CleanSpark (CLSK.US) - mining update 2nd of July

In June 2024, CleanSpark Inc. mined 445 bitcoins, increasing its total mined bitcoins for the year to 3,614. The company holds 6,591 bitcoins as of June 30, having sold 8.06 bitcoins at an average price of $67,514 each. CleanSpark's operational hashrate surpassed its mid-year target, reaching 20.4 EH/s, more than doubling from December, due to the acquisition of five new mining sites in Georgia. The company’s fleet includes 152,505 deployed miners with a month-end efficiency of 22.31 J/Th. Despite achieving significant milestones, including a definitive agreement to acquire GRIID Infrastructure and ongoing expansion projects, CleanSpark’s stock fell by 5.5% on July 2 but remains significantly up year-to-date.

Marathon Digital Holdings (MARA.US) - mining update 3rd of July

In June 2024, Marathon Digital Holdings mined 590 bitcoins, a 40% year-over-year decrease due to the April halving, but saw an increase in transaction fees to 6.8% of total income. The company’s average operational hashrate rose by 2% from the previous month to 26.3 EH/s, doubling from June 2023. Marathon held 18,536 bitcoins as of June 30, 2024, valued at over $1.1 billion, and did not sell any bitcoins during the month. The company aims to reach a hashrate of 50 EH/s by year-end, bolstered by operational improvements and the expansion of its mining fleet. Marathon also reported holding $268 million in cash and cash equivalents, contributing to a combined total of $1.4 billion in cash and BTC.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appBitfarms - mining update 1st of July

In June 2024, Bitfarms mined 189 bitcoins, increasing their total year-to-date production to 1,557 BTC. The company's installed hashrate reached 11.4 EH/s, with 10.4 EH/s operational, reflecting a 39% month-over-month increase. Bitfarms improved its energy efficiency to 25 w/TH, up 36% year-over-year. The firm sold 134 BTC for $8.8 million, retaining 905 BTC in treasury valued at $55.2 million. Bitfarms also advanced its U.S. expansion with a new 120 MW site in Pennsylvania, aiming to double its 2025 power capacity target to 648 MW and achieve a hashrate of over 35 EH/s. The company holds total liquidity of $194 million, including $139 million in cash.

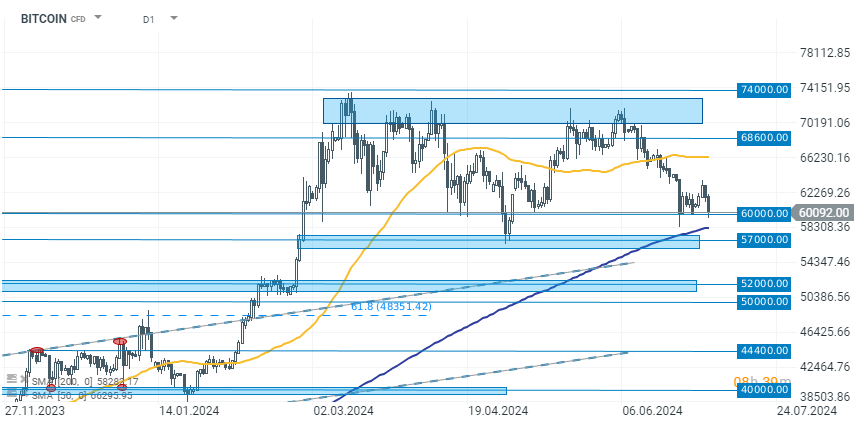

Bitcoin (D1)

A report on three Bitcoin mining companies indicates that these firms were not panic selling their assets in June. Instead, they were strategically and partially liquidating positions to maintain profitability. The selling prices ranged between $65,000 and $68,000 USD, suggesting that miners are reluctant to sell at lower levels. Nevertheless, the situation for Bitcoin remains challenging, with prices retesting the $60,000 USD level at the time of the publication. The summer months have not been favorable for cryptocurrency investors, even though record highs are being observed in stock market indices.

Source: xStation 5