Oil prices are jumping over 2.5% today, following another increase in tensions in the Middle East. Two high-profile assassinations took place in the Middle East in the past 24 hours, increasing the risk of a broader conflict in the region, which would have a big implication for the oil markets.

Ismail Haniyeh, chief of Hamas political wing and the group's key negotiator in ceasefire talks with Israel, has been assassinated in Teheran, Iran, while attending the inauguration of the new Iranian president. His death was confirmed by both Hamas and Iran. A few hours earlier, Fuad Shukr, Hezbollah's second-in-command, has been targeted in a missile strike in Beirut, Lebanon. There are conflicting reports on the outcome of Shukr's assassination attempts, with Hezbollah claiming he survived, while other sources claim he was killed. Shukr is said to have been responsible for a weekend missile strike in Golan Heights, which resulted in number of Israeli civilian casualties.

While no one has claimed responsibility for the attacks, the identity of the targets - senior commanders of Iranian proxies - caused the blame to be quickly put on Israel. While such high-profile assassinations have taken place in the past in the Middle East, this time observers fear a strong response from Iran and its regional proxies. This is because Haniyeh was assassinated in Teheran, capital of Iran, while visiting the country on invitation of Iranian authorities. This is a huge reputational blow to Iranian security forces and Iranian authorities has already vowed to take a revenge.

Tensions in the Middle East are on the rise, and whether they led to a broader regional conflict will likely depend on the scale of Iranian response.

Iranian response to April's strike on the consulate in Damascus involved 300 missiles being fired at Israel, but almost all of them have been shot down by Israel and its allies, causing little to no damage on the ground. Should potential Iranian retaliation to today's attacks play out in the same way with similar outcome, a broader conflict may be avoided. However, should it cause a significant damage to Israel, Israel would likely respond with its own retaliatory strikes, and it could trigger a broader war in the Middle East.

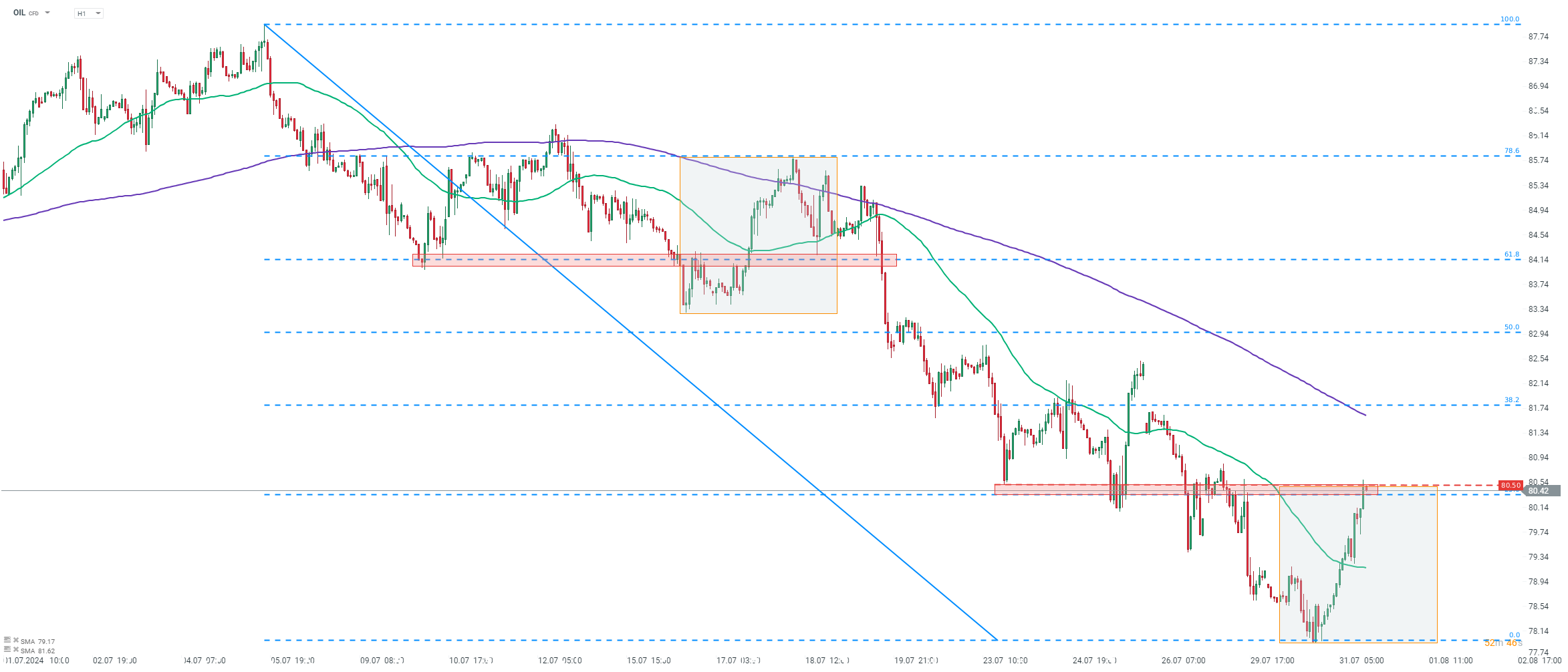

As the Middle East is responsible for around a third of global oil supply, broader war in the region could significantly disrupt oil trade and lead to higher prices. Brent (OIL) and WTI (OIL.WTI) are trading around 2.5% higher today. Taking a look at OIL chart at H1 interval, we can see that the price is attempting to break above a key resistance zone in the $80.50 per barrel area. This zone is marked with previous price reactions, 23.6% retracement of the ongoing downward impulse as well as the upper limit of local market geometry, therefore a break above it could, in theory, signal short-term trend shifting to bullish.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30