There’s been some small upside seen in the pound today with the currency moving back above the $1.28 mark, aided by a softer dollar and also reports from the ECJ that the UK can unilaterally end Brexit. According to judges, Britain can decide to withdraw its notification leave the EU without the need for permission from the other 27 states in what is being touted as a significant success for Remainers. Unfortunately for them, while this may fractionally increase the chances of reversing Brexit it isn’t really a game changer as the remaining EU countries would in all likelihood have accepted the withdrawal of Article 50 anyway.

Pound not pricing in disorderly Brexit

The legality surrounding the possible withdrawal of Article 50 is making the news, but it still remains highly unlikely to occur with the more pressing issue for the UK, and traders of the pound, being whether May’s Brexit deal can avoid a crushing defeat in the commons next week. While the parliamentary arithmetic to pass the agreement remains highly challenging, a narrow defeat could well be seen as a victory as it would show that there is not far from the requisite support needed to proceed. Should the outcome show the bill being voted down by around 20 votes or less then the government will likely feel confident that they can flip more than half of these to deliver their desired result, but anything significantly higher than this as a losing margin would throw the whole process into turmoil.

The pound is moving higher today and on course for a solid day of gains with the GBPUSD pair once more respecting support in the 1.2660-1.2720 region. Source: xStation

In terms of how forex traders are assessing the likely outcome, BoE Governor Carney has stated that he believes the underlying price of sterling hasn’t factored in a high chance of a disorderly Brexit. It is hard to disagree with the standpoint given the fairly sanguine nature of the pound of late, but the concern is that there’s a worrying level of complacency around should May’s deal be vetoed. To be clear, if the deal is rejected by a large margin next week it won’t necessarily ensure a disorderly Brexit, but it would certainly raise the prospect of one and could lead to a swift move lower in the pound.

Pick-up in latest manufacturing data

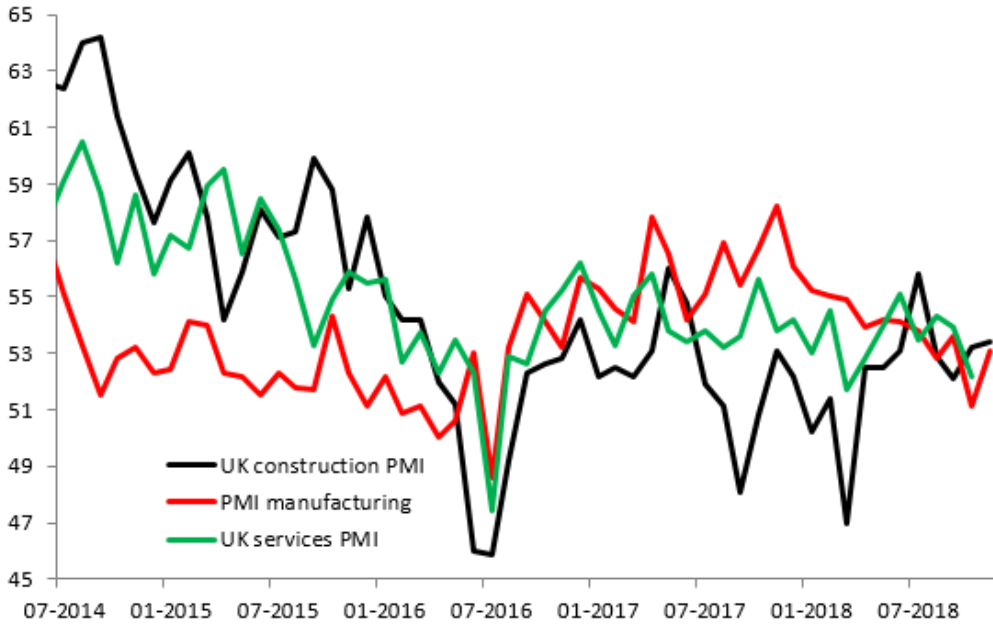

For the second day running we’ve had some better than forecast economic data from the UK, with a print of 53.4 in the November construction PMI coming in above the expected 52.5. The rebound from the numbers for October is pleasing, but due to the sector representing a relatively small part of the UK economy it has had little impact on the pound. The economy is seemingly keeping calm and carrying on in the face of ever growing uncertainty regarding Brexit and while downside risks clearly remain their could actually be a decent pick-up in economic activity if a favourable outcome can be reached.

Sector surveys have shown a bit of a pick-up in manufacturing and construction in the last month despite the ongoing uncertainty surrounding Brexit. Source: XTB Macrobond

Sector surveys have shown a bit of a pick-up in manufacturing and construction in the last month despite the ongoing uncertainty surrounding Brexit. Source: XTB Macrobond