Apple (AAPL.US) shares have recently come under pressure after analysts at several Wall Street funds saw a threat to the company's further expansion. On Tuesday, Barclays and today Piper Sandler decided to change their rating from 'overweight' to 'neutral', lowering their target price by $15, to $205 per share. The giant's shares are losing 1% before the open. Will Apple be a company highly sensitive to a possible 'recession'?

Piper Sandler has doubts in Apple 2024 momentum

- In an analyst report, Piper Sandler cited a weaker smartphone demand globally, a fairly high stock valuation and macro uncertainty weighing on sentiment in 2024. This shows that potentially weakening macro data from the U.S. or other economies could cause more concern around the valuation of the shares of the largest U.S. listed company;

- In particular, Piper Sandler expects the first half of the year to be challenging for consumers in many countries, making the semiconductor and smartphone industries vulnerable to uncertain new trends. In the case of Apple, the report highlighted the risk of accumulated large inventories entering the new year. This could put pressure on margins and earnings per share if product sales are lower;

- Analysts pointed out that Apple's growth rate has likely already reached a record high for unit sales. Also, the deteriorating macro environment in China could have a significant impact on Apple's smartphone business, in the Asian market;

- Also in the broader context is Apple's strategic Taiwan, where elections will be held this year. The company has the largest factories in mainland China, and rising tensions between Beijing and Washington may indicate risks to the manufacturing chain. Chinese diplomats have indicated that the new year will be a year for Taiwan to choose between 'war and peace' which has somewhat raised concerns around a possible escalation.

Apple will report Q4 2023 results on February 1, 2024.

Start investing today or test a free demo

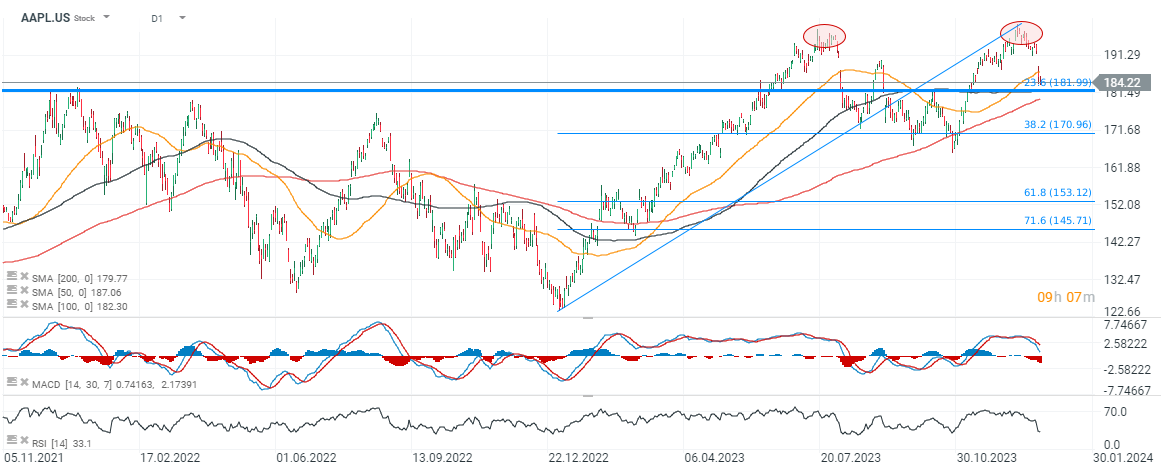

Open real account TRY DEMO Download mobile app Download mobile appApple shares (AAPL.US, D1)

Looking at the chart of Apple shares, we see a bearish double peak formation above $200 per share, previous price reactions, the 23.6 Fibonacci retracement and the dynamics of the SMA200 moving average as well as the extent of the previous correction in the uptrend suggest that the stock may seek to test the $170 level. On the other hand, the RSI indicator at 33 points suggests an oversold condition.

Source: xStation5