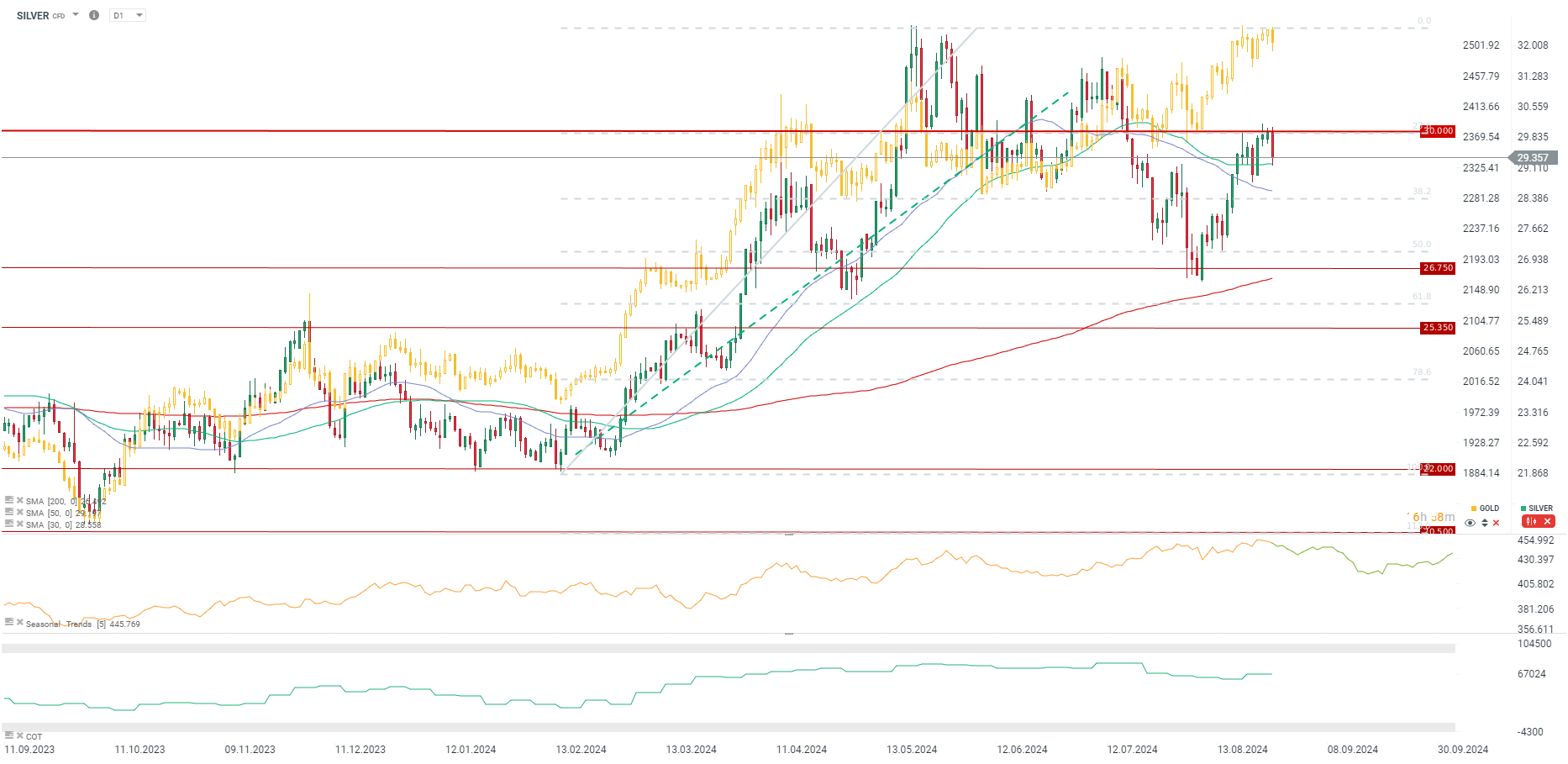

Today, we are observing a strong pullback in the silver market after the metal reached its highest levels in a month earlier this week, briefly surpassing the $30 per ounce mark. Silver is retreating by 2% today, with gold prices also down by 0.7%. Market chatter suggests portfolio rebalancing ahead of the month's end, just before investors return from their summer holidays. Historically, September has been one of the weaker months for both gold and silver. Additionally, the U.S. dollar is stronger today, gaining more than 0.5% against the European currency. The dollar's strength is due to uncertainty surrounding the number of interest rate cuts by the Federal Reserve. The market is expecting as much as a 100 basis point cut and is still giving about a 35% chance of a double cut in September. It is also worth noting that after today's trading session, Nvidia's earnings will be released, which could influence movements in the bond market and, consequently, the dollar. On Friday, we will receive the U.S. PCE inflation data.

Silver is responding positively to the 30-period moving average. Slightly below, around 28.5, is the 50-period moving average. Source: xStation5

The gold-to-silver ratio has once again retreated from the 88-90 range. Nevertheless, such a high ratio suggests that silver is undervalued relative to gold. On the other hand, during a bear market in precious metals, silver typically loses more value than gold, so during a correction, we cannot rule out a return of the ratio to the 88-90 range. However, this year we have seen the ratio around the 72-73 level. The 20-year static average indicates a level of 69-70 as the equilibrium point. Source: Bloomberg Finance LP, XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?