMajor banks will start reporting their earnings on Tuesday, 15 October. We have provided a summary of key releases during the first week of the season in the table above. On the index level earnings of S&P 500 companies are expected to decline 4.1% YoY and revenue is expected to be 2.8% higher than in Q3 2018. A point to note is that, if confirmed, it would be the third quarter in a row of annual earnings decline - the longest such streak since Q4 2015-Q2 2016 period. Energy stocks are expected to experience the biggest decline with sector earnings slipping over 30% YoY. However, it should not come as a surprise as average oil price in the quarter was significantly lower than a year ago ($56.44 vs $69.43). On the other hand, utilities are expected to see the biggest increase in earnings with a 4% YoY increase on the sector level.

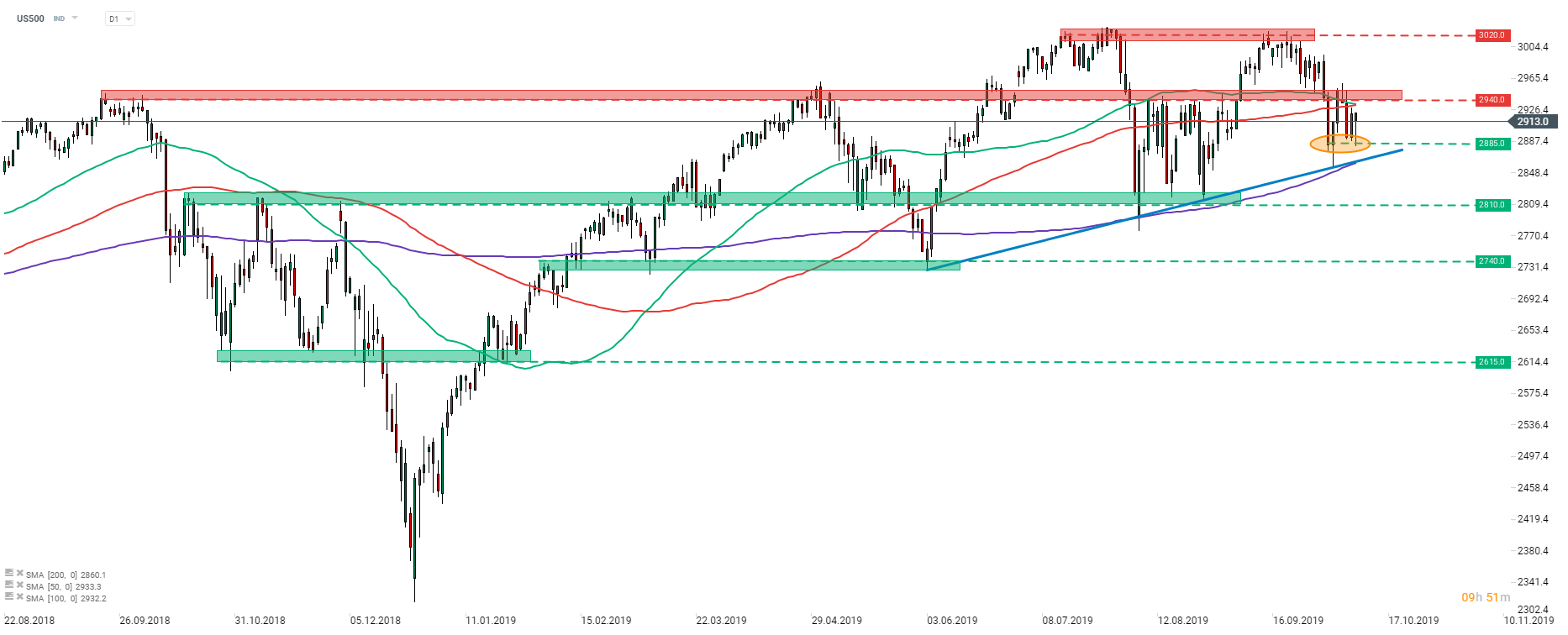

In spite of another steep dive, S&P 500 (US500) index managed to stay above the upward sloping trendline. While the earnings season begins in a full swing next week, the index is also likely to enjoy elevated volatility today and tomorrow due to Sino-US trade talks. The closest zones to watch are the resistance above 2940 pts and support at 2885 pts swing level. However, one should keep in mind that 50-session moving average (green line) is nearing a break below 100-session moving average (red line) and threatens painting a death cross - a bearish technical pattern. Source: xStation5

In spite of another steep dive, S&P 500 (US500) index managed to stay above the upward sloping trendline. While the earnings season begins in a full swing next week, the index is also likely to enjoy elevated volatility today and tomorrow due to Sino-US trade talks. The closest zones to watch are the resistance above 2940 pts and support at 2885 pts swing level. However, one should keep in mind that 50-session moving average (green line) is nearing a break below 100-session moving average (red line) and threatens painting a death cross - a bearish technical pattern. Source: xStation5

Airlines start to cancel 737 MAX orders as take-off may be delayed further

While 7 months have passed since the second 737 MAX crash, flagship Boeing (BA.US) aircraft remains grounded worldwide. Chances that planes will be back in the air this year are getting smaller. While Boeing expects the US Federal Aviation Administration to lift ban in the fourth quarter of 2019, regulators in other parts of the world, especially in Europe, are less satisfied with fixes proposed by the company. Moreover, airlines started to cancel existing orders for 737 MAX with Russian Aeroflot formally cancelling $5.5 billion order for 22 planes this week. These factors combined prevent Boeing shares from jumping above its trading range.

After steep declines following the second 737 MAX crash in March, the share price of Boeing (BA.US) started to move sideways. The stock pulled back from the upper limit of the range at the end of September but found support at the 200-session moving average (purple line) and resistance zone ranging around $365 handle. As long as 737 MAX planes remain grounded, any bigger upward move looks questionable. However, the lifting of a ban could be a trigger for larger rally. The nearest resistance levels to watch are zones at $375 and $385. Source: xStation5

After steep declines following the second 737 MAX crash in March, the share price of Boeing (BA.US) started to move sideways. The stock pulled back from the upper limit of the range at the end of September but found support at the 200-session moving average (purple line) and resistance zone ranging around $365 handle. As long as 737 MAX planes remain grounded, any bigger upward move looks questionable. However, the lifting of a ban could be a trigger for larger rally. The nearest resistance levels to watch are zones at $375 and $385. Source: xStation5

Google may release 5G smartphone ahead of Apple

Lack of 5G-compatibility in new Apple (AAPL.US) smartphones turned out to be a surprise and raised questions whether the move will not cause the US company to underperform its Chinese peer, Huawei Technologies. However, US consumers could be reluctant to buy Chinese product and it turns out they will have an alternative. According to Nikkei Asian Review report, Alphabet (GOOGL.US) is readying its own 5G smartphone. Moreover, Google-parent could officially announce the product during launch event next Tuesday, 15 October. Alphabet may become another major US rival to Apple after Microsoft (MSFT.US) unveiled its dual-screen foldable smartphone.

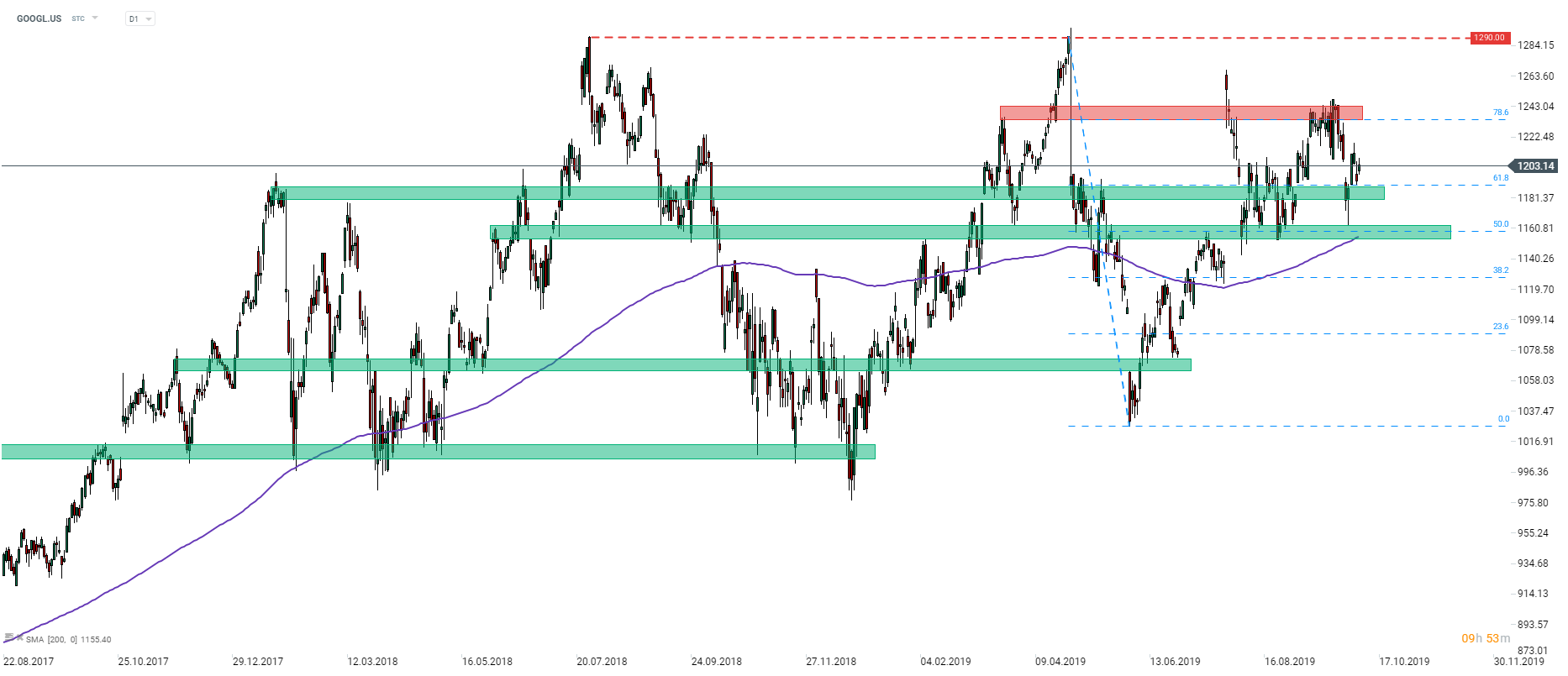

2019 has been a tumultuous year for Alphabet (GOOGL.US) shareholders. Following a gain of around 25% in the first 4 months, share price slumped 20% in May. Another 20+% gain occurred later on and after a brief pullback the stock is on the rise again. Price bounced off the 50% Fibo level of May’s decline ($1160) and climbed back above the $1200 mark. The focus now shifts to the resistance zone ranging above the 78.6% Fibo level ($1235) as it is the last hurdle ahead of all-time high at $1290. Product event scheduled for next week could be a major driver for the stock. Source: xStation5

2019 has been a tumultuous year for Alphabet (GOOGL.US) shareholders. Following a gain of around 25% in the first 4 months, share price slumped 20% in May. Another 20+% gain occurred later on and after a brief pullback the stock is on the rise again. Price bounced off the 50% Fibo level of May’s decline ($1160) and climbed back above the $1200 mark. The focus now shifts to the resistance zone ranging above the 78.6% Fibo level ($1235) as it is the last hurdle ahead of all-time high at $1290. Product event scheduled for next week could be a major driver for the stock. Source: xStation5