Netflix (NFLX.US)

The world's largest streaming service Netflix (NFLX.US) reported financial results that shut the mouths of critics and positively disappointed Wall Street:

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appNumber of subscriptions: 2.41 million vs. 1.07 million forecast (Refinitv)

Revenues: $7.92 billion vs. 7.85 billion forecasts (up 6% y/y)

Earnings per share (EPS): $3.10 vs. $2.22 (43.1% above expectations)

- Netflix surprised with a positive forecast of 4.5 million new subscriptions by the end of 2022 thanks to the ad-supported version of the service, again ahead of Wall Street's estimate of 4.2 million, according to Reuters. However, the company expects Q4 revenue to fall to $7.8 billion due to the still-strong U.S. dollar, which is weighing on the company. Netflix plans to premiere 'The Crown' and 'Knives Out' in Q4 of the year, which could prove positive for the company especially with the fall and winter season likely to drive viewership;

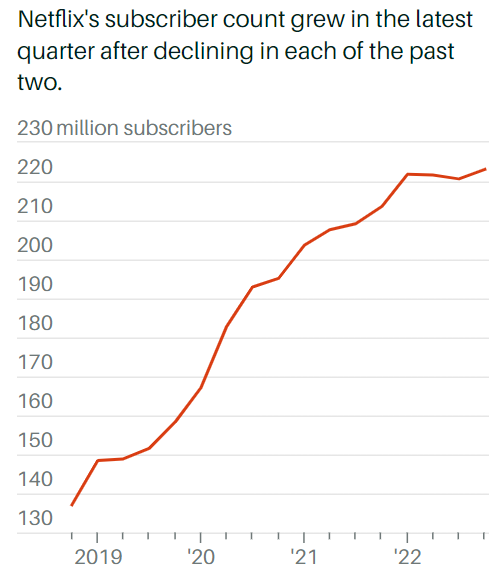

- Netflix added 2.4 million new subscriptions between July and September. It lost about 1.2 million in the first two quarters of the year amid growing competition from Paramount+ and Disney+, among others. Netflix now has 223.1 million subscriptions worldwide, and its annual subscription balance came out on the plus side already in the third quarter of the year. The stock is still trading nearly 60% below its 2021 peaks;

- According to Netflix, streaming competitors are still far from matching the company, and are estimated to end the operating year with losses of more than $10 billion, while Netflix expects an annual operating profit of $5 billion to as much as $6 billion;

- The subscription figure of 2.41 is more than double the pessimistic forecast two quarters ago. Analysts are looking positively at the possibility of making ads available. According to Evercore ISI, ads will bring in $1 billion to as much as $2 billion in additional revenue from advertisers, through 2024. Uanalysts BC and Citigroup also commented positively on the company's decision.

Netflix's subscription numbers are back on the rise and have left two quarters of slowdown behind. The level above 230 million could be reached as early as Q1 2023. Source: FactSet

Netflix's subscription numbers are back on the rise and have left two quarters of slowdown behind. The level above 230 million could be reached as early as Q1 2023. Source: FactSet

United Airlines (UAL.US)

The airline's results positively surprised Wall Street, with the company expecting the trend of post-pandemic covid travel to overcome recessionary pressures. Shares gained 7% before the open:

Revenue: $12.88 billion vs. $12.75 billion forecast (8% below Q3 2019)

Profit: $942 million (13% higher than Q3 2019)

Earnings per share (EPS): $2.81 vs. $2.28 forecasts

- The airline said it expects Q4 earnings per share of $2.25 vs. $0.85 expectations of Refinitv analysts. The company also expects operating margin to be above pre-pandemic levels for the first time in the fourth quarter of this year. Similarly to United Airlines, Delta Airlines also shared a 'bullish' forecast last week

Netflix (NFLX.US) shares, D1 interval. Bulls are trying to change the trend and bring about a positive intersection of the SMA50 average with the SMA200, which could indicate a change in trend, a situation described by AT as a 'golden cross'. An opening above $270 could indicate increasing pressure for the price to climb above the SMA200, which runs around $280. Source: xStation5