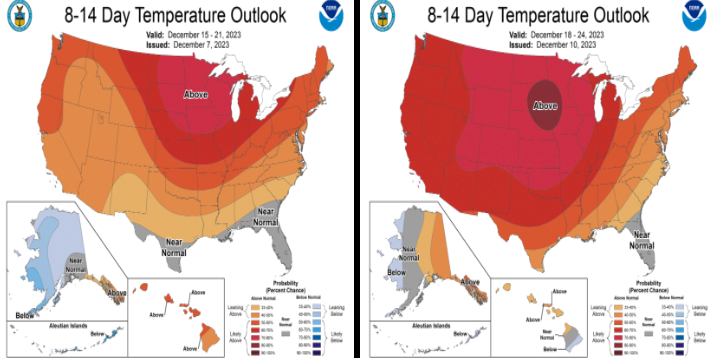

Natural gas prices are slumping at the start of a new week, with US prices (NATGAS) dropping over 6% at press time. Declines can be also spotted in Europe with the front-month TTF benchmark dropping 5%. Drop is driven primarily by new weather forecasts for the United States, which continue to show that a period of above-average temperatures is ahead. However, new forecasts show that above-average temperatures are expected in a much bigger part of the US in the next 8-14 days, compared to pre-weekend forecasts.This means that demand for heating will be lower, and it means that demand for natural gas will be lower as well.

New forecasts for the 8-14 day ahead period (right map) point to above-average temperatures across a bigger part of the US than pre-weekend forecasts did (left map). Source: Bloomberg Finance LP

While Europe has faced a cold snap recently, demand for natural gas on the Old Continent is also subdued. Inventories in Europe are fuller-than-usual for this period of the year, what makes markets less concerned over energy supplies for this heating season. As a result, an interesting development took place - TTF price for January delivery dropped below TTF price for April delivery. This shows that markets now seem to be more concerned about Europe's ability to fill inventories for the next winter rather than about supplies for this heating season.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

Taking a look at NATGAS chart at D1 interval, we can see that the price has been trading in a very steep bearish channel recently. NATGAS launched today's trading with an over-2% bearish price gap, clearing the $2.50 support zone in the process. Declines deepened during the Asia-Pacific trading, with price dropping to the lowest level since mid-June 2023. Pullback was halted after launch of the European trading, but bulls are yet to regain control over the market and begin to trim losses. The next major support zone to watch can be found in the $2.15 area.

Source: xStation5

Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)