Gold futures are gaining nearly 1.6%, with yields on US 10-year US bonds falling 3 basic points, below 4.2%. Silver is also trading up 1.8% today.

- Following Fed Chairman Jerome Powell's speech yesterday, Fed interest rate contracts are pricing in a September rate cut with a near 100% probability;

- Powell signalled that the Fed will cut rates before inflation reaches its 2% target, and that delaying the decision would weaken the economy;

- Perspectives of U.S. interest rates pressuring the US dollar and bond yields, making bullion more attractive. Gold prices are up more than 19% this year, following a 13% rise in 2023.

- Even higher-than-expected US retail sales data for June, which strengthened the dollar slightly, failed to hold gold back today;

- A still bullish backdrop for gold trend prices is also provided by recession risk and geopolitics, which, according to a BofA FMS survey in the face of ongoing disinflation, is now the biggest 'tail risk' to the health of the global economy and asset valuations

- The soon expected normalization of monetary policy in the United States appears to be a key factor, driving up gold prices and potential spot purchases by ETFs.

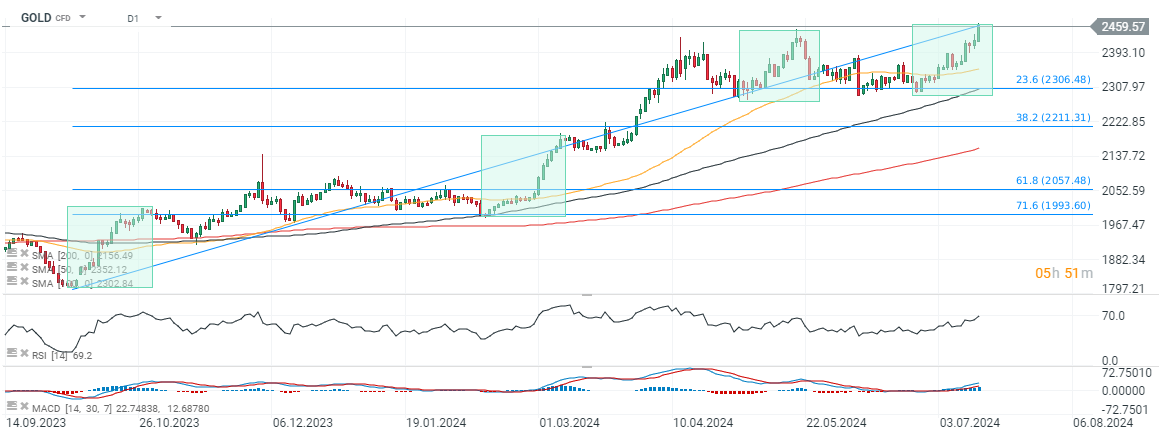

GOLD (Interval D1)

Gold is climbing to new historic highs today. Source: xStation5

Daily summary: Technology Drives Wall Street as Tehran Seeks Truce

Cocoa slumps 5% falling below $3000 firs time since May 2023 📉

EU Suspends Landmark Trade Deal. Gold is up 2%

⛔ Trump’s tariffs ruled illegal: will companies receive billions of dollars in refunds?