The US labour market created a whopping 353k jobs last month, and December figures were also revised higher to 333k. This is nearly double the 180k expected by analysts ahead of the data release, and it goes some way to explain the Fed’s cautious tone at its meeting earlier this week. The US economy created an average of 255k jobs for each month of 2023, which suggests that the US economy is not ready to land, and the growth rate remains strong.

Revisions boost jobs numbers, but gains are strong across the board

Looking at the detail of the NFP report first, the job gains were broad-based, with gains in professional and business services, healthcare, retail trade and social assistance. There were job losses in the mining and oil and gas sectors. Government employment also continued its trend higher. The establishment labour market data, which generates the NFP report, had been revised as part of the annual benchmarking process, updating seasonal adjustment factors, and reflecting updated population estimates. The impact of these revisions saw a 126,000 increase in employment in November and December 2023, while the March 2023 figure was revised downward by 266,000. What this means is that the labour market in the US actually strengthened from Q2 -Q4 and has started Q1 2024 on a high note.

The impact of revisions has probably led to an upward adjustment to the payrolls data and that may be a one off. However, the data is telling us that the labour market is still strong, and that the US economy is still creating a high level of jobs on a monthly basis.

Wage pressure is a threat to inflation

Demand for labour is still strong, and this is pushing up labour costs. Average hourly wages for January rose to 4.5% YoY, higher than the 4.1% expected. Although average wage data is not the perfect way to measure wage growth, and it is not the Fed’s preferred measure, it is none the less a strong reading, and one that could be perceived as inflationary. This is the highest reading for average wage growth since February 2023, and it suggests that after trending downwards, the pace of wage growth has now picked up. There could be further upward wage pressures since the unemployment rate fell a notch to 3.7% from 3.8%, which suggests that the labour market in the US remains tight.

The data plays into the Fed’s hands

The data exemplifies the concerns about inflation that we heard from the Fed and the BOE earlier this week. The Fed said it would not cut rates until it sees a continuation of the ‘good’ data on inflation. This data is too strong for the Fed, and it could lead to a further recalibration of market-based interest rate expectations. The BOE mentioned that it does not expect UK inflation to fall in a straight line, which is exactly what we have seen with US wage growth – it falls, stalls for a few months, and then starts to pick up again. Central banks are wary of the risks of cutting rates too quickly incase inflation starts to accelerate once more. This is why we might be in the ‘higher for longer’ stage for some time.

Shifting interest rate expectations

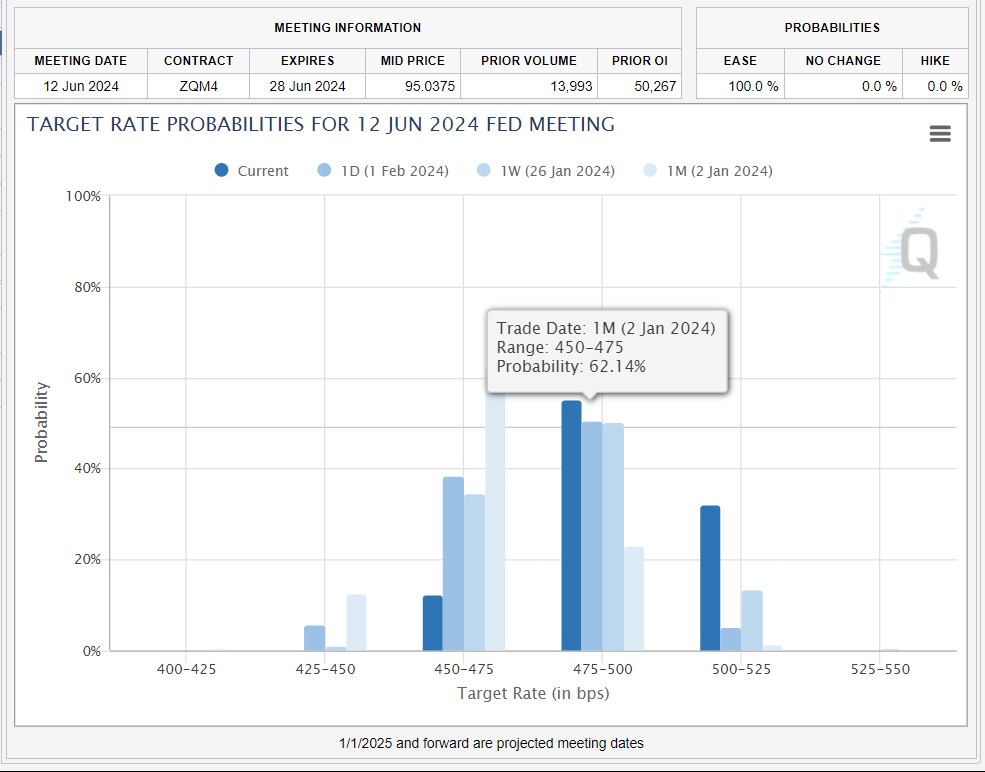

The initial market reaction was to further price out the prospect of a March rate cut. This now stands at less than 20%, according to CME Fedwatch tool, this had been at nearly 70% 1 month ago. There are now growing expectations that the first-rate cut won’t come until June. The market is currently pricing in a 32% chance of the first rate cut coming in the middle of the year, one month ago there was only a 1.5% chance of this happening.

Chart 1: CME Fedwatch tool – March interest rate expectations

Source: CME

The Market reaction: A good day for Meta

Futures markets are predicting a mildly positive open for the US index, while European indices are a sea of green. The German Dax made a fresh record high on Friday, and the European stocks look poised to outperform their US counterparts for the second week running, which we will talk about more next week. A higher for longer environment could make it harder for value stocks and cyclicals to stage a meaningful rally, and instead we could see investors rush to the safety of big tech. Meta is expected to shrug off concerns about higher interest rates and open up by more than 16%, while Amazon is expected to open up more than 6%. We mentioned yesterday that Meta’s results were the Carlsberg of earnings: not only is it producing fantastic results across all of its business lines, but it also generated $1bn in sales for its Reality Labs business for the first time, and it will distribute its first ever dividend. Meta is turning into the perfect hybrid stock: a growth stock that generates profits at a high level, has exposure to AI and also acts like a defensive stock that pays a decent dividend for a US firm. All in, today should be a good day for Meta.

US100 gains 1% before Nvidia earnings📈

Will Powell remain hawkish❓

Market story: Valentine's Day has never been so expensive? The prices of coffee, chocolate and gold are at an all-time high

Will the ECB be forced to follow the Fed?