International Business Machines (IBM) reported strong fourth-quarter earnings, beating analyst expectations on both the top and bottom lines. The company also issued a bullish outlook for 2024, with strong guidance for free cash flow and revenue growth. IBM shares are up nearly 13% after yesterday’s report.

Key Highlights:

Start investing today or test a free demo

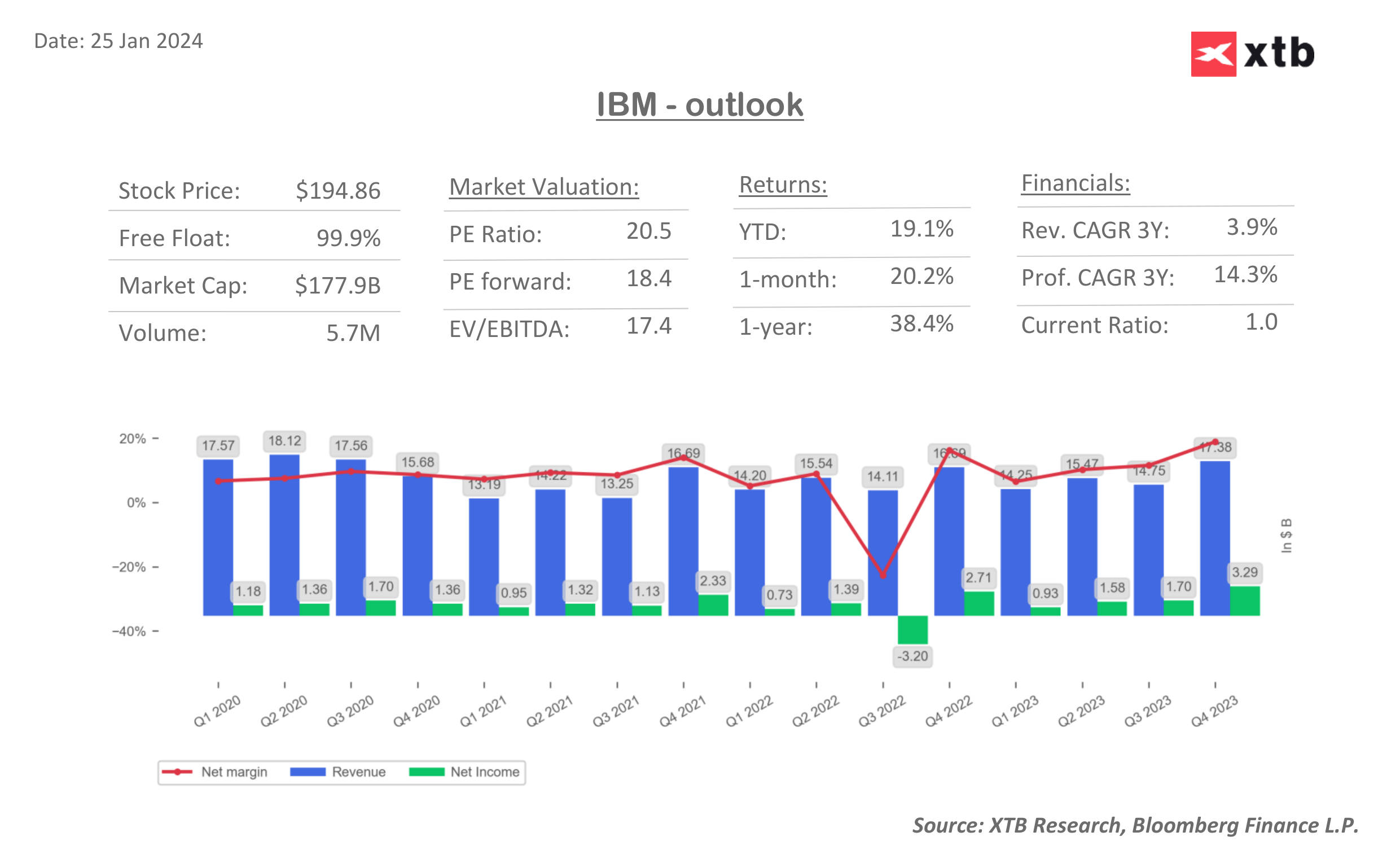

Create account Try a demo Download mobile app Download mobile app- Revenue: $17.38 billion, up 4.1% year-over-year (y/y), above the consensus estimate of $17.29 billion

- Software revenue: $7.51 billion, up 3.1% y/y, just below the consensus estimate of $7.69 billion

- Consulting revenue: $5.05 billion, up 5.8% y/y, just below the consensus estimate of $5.11 billion

- Infrastructure revenue: $4.60 billion, up 2.7% y/y, in line with the consensus estimate of $4.35 billion

- Adjusted gross margin: 60.1%, up from 58.6% y/y

- Operating EPS: $3.87, up from $3.60 y/y

- Free cash flow: $6.09 billion, up 17% y/y

Comments from company:

CEO of the company, Arvind Krishna attributed the strong fourth-quarter results to continued adoption of hybrid cloud and AI offerings. He also said that client demand for AI is accelerating, with IBM's book of business for Watson X and generative AI doubling from the third quarter to the fourth quarter. IBM's strong outlook for 2024 is based on its expectation for continued strong demand for hybrid cloud and AI offerings. The company also expects to benefit from its investments in data and automation. IBM also announced further job cuts, similar to other tech companies like Alphabet or Amazon.

Comments from Wall Street analysts:

Analysts were positive about IBM's fourth-quarter results and outlook. Analysts from Evercore Isi called the results positive for the story and said that IBM is an underappreciated AI beneficiary. Jefferies analyst Brent Thill said that IBM's revenue beat was driven by its infrastructure business and that the company is "on a turnaround story with FCF support." Bloomberg Intelligence said that IBM's outlook for free cash flow is "encouraging and suggests greater operational efficiencies and steady organic growth."

Overall, IBM's fourth-quarter results and outlook were strong. The company is well-positioned to benefit from the continued growth of hybrid cloud and AI, and its investments in data and automation should drive future growth.

IBM shares have jumped to the highest since 2024 and are only 10% off the all time highs. Source: xStation5