Shares of haptic technology company Immersion (IMMR.US) gained nearly 8% in yesterday's session and are trading 3% higher before the open as investors were optimistic about a new $50 million share repurchase program and a special dividend the company plans to share with shareholders. Yesterday's increases took place on a high volume of nearly three times the average.

- Based on the company's strong operating performance in 2022, the board announced the payment of a special dividend in addition to the recently declared quarterly dividend of $0.03 per share;

- Immersion's board of directors approved a new share repurchase program of up to $50 million for 2023, with the timing, price and size of any repurchases depending on a number of factors including the market price of the company's shares and general market and economic conditions. Of course, the adopted program can be discontinued or suspended at any time. In 2022, the company repurchased a total of 2,542,065 shares (nearly 7.5% of outstanding shares);

- Eric Singer was appointed President and Chief Executive Officer (CEO). The Board of Directors said it believes Singer's significant experience in operations, transactions and capital allocation, along with his technology expertise, will help create long-term shareholder value;

- Former CEO, Franic Jose will assume his previous role as General Counsel and will oversee the Company's ongoing intellectual property licensing activities (more than 2,000 patents in haptic technology);

Eric Singer commented on the company's current events and business as the new CEO: "Immersion has a unique set of assets, and the Board is redoubling its efforts to create a step function increase in value over the long term. Over the past two years, we have driven a significant increase in profitability, helping to fortify Immersion’s balance sheet with record levels of cash and investments. We now have multiple levers to drive shareholder value concurrent with our workstreams around monetization of our intellectual property, which encompasses entering new license arrangements and renewing existing licenses as well as our targeted litigation strategy, including but not limited to our recent lawsuit against Meta Platforms. Our special dividend and stock repurchase program underscore our financial flexibility to return value to shareholders in a very uncertain macro environment, and we intend to leverage our financial resources to continue to increase shareholder value."

- The company will pay a special dividend of $0.10 per share on January 30, the ex-date will be January 15. In addition, the standard dividend will be $0.03 per share, its pay-date and ex-date will coincide with the special dividend.

Eric Singer, who manages the investment fund VIEX Capital, which operates in the new technology industry, has been buying up Immersion shares extensively recently,.The last purchase took place on December 1, at a price of $7.29 per share. Source: Finviz

Eric Singer, who manages the investment fund VIEX Capital, which operates in the new technology industry, has been buying up Immersion shares extensively recently,.The last purchase took place on December 1, at a price of $7.29 per share. Source: Finviz

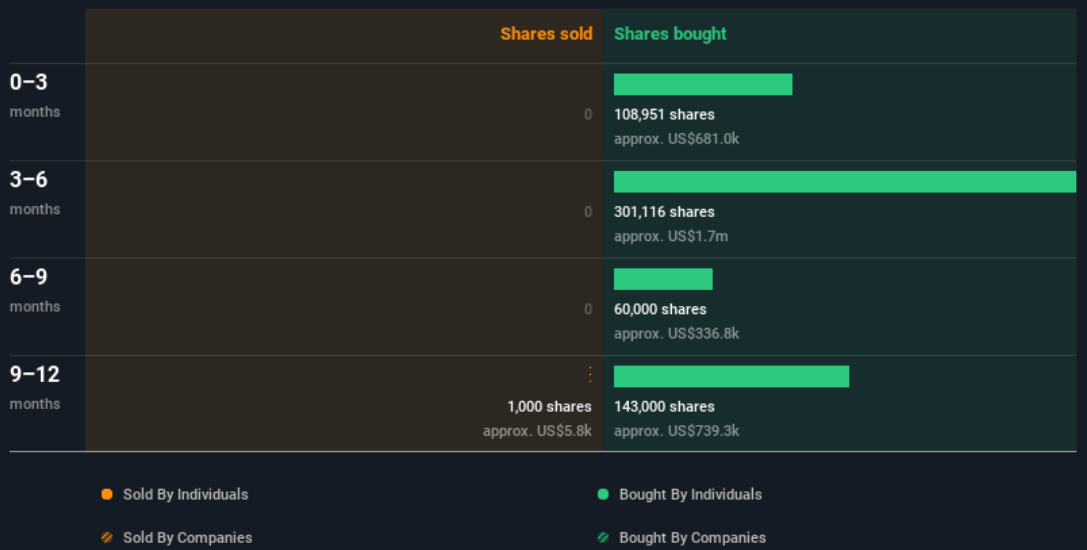

Over the past 12 months, Immersion's shares have been intensively repurchased by entities associated with the company.Significantly, sales transactions have been almost unrecorded, with the exception of 1,000 shares sold, worth nearly $5,800. Individuals close to Immersion's so-called insiders now hold more than 5% of the company's shares. Source: SimplyWallStreet

Over the past 12 months, Immersion's shares have been intensively repurchased by entities associated with the company.Significantly, sales transactions have been almost unrecorded, with the exception of 1,000 shares sold, worth nearly $5,800. Individuals close to Immersion's so-called insiders now hold more than 5% of the company's shares. Source: SimplyWallStreet

- In the face of declines of technology giants in a bear market, it is common for investors to return to 'forgotten stocks'. One such seems to be Immersion, a small-cap company. Some investors may be interested in the company's stock in view of the increasing use of haptic technology, which enables the transfer of touch over a distance and interaction with digital technology (including VR devices and controllers, cockpits of cars, airplanes, medicine, precision industry);

- Some analysts consider haptic technology to be one of the cornerstones of the metaversion and development of VR technology towards the closest possible reproduction of real-life experiences in virtual reality. Immersion has won lawsuits against Microsoft, Sony and a settlement with Apple. Uncertainty, however, is created by the company's historically uneven earnings per share structure and volatile revenues, which depend mainly on demand for its intellectual property.

On the fundamental side, the company's C/Z ratio is around 18, nearly 20% lower than the median C/Z for NASDAQ companies. The price-to-book ratio is a C/WK of 1.65, nearly double the average of technology companies. Net margin in Q1, Q2 and Q2 2022 was 44%, 26% and 31.5%, respectively. Return on equity (ROE) is around, 8.5% and is similar to Amazon's (AMZN.US) current performance.

Chart of Immersion (IMMR.US) and US100, D1 interval. The chart shows Immersion's divergence with the NASDAQ index (US100, yellow). The company's shares have risen nearly 34% over the past year, compared to 34% declines in the NASDAQ index. Since the start of the new year, the index has lost nearly 0.5% against the company's 7% gain. Source: xStation5

Chart of Immersion (IMMR.US) and US100, D1 interval. The chart shows Immersion's divergence with the NASDAQ index (US100, yellow). The company's shares have risen nearly 34% over the past year, compared to 34% declines in the NASDAQ index. Since the start of the new year, the index has lost nearly 0.5% against the company's 7% gain. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡