- US consumer shows resilience

- Recession concerns mount in Europe

- Chinese economy slows in July

US – strong sales lifts US dollar

This was a decent week for the US data, especially against the ever deteriorating global backdrop. Especially retail sales report was strong as ex-auto sales surged by 1% m/m in July, well above the consensus for 0.4% gain. This category is now 3.8% up y/y, not a blistering pace but not recessionary either (in real terms sales grows closer to 2%). Furthermore, business surveys from NY and Philly slightly better than anticipated. On the other hand industrial output slid again and housing data was mixed with permits rising but starts falling (again). US still looks like Europe few months ago – with manufacturing already struggling but the broader economy holding up relatively well. This offers the Fed more time to act.

Start investing today or test a free demo

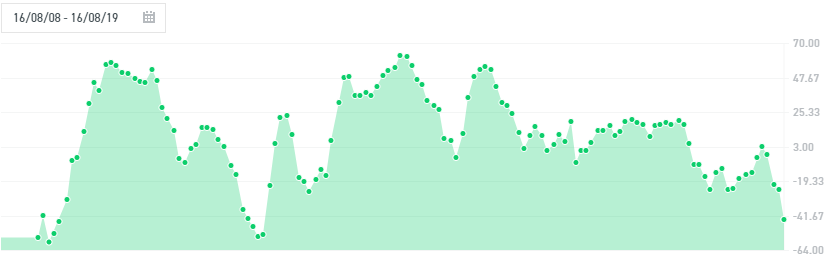

Open real account TRY DEMO Download mobile app Download mobile app Awful data from Europe and mixed from the US was enough to send EURUSD close to 2019 lows. Source: xStation5

Awful data from Europe and mixed from the US was enough to send EURUSD close to 2019 lows. Source: xStation5

Europe – contraction in Germany, ZEW sees new lows

Germany Q2 q/q GDP contraction was a highlight of the week but actually it’s the August ZEW that is more of a concern. The Q2 data had been anticipated and while we normally treat sentiment indicators like ZEW with caution, this time it might be a self-fulfilling prophecy. The manufacturing recession is already a fact and the risk is that business downbeat mood spreads across the whole economy. Flash PMIs next Thursday will be a good update if that is indeed taking place.

Germany’s ZEW sentiment index plunged to the levels last seen during the 2011 eurocrisis. Source: xStation5

Germany’s ZEW sentiment index plunged to the levels last seen during the 2011 eurocrisis. Source: xStation5

Asia – Chinese output growth at 17y low

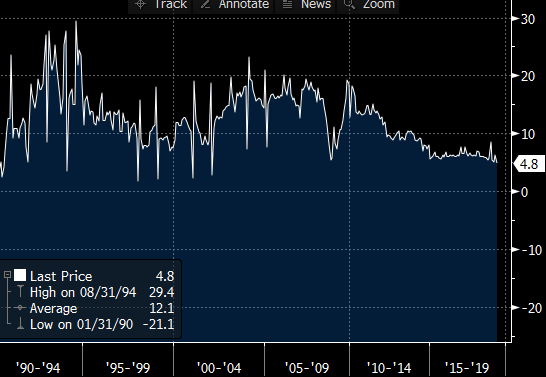

Last week we warned that stronger data from China and Japan was an unlikely turnaround sign and this was more than confirmed by the Chinese monthly reports for July. Sales, investments and industrial output all slipped big time with output growth (4.8%) the lowest in 17 years (would be much more if not for some wild base-related y/y swings). What is interesting, new loans data came out below expectations for the second month. Is this a sign that China is unable to stimulate its economy or it does not want to bail global economy ahead of the US elections? Outside of China we had a solid labour market report in Australia, but that’s been quickly balanced with a slide in New Zealand’s’ PMI.

If not for the base-related swings, the Chinese output growth would be the lowest since 1990. Source: Bloomberg

If not for the base-related swings, the Chinese output growth would be the lowest since 1990. Source: Bloomberg