-

Gold price rushed above $2,000 earlier in the year

-

Gold mining stocks outperformed major US indices

-

Loose monetary policy keeps gold prices supported

-

Newmont (NEM.US) trades in a downward channel

Gold mining stocks can be a great alternative to gold investments. They have attracted a lot of attention from investors this year as gold prices run towards all-time highs above $2,000. Favourable monetary landscape can help bonanza last for years. Moreover, weaker correlation with the broad stock market can make them an interesting tool for portfolio diversification.

Great performance in 2020 so far

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appPortfolio investors can look towards gold mining stocks as an alternative to gold investments. Correlation between gold and gold mining stocks is not perfect but the latter does not incur cost related to holding physical commodity and represent ownership of the company. Lack of perfect correlation with the gold market does not necessarily mean that they offer worse investment results.

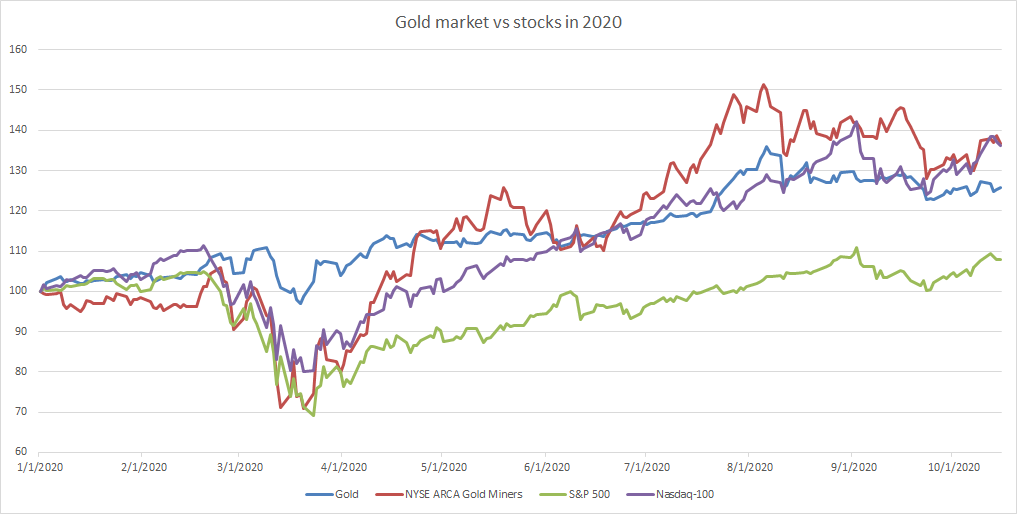

Gold miners index outperformed gold and most major US indices this year. Its performance this year is on par with tech Nasdaq. Source: Bloomberg, XTB

Gold miners index outperformed gold and most major US indices this year. Its performance this year is on par with tech Nasdaq. Source: Bloomberg, XTB

2020 is a perfect example. Both gold and stocks rallied during post-pandemic recovery. Gold outperformed most US indices with exception of Nasdaq. However, NYSE Arca Gold Bugs, index grouping gold miners from all around the world, managed to gain not only more than gold but also more than US tech index! After a recent pullback, Nasdaq and NYSE Arca Gold Bugs both trade around 36% higher year-to-date.

Monetary policy helps keep prices high

Gold prices are being supported by loose monetary policy of most central banks. It looks unlikely that the situation will change anytime soon and a flood of cheap money will keep precious metals prices elevated. This is of course great news for gold miners. Even after a pullback from all-time highs, gold continues to trade at historically high levels at which all gold mines are profitable. As gold mining costs are insensitive to price levels, high prices directly translate into higher profits. Not to mention that high US debt resulting from pandemic recovery programmes may keep pressure on USD.

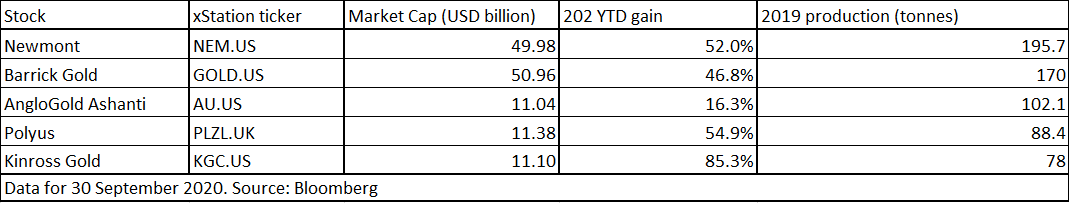

Top5 gold mining stocks. Source: Bloomberg, XTB

Top5 gold mining stocks. Source: Bloomberg, XTB

A point to note is that gold mining stocks can be used to diversify portfolios. Taking early-year rout as an example, gold miners index experienced a smaller drawdown than most of US and European stock market indices. Gold has a weaker correlation with the broad market than, for example, oil or copper as it is not as extensively used in the global economy. It functions as one of preferred reserve assets and tends to gain in risk-off situations (other commodities tend to drop). Investors can find top gold mining stocks on xStation, including world's biggest producer Newmont (NEM.US)

Newmont (NEM.US) revisited highs from 2011 in the $72 area in August this year. Stock has pulled back since and started to trade in a downward channel. However, unless the price breaks below the lower limit of the Overbalance structure at $55 it can still be considered just a correction move. Upper limit of the price channel at $63.50 is a key target for buyers in the near-term. Source: xStation5

Newmont (NEM.US) revisited highs from 2011 in the $72 area in August this year. Stock has pulled back since and started to trade in a downward channel. However, unless the price breaks below the lower limit of the Overbalance structure at $55 it can still be considered just a correction move. Upper limit of the price channel at $63.50 is a key target for buyers in the near-term. Source: xStation5