The shares of the oldest operating bank in the world, Italy's Monte dei Paschi di Siena (BMPS.IT) are gaining nearly 4% in the face of an announcement by the Italian Treasury that it intends to sell off nearly 64% of the Bank's shares. However, there is a condition, such an option is only considered if it would be financially advantageous and provided that any, significant new investor would manage the Bank in line with the Italian national interest.

It is worth recalling that the commitments made with the European Union at the time of the Bank's rescue in 2017 bind Italy to the eventual resale of Monte dei Paschi di Siena. The government wants the Bank to be acquired by one of Italy's existing banking conglomerates, such as UniCredit (UCG.IT) or Banco BPM SpA (BAMI.IT). At this point, however, these institutions deny any interest in a potential takeover of BMPS. Prime Minister Giorgia Meloni has repeatedly said that the privatisation of MPS should foster the creation of several large banking groups in the country.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app

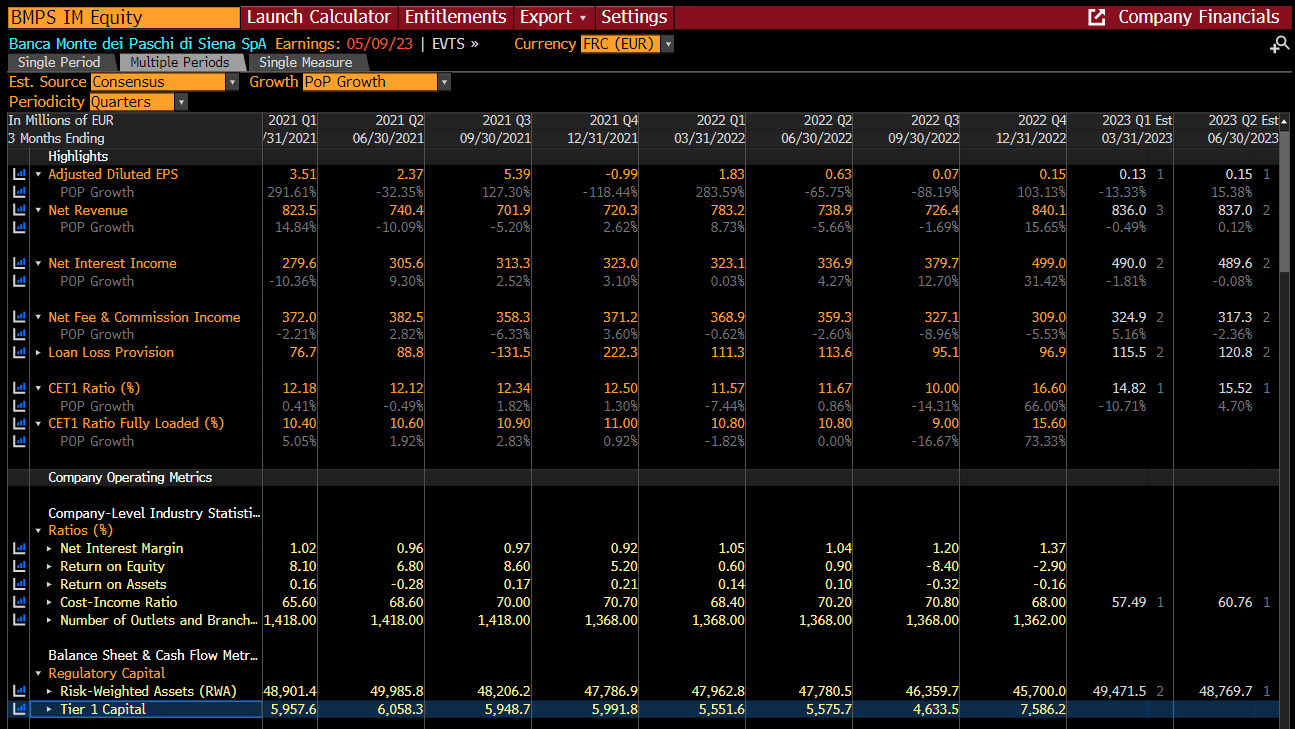

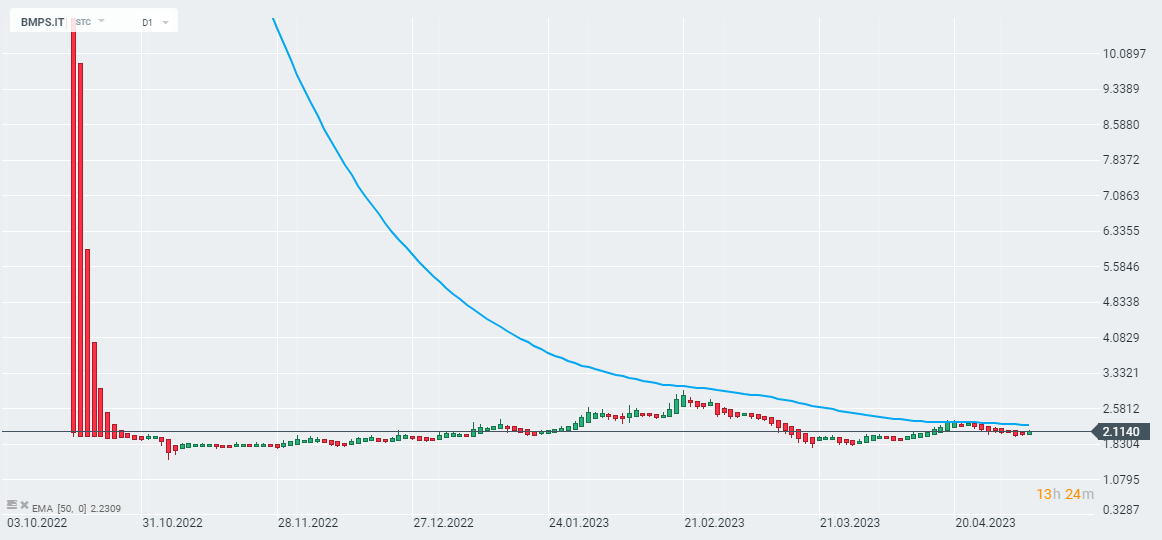

Despite the fact that the Bank's shares have already been trading in a dynamic downtrend for many years, State aid and the preventive plans implemented seem to be supporting the business operability of Monte dei Paschi di Siena (BMPS.IT). Performance is improving, which may support the entity's attractiveness towards future M&A opportunities. The latest quarterly results will be presented tomorrow. Source: Bloomberg

Heikin Ashi chart of Monte dei Paschi di Siena (BMPS.IT) shares. Source: xStation 5