Rivian (RIVN.US) stock dropped over 10% during today's session after the electric vehicle maker posted a quarterly loss of $1.23 billion for the third quarter stemming from expenses to begin production of its electric pickup truck. The company had previously predicted an operational loss between $745 million and $795 million and a net loss between $1.21 billion and $1.28 billion. It was Rivian’s first quarterly report as a public company, and revenue was $1 million from its first deliveries. Moods worsened after the company said it expects to fall “a few hundred vehicles short” of its 2021 production target of 1,200 vehicles as it struggles with supply chain problems as well as challenges ramping up production of the complex batteries that power the vehicles.

On the other hand, the company confirmed plans for a new $5 billion plant in Georgia that’s expected to be operational in 2024. Also combined preorders for the electric truck and SUV climbed to 71,000 as of December 15 from 55,400 at the end of October, the company said.

Start investing today or test a free demo

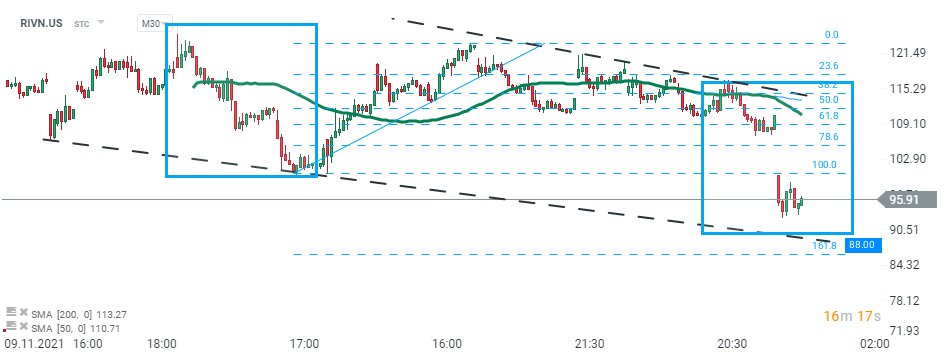

Open real account TRY DEMO Download mobile app Download mobile app Rivian (RIVN.US) stock price dropped to the lowest level since IPO during today’s session. If current sentiment prevails, a downward move may accelerate towards support at $88.00 which is marked with a lower limit of the 1:1 structure and lower boundary of the wedge formation. Source:xStation5

Rivian (RIVN.US) stock price dropped to the lowest level since IPO during today’s session. If current sentiment prevails, a downward move may accelerate towards support at $88.00 which is marked with a lower limit of the 1:1 structure and lower boundary of the wedge formation. Source:xStation5