-

US indices finished yesterday's trading significantly lower - S&P 500 dropped 1.40%, Nasdaq declined 2.20% and Russell 2000 closed over 1.40% lower.

-

The stock market experienced a sell-off, driven by robust jobs data and an increase in Treasury issuance.

-

This market reaction came a day after the U.S. credit was downgraded, leading traders to pull back following a rally that amassed $6.5 trillion.

-

Equities suffered broad declines, with the S&P 500 experiencing its worst performance since April.

-

The Nasdaq 100 index fell by 2%, following a 40% increase earlier in the year, spurred by interest in artificial intelligence.

-

Both NVIDIA and Tesla shares dropped by at least 2.7%.

-

The VIX, often referred to as Wall Street's "fear gauge," saw its most significant rise in nearly five months.

-

Ten-year bond yields reached levels not seen since November.

-

The U.S. dollar appreciated against all other developed-market currencies. Despite gains, the mood surrounding the dollar remains cautious, with less than 0.1% changes observed in dollar pairs.

-

Concerns grew among traders regarding a steepening yield curve, as rates on long-term bonds rose more quickly than those on short-term maturities.

-

A high-level conversation took place between the Pentagon's top Asia official and a representative from China's Ministry of Foreign Affairs, focusing on U.S.-China defense relations and regional security.

-

Australian Composite PMI registered at 48.2, and Australian Services PMI was 47.9.

-

Japanese Services PMI came in at 53.8, with the Composite PMI at 52.2.

-

Australian Trade Balance was reported at 11321M, with imports decreasing by 4% and exports by 2%.

-

The Chinese Caixin Services PMI was measured at 54.1.

-

India's Services PMI was recorded at 62.3.

-

Japan's Chief Cabinet Secretary Matsuno emphasized the close monitoring of foreign exchange movements and their potential effects on the Japanese economy.

-

Bill Ackman, of Pershing Square Capital Management, is taking a short position on bonds, anticipating a persistent inflation rate around 3%.

-

A preview of the Bank of England's Monetary Policy meeting hints at a potential 25 basis points rate increase.

-

Both Deutsche Bank and Japanese bank Nomura are projecting a 25 basis points rate hike from the Bank of England.

-

Analysts at ANZ bank are holding their end-of-year oil price prediction at $100 per barrel, citing expected slow growth in U.S. oil production.

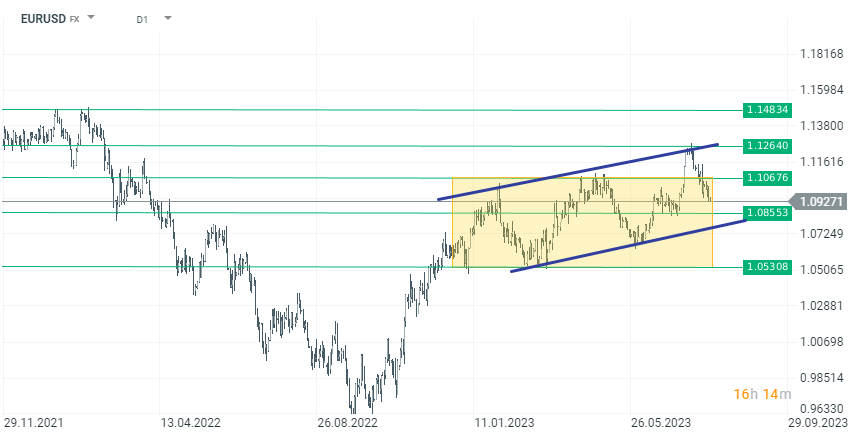

The U.S. dollar continues to strengthen, and today it is the best-performing currency among the rest of the developed countries. EURUSD has returned to the consolidation range and below the key level of 1.10. Currently, EURUSD is trading 0.10% lower at 1.0927.

The U.S. dollar continues to strengthen, and today it is the best-performing currency among the rest of the developed countries. EURUSD has returned to the consolidation range and below the key level of 1.10. Currently, EURUSD is trading 0.10% lower at 1.0927.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report