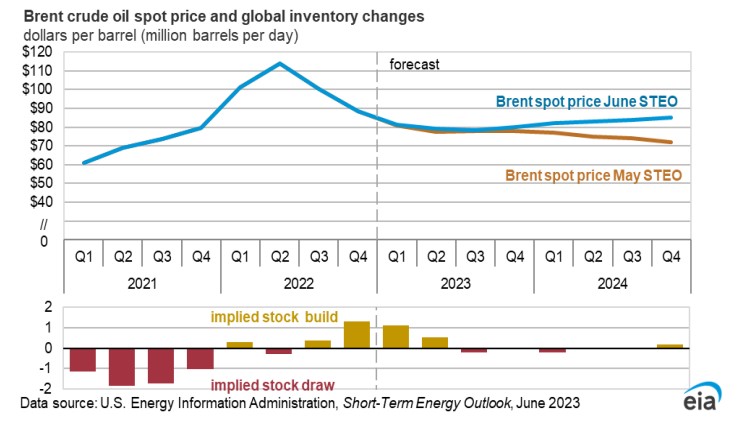

A new Short-Term Energy Outlook (STEO) report from the U.S. Energy Information Administration (EIA) has been released today. The report primarily indicates that the supply constraints from OPEC will lead to a decline in global oil inventories over the next five quarters. However, it is important to note that this decline will be very small, and the market will remain balanced. That is why the EIA expects price stability, with Brent averaging around $79 USD this year and $83 USD next year.

Long-term oil price forecast was revised higher. EIA expects inventory drop in Q3 and a price jump in Q4. Source: EIA

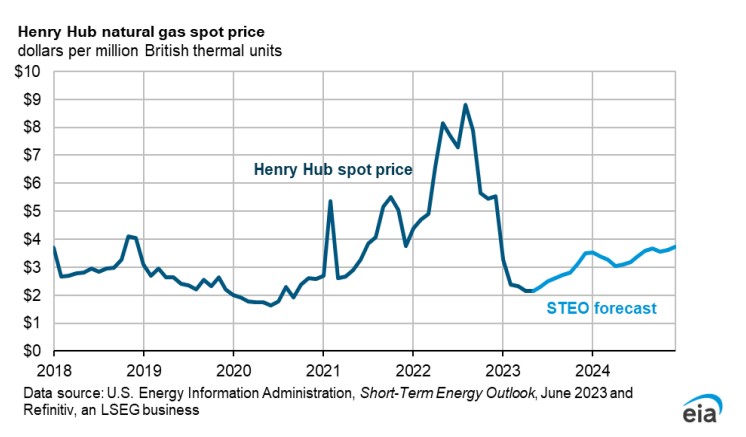

Regarding the natural gas market, the EIA indicates that gas production is averaging at high levels. However, production in the following year is expected to average at lower levels than initially anticipated. The EIA points to a moderate increase in spot prices, although it is important to keep in mind that the forecast largely relies on the futures curve, which is currently in a significant contango.

EIA forecast for natural gas prices relies on the futures curve to a huge extent. EIA expects a rather significant natural gas oversupply to continue, what may limit potential for large price gains. Nevertheless, should US production begin to struggle, for example due to a drop in number of gas drilling rigs, one cannot rule of below-average inventory builds. Source: EIA

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report