- Wall Street is losing at the start of today's session. US30 and US500 are losing 0.7% and 0.35% respectively, US100 is trading flat

- US consumer sentiments according to University of Michigan came in weaker, inflation expectations slightly higher - bad for the stock market

- Companies related to the luxury furniture (RH.US) and industrial (MSM.US) sectors are losing today

- Adobe (ADBE.US) leads the way among tech companies, with nearly 15% growth driven by AI

Today's US data suggests that price pressures are easing, though at the expense of consumer sentiment. Sentiment readings by the University of Michigan (preliminary data) showed weaker data, with a (slight) increase in inflation expectations). Mester's comments from the Fed suggest that policymakers will be willing to cut rates before inflation falls to the Fed's 2% target, but there are increasing signs that falling price pressures will result in weak cyclical business and weaker consumption readings. Shares of US luxury furniture maker RH and industrial parts provider MSC Industrial are pressured today, losing -16% and -10% respectively.

Prelim University of Michigan US data

University of Michigan sentiments came in 65.6 vs 72 expected and 69.1 previously

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Expectations: 67.6 vs 72 exp. and 68.8 previously

- Current condition: 62.5 vs 72.2 exp. and 69.6 previously

5yr inflation expectations came in 3.1% vs 3% exp. and 3% previously

- 3yr inflation expectations came in 3.3% vs 3.2% exp. and 3.3% previously

US import / export prices

-

US Import prices: -0.4% MoM vs -0.1% exp. and 0.9% previously

- US Export prices: -0.6% MoM vs 0.1% exp. and 0.5% previously

US30 chart (M30 interval)

Contracts on the Dow Jones Industrial Average (US30) are having a weak session today, slipping below the 71.6 Fibonacci retracement of the May 30 upward wave, near 38,400 points. A drop below could lead to a test of 38,000 points, where the important price reactions of March and April, this year, are located.

Source: XStaiton5

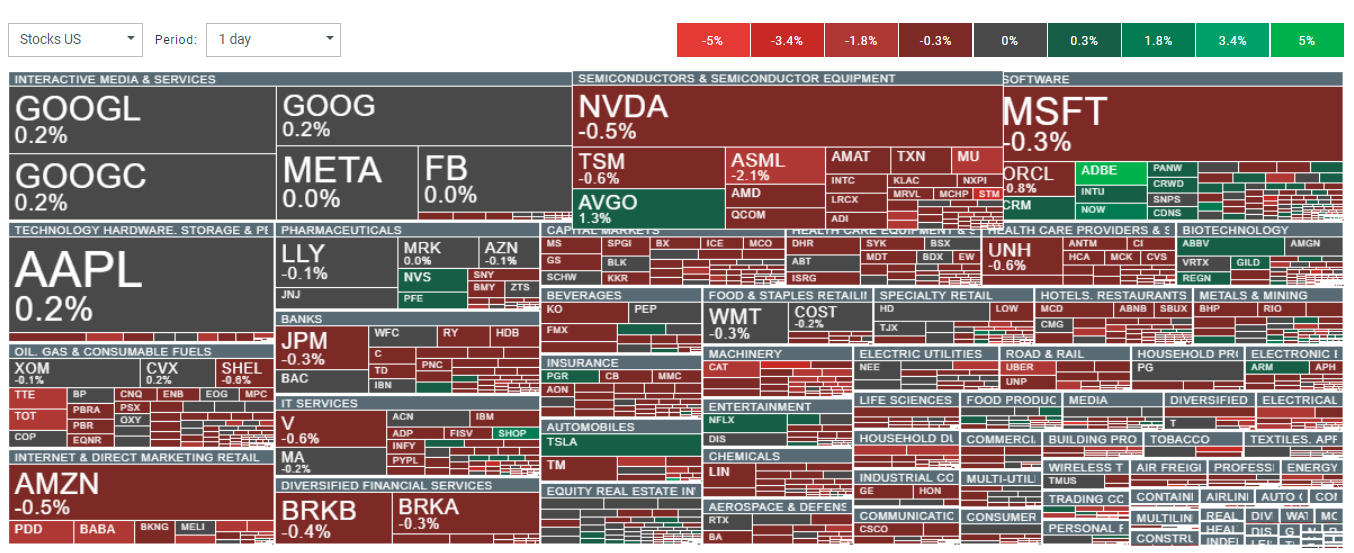

After Wall Street opened, declines prevail on the stock market. Most 'large cap' companies are losing, Shopify (SHOP.US) and Adobe (ADBE.US) stand out among the rising stocks. Source: xStation5

News from companies

- Adobe (ADBE.US) shares gain double digits after the company beat earnings and raised annual forecasts, citing improving demand for its AI solutions

- MSC Industrial (MSM.US) shares are losing ground after the large U.S. supplier of industrial and foundry parts reported disappointing preliminary quarterly results

- Shares of steelmaker Nucor (NUE.US) lose nearly 1%; Q2 2024 profit forecast disappointed investors

- Shares of Pinterest (PINS.US) lose more than 3% after analysts at Piper Sandler pointed to a shift in growth momentum toward rival Amazon, seen in May

- Luxury furniture distributor and manufacturer RH (RH.US) loses nearly 16% after the company reported a larger-than-expected quarterly loss. The company expects Q2 revenue growth on a yearly basis between 3% and 4%, below Wall Street expectations of at least 7%. RH expects that monetary policy will continue to weigh on the housing market demand in the second half of the year and probably also in 2025. RH lost $0.4 per share non-GAAP vs $0.12 expected by analysts. Company revenue of $726.96 million beat estimates only slightly, by $1.8 million.

RH stock (RH.US, W1 interval)

Source: xStation5

MSC Industrial (MSM.US, W1 interval) shares

The company's shares are trading today at one of their weakest sessions on record, and are trading near the 38.2 Fibonacci retracement of the 2020 upward wave.

Source: xStation5