AMC gains almost 100%, GME +75% and SunPower 60%. Russell 2000 gains around 1%.

‘Meme stocks’ have once again taken over Wall Street, as can be seen from the strong gains of companies such as AMC, GameStop and AMC. For companies related to photovoltaics and renewable energy in the broader sense, we also have news of new tariffs on Chinese photovoltaic manufacturers announced by the US President Joe Biden. This is why a large proportion of the growth leaders in the Russell 3000 index, which brings together 95% of US companies by capitalisation, are PV-related companies.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appCompanies considered to be meme companies are growth leaders in the broad Russell 3000 index. These companies are mostly characterised by very high short-interest, which is the proportion of stocks that are used for short selling. Source: Bloomberg

Of particular note is SunPower, where short-interest is over 95% and the number of days needed for funds to cover short positions is about 8 according to Bloomberg estimates! It is the short-interest that is the key factor in the strong growth of the meme companies. In 2021, individual investors targeted heavily sold companies by funds, leading to multi-billion dollar losses. GameStop, which started the whole meme company movement, has a lower short-interest of 24%. However, this company has a significantly larger capitalisation and the number of days needed to cover short positions is as high as 17. Among the growth leaders we also have AMC, with a short-interest of 18%, PlugPower 26%, Maxeon 43%, or BigLots 30%. Riding the wave of growth in smaller companies, the Russell 2000 index is gaining quite strongly.

GME shares have been at the forefront of increases over the past few sessions. It can be seen that AMC and SunPower shares have lost more heavily since the holiday period last year. Source: xStation5

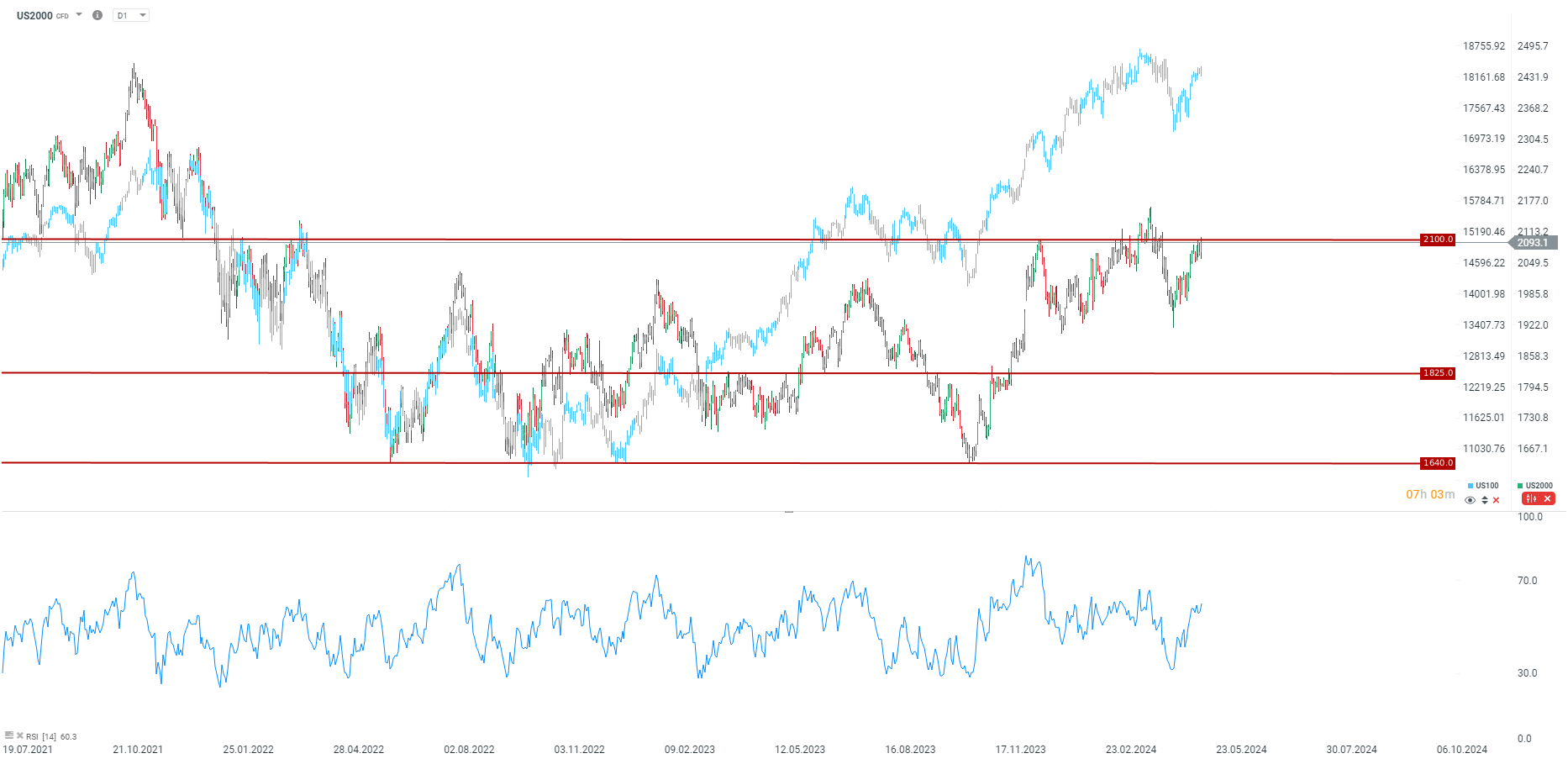

US2000 is trying to knock out recent local peaks, while it is more than 15% short of its historic highs. The situation on the US100 is completely different. The big difference in the indices is precisely the result of the over-selling of smaller companies from the holiday season last year. Seasonality suggests that we may be behind a local low, with seasonal peaks likely in late May and then late July. Of course, further movements will depend largely on the health of companies and the outlook for monetary policy in the US, although of course the frenzied demand for meme stocks could lead to increased interest in smaller companies. Source: xStation5