The Fed surprises with a 50 basis point cut, given the consensus of Bloomberg economists, where more than 110 forecasts pointed to a 25 basis point cut. In the anticipation of the more aggressive Fed rate cuts cycle, US dollar weakens and gold rallied above $2600 per ounce. However, the Fed opted for a stronger cut, pointing to strong declines in inflation and a slowing labor market. The key point, however, is that the Fed's statement does not see economic problems, as the macroeconomic projections also indicate:

- The Fed minimally cuts its GDP growth projection to 2.0% from 2.1% for 2024, but maintains its growth outlook at 2.0% in 2025 and 2026. It also sets a new projection for 2027 also at 1.8%

- The forecast for the unemployment rate has been raised upward, given the current market situation. The unemployment rate is expected to be 4.4% this year (up from 4.0% in the forecast and 4.2% currently). The rate in 2025 also at 4.4% (up from 4.2%), followed by 4.3% in 2026 and 4.2% in 2027 (along with the long term)

- Inflation forecasts were sharply reduced to 2.3% y/y this year from 2.6%. For next year, the PCE forecast was reduced to 2.1% from 2.3%. The forecast for 2.0% for 2026 and the long term was maintained at the same level.

- Forecasts for core inflation were also lowered, to 2.6% y/y this year and to 2.2% y/y next year.

- The target, however, is to be achieved as before in 2026

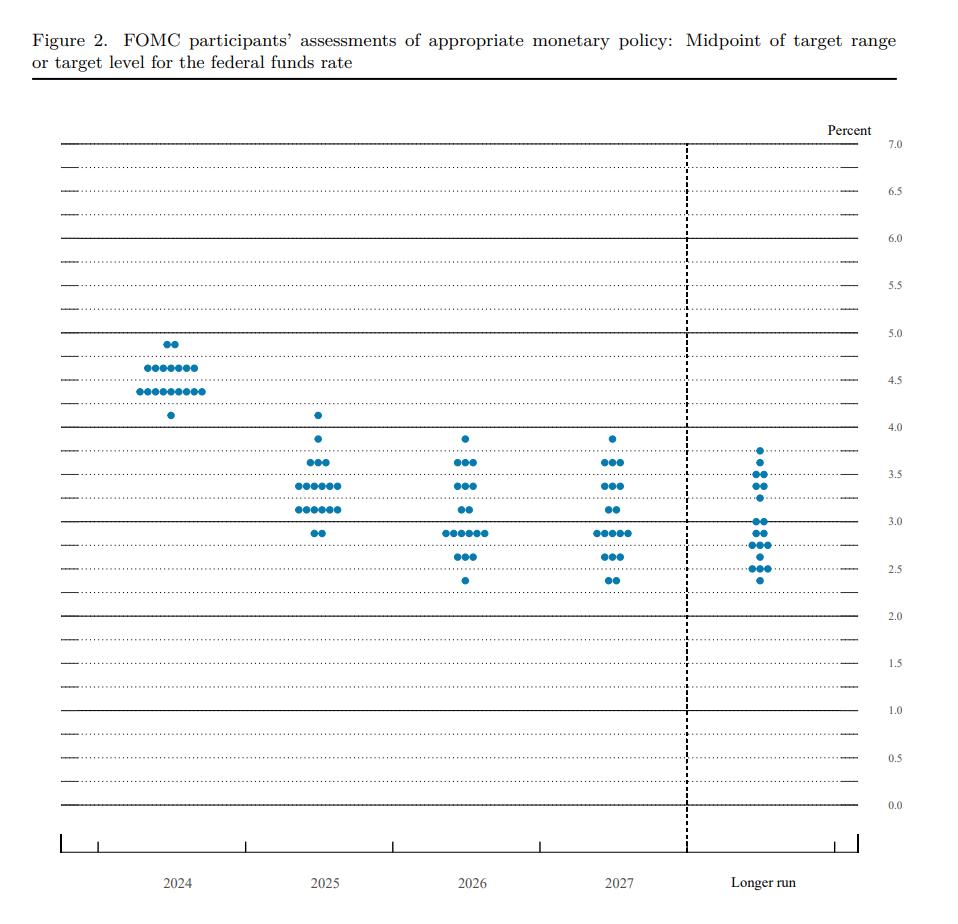

- Expected interest rates have been lowered very sharply, with two-three more cuts expected this year (with a median of 4.4%) and the expectation of another 4-5 cuts in 2025 to 3.4%. The Fed also sees rates at 2.9% in 2026 and the same level in 2027 and long term. It is worth remembering that June forecasts pointed to just 1 cut this year of 25 basis points

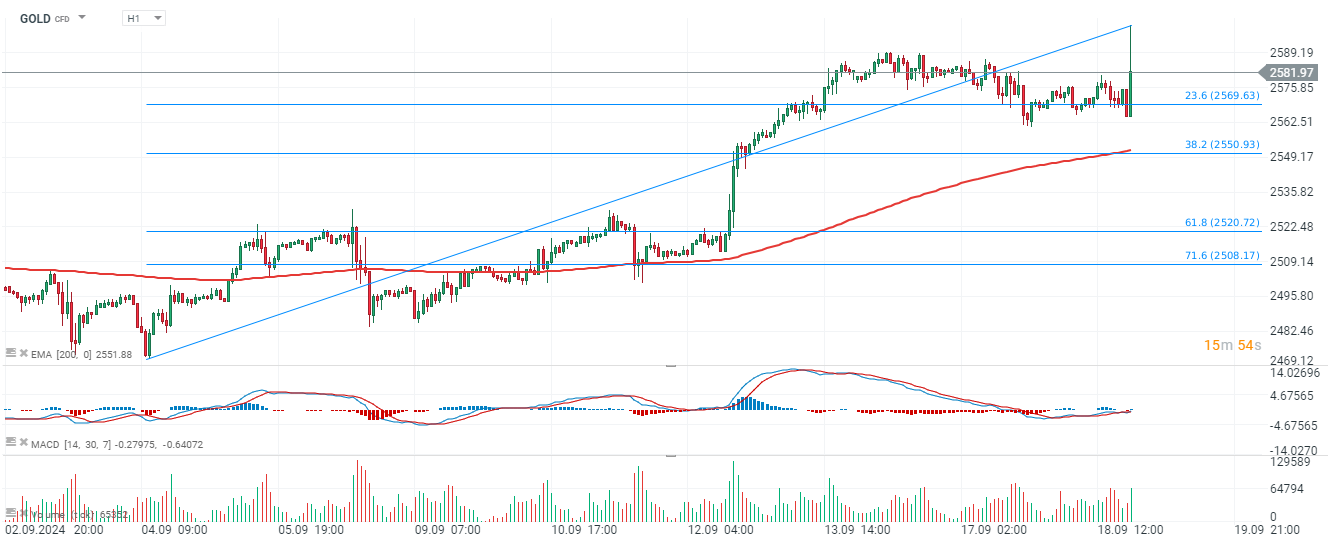

GOLD rallies almost 0.6% today and for a while the precious metal reached new all-time high above $2600 per ounce.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app Source: xStation5

Source: xStation5

.

Source: Fed

Source: Fed