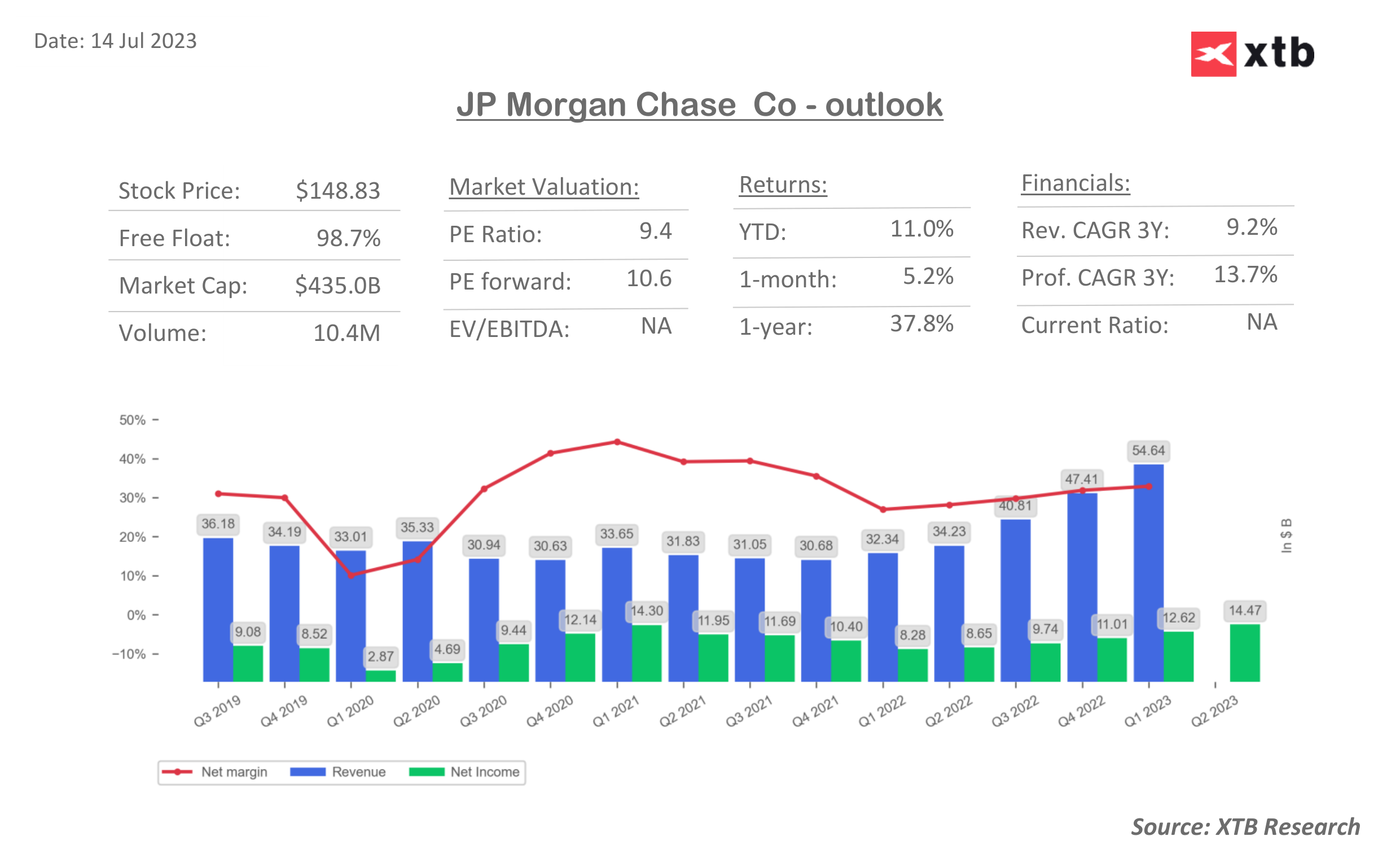

JP Morgan (JPM.US)

JPMorgan Chase shares gained 4.53% in the ppre-market reading after the company reported a 67% increase in second-quarter profit, driven by higher interest payments from borrowers and the acquisition of First Republic Bank. The bank's net interest income rose significantly, bolstered by the purchase of First Republic. CEO Jamie Dimon reassured investors about the resilience of the economy but highlighted risks such as consumer cash buffers, high inflation, and the war in Ukraine. JPMorgan's quarterly profit reached $14.47 billion, or $4.75 per share, compared to $8.65 billion, or $2.76 per share, in the same period last year. The bank's consumer banking and investment banking divisions showed strength, while investment banks, in general, have been cutting costs due to sluggish trading revenues.

Key financials:

- Net Income: $14.6 billion, an increase of 15% compared to the Q2 2022.

- Total Revenue: $42.4 billion,compared to the $31.6 billion the same period last year.

- Earnings per Share (EPS): $4.75 compared to the $3,83 expected

- Total deposits $2.40 t, est. $2.44 t

** The dashboard presents net profit and total revenue, hence these values differ from the summary, where net revenues were given.

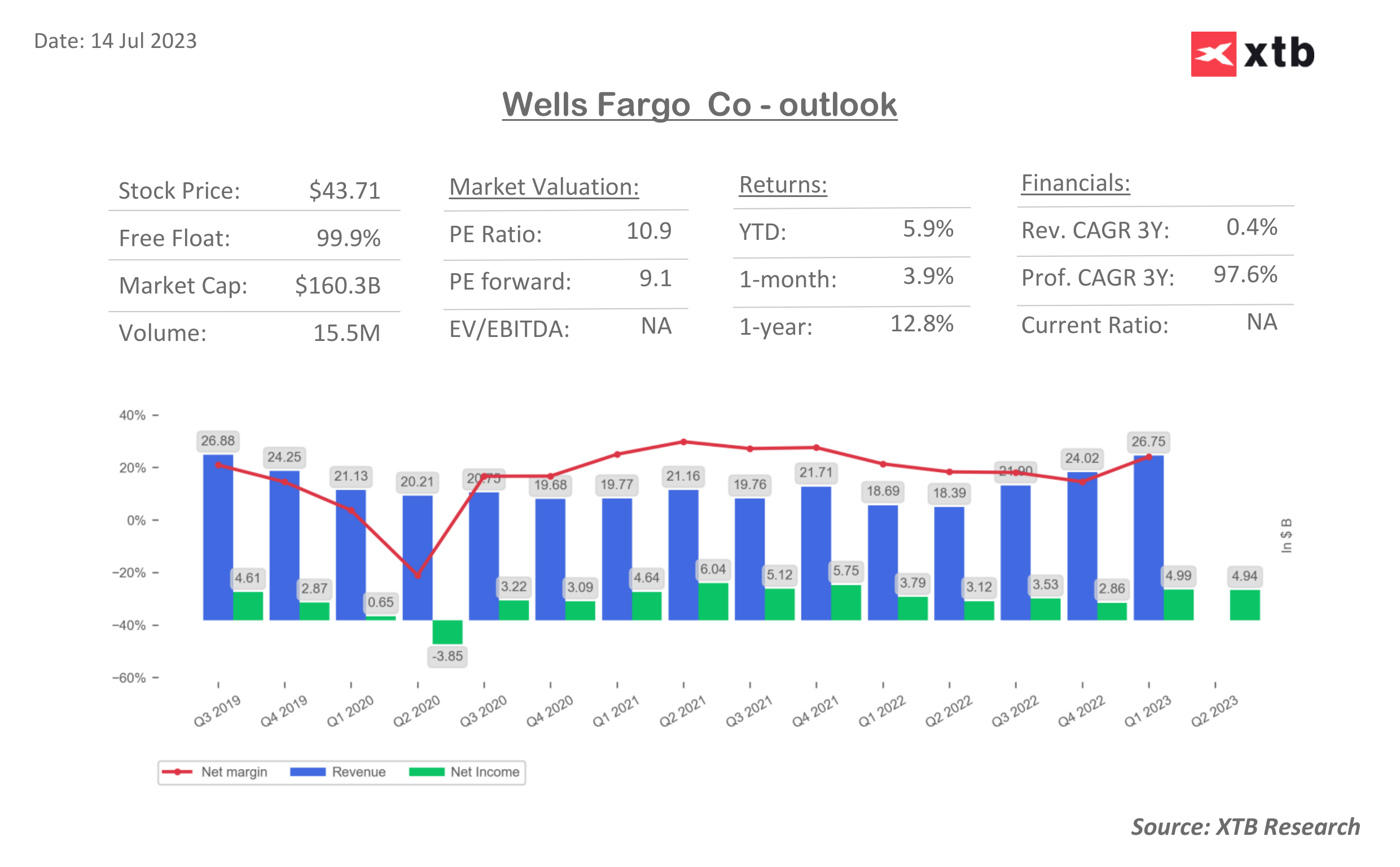

Wells Fargo (WFC.US)

Similarly, shares of Wells Fargo are gaining after a 57% surge in second-quarter profit, driven by increased customer interest payments and a higher annual forecast for net interest income. The bank's net interest income climbed 29% to $13.16 billion as borrowing costs rose following rate hikes by the U.S. Federal Reserve. Wells Fargo raised its net interest income forecast by 14%, expecting it to exceed last year's $45 billion. The provision for credit losses, including potential losses in commercial real estate office loans, increased to $1.71 billion. Despite the positive results, Wells Fargo is still operating under an asset cap, limiting its growth until regulatory concerns are addressed.

Key financials:

- Net Income: $4.9 billion, an increase of 57% compared to Q2 2022.

- Total Revenue: $20.5 billion, up 21% from the same period last year.

- Earnings per Share (EPS): $1.25, compared to the $1,16 expected

- Total avg. deposits $1.35t, est. $1.35t.

** The dashboard presents net profit and total revenue, hence these values differ from the summary, where net revenues were given.

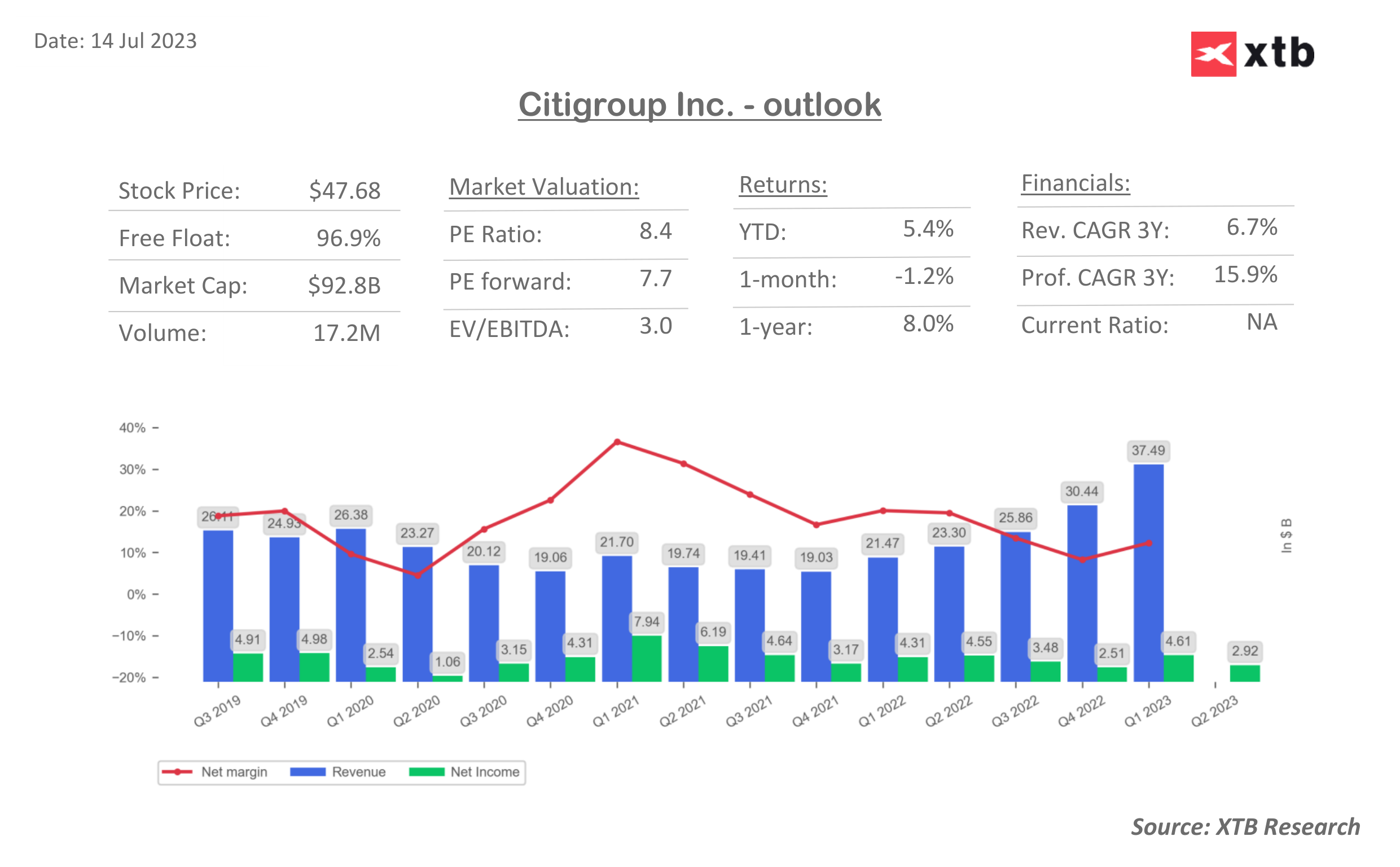

Citigroup (C.US)

Citigroup's profits fell by over a third in the last quarter, affected by slower corporate spending, fewer deals, and a costly round of layoffs. The bank reported a net income of $2.9 billion, down from $4.5 billion in the same period last year, with revenues dipping 1% to $19.4 billion. The bank's corporate and investment banking revenue fell 44%, and fees from its markets business dropped 13%. Despite these challenges, Citigroup's retail credit card business saw a 27% rise in revenue, helping the bank's overall profits exceed Wall Street's expectations. However, with the Federal Reserve's intent to continue raising interest rates, Citigroup anticipates more loans will sour, leading to a nearly 40% increase in its provision for loan losses to $1.8 billion. CEO Jane Fraser, who has been leading a restructuring effort since 2021, continues to guide the bank in its recovery from the financial crisis.

Key financials:

- Net Income: $2.9 billion, compared to the $4,55 billion last year

- Total Revenue: $19.48 billion, compared to the $19.3 billion expected

- Earnings per Share (EPS): $1.31, compared to the $1,32 expected

- Total deposits $1.32t

** The dashboard presents net profit and total revenue, hence these values differ from the summary, where net revenues were given.

Euphoria hits semiconductor stocks 📈 KLA Corp hits an all-time high

Experimental drug suspended❓💊 Shares od Disc Medicine lose as much as 7% 🚨

Divorce of Europe and the USA over Greenland

US Open: Optimism drives indices on Wall Street📈BlackRock surges after earnings