Porsche AG - the famous manufacturer of the iconic 911 model - is going public. The planned IPO is expected to take place as early as September 29. What do we know about the IPO? Can it be attractive investment?

What do we know about Porsche's IPO?

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile appThe IPO will include a symbolic element. According to the website, it will involve 911 million Porsche AG shares (in tribute to the most famous model produced by the conglomerate). The pool will be split 50/50, i.e. 455.5 million preferred shares and 455.5 million ordinary shares.

The subscription period begins tomorrow. The news is good for Volkswagen and Porsche SE shares, which are trading up today. Volkswagen expects proceeds from the IPO and the sale of common shares to reach more than 19 billion euros.

A few notable news items should be pointed out:

-

Porsche SE (PAH3.DE) and Porsche AG, which is affected by the IPO, are not the same company. Porsche SE is already a listed company controlled by the Porsche-Piech family and is Volkswagen's largest shareholder. Porsche AG is a sports car manufacturer and is part of the Volkswagen Group, and it is its shares that are affected by the IPO.

-

The IPO includes 25% non-voting preferred shares. Half of this pool will be bought by Porsche SE at a premium over the IPO price of 7.5%. The remaining 12.5% of the preferred shares will be offered to investors.

-

Subscriptions for the shares began on Tuesday, September 20.

-

The manufacturer's preferred shares are to be offered to investors at a price in the range of 76.5 euros to 82.5 euros.

-

Ordinary shares will not be listed and will remain in the hands of Volkswagen, meaning it will remain the controlling shareholder of the company after Porsche AG goes public.

-

As Bloomberg reported, the Volkswagen Group (VW.DE) expects the company's valuation to reach €75 billion, which would give it an amount equivalent to almost 80% of Volkswagen's valuation.

-

Ordinary shares will have voting rights, while preferred shares will remain silent (non-voting). This means that those investing after the IPO will hold shares in Porsche AG, but will have no say in how the company is managed.

-

Porsche AG will remain under significant control of both Volkswagen and Porsche SE, and it's free float will include only a fraction of all shares and will offer no voting rights. This will make it difficult for any investor to build a significant stake in the company or push for change. What this may in turn do is reduce the risk of volatility caused by speculative moves by retail investors.

Why did Volkswagen decide to IPO Porsche?

Although Volkswagen is known around the world, the company consists of a number of brands that range from economy cars such as Skoda to premium brands such as Lamborghini, Ducati, Audi and Bentley. Of these brands, Porsche AG has been one of the most successful, focusing on quality and serving the top end of the market. Although Porsche accounted for only 3.5% of all deliveries made by Volkswagen in 2021, the brand generated 12% of the company's total revenue and 26% of its operating profit.

Source: XTB marketing materials

How much is Porsche AG worth?

Shortly after Volkswagen announced its IPO plans, Porsche AG's valuation hovered around €90 billion. Today, the value has dropped to around 65 to 85 billion euros due to a significant change in market conditions. Volkswagen itself is targeting a valuation in the range of 70.1 - 75.1 billion euros. This does not change the fact that it will still be one of the largest in German history. How does Porsche AG's valuation compare to its peers?

Assuming even the upper end of estimates for valuation, Porsche's valuation would still be lower than that of luxury carmaker Ferrari according to benchmarks.

Porsche's valuation in the €65-85 billion range would equate to a projected 2023 EV/EBITDA ratio of 8.5-11.3 and a P/E of 12.6-16.5, according to a person associated with handling the IPO process.

By comparison, Mercedes is valued at a projected EV/EBITDA ratio for 2023 of 1.46, BMW at 6.26 and Ferrari at 18.13

Similarly, the projected P/E ratio for 2023. for Mercedes is 4.80, for BMW 4.96 while Ferrari is valued at 32.27.

Valuation of comparative companies according to Bloomberg data as of 26/09/2022.

Source: Bloomberg

Volkswagen said it plans to pay 49% of the total gross proceeds from the listing to shareholders in the form of a special dividend, and use the rest to invest in the company and implement a new strategy.

According to HSBC, a valuation of 70-75 billion euros may be exorbitant (this would represent almost 80% of the valuation of Volkswagen as a whole). According to analysts, a figure in the range of 44.5 - 56.9 billion euros is more plausible.

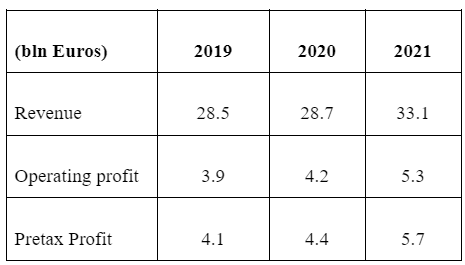

How is Porsche doing financially?

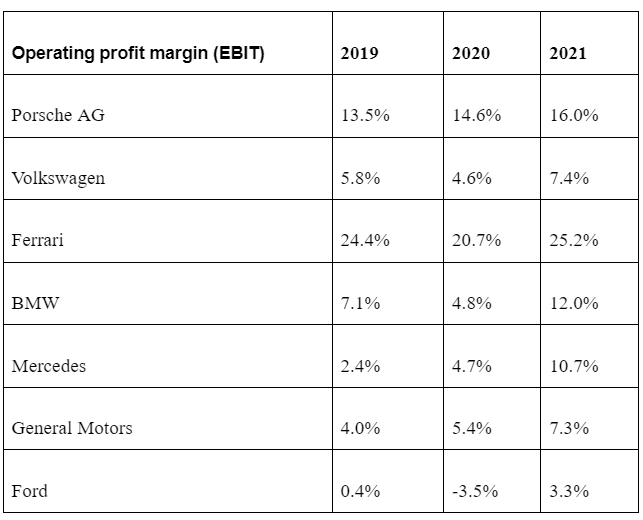

The company has increased sales and profits for at least three consecutive years, and in 2021 generated more than 30 billion euros in sales and more than 5 billion euros in operating profit (EBIT). The company has seen steady revenue growth with a rising operating margin, which is also well above that of wi competitors.

Selected financial results of Porsche AG

Source: Company

Profitability of Porsche AG's operating profit compared to peer companies

Source: Company

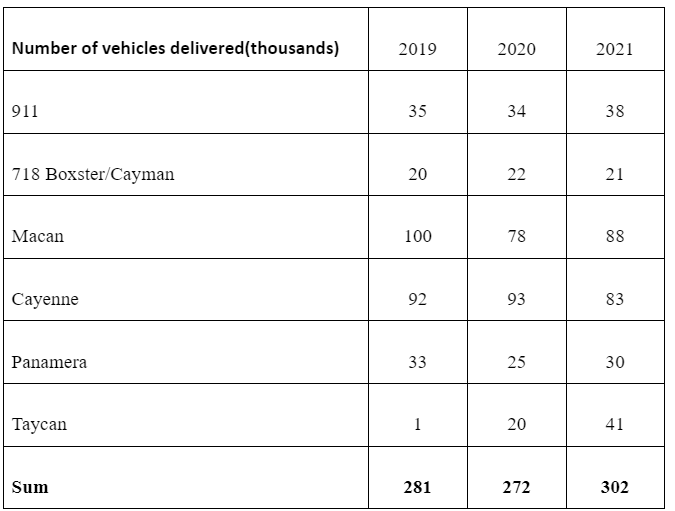

Porsche AG currently has six core models available. These include the 718 and 911 sports cars, the Taycan electric sports car, the Panamera luxury car and the Macan and Cayenne SUVs.

The company has seen steady production growth. In 2021, Porsche delivered more than 300,000 vehicles, a new record for the company, following a steady increase in production in recent years.

Porsche sales results by model

Source: Company

Below is an infographic showing the highlights of Porsche AG's history:

Source: XTB marketing materials

Summary

Porsche AG's valuation appears attractive against its peers, especially when compared to Ferrari. The company has seen year-on-year growth in sales revenue and operating profit margin, which is no small achievement in the face of a challenging market environment. A potential risk factor could be the valuation, which, representing almost 80% of the valuation of Volkswagen as a whole, seems excessive. The premium sports car segment, in which Porsche AG is well established, seems to be relatively immune to the effects of the economic downturn and rising inflation, so the company's shares may have upside potential in the long term. They will be available on XTB's offering on IPO day.