Sentiment on Wall Street is weak in early Monday trading, with US500 futures down nearly 1.3%. The primary reason is that investors still see no signs of a de-escalation in trade tensions from either the U.S. or China. Beijing has reiterated that it will not accept what it calls the U.S.’s 'imperial' stance, and once again launched military drills in the Taiwan Strait.

- Additionally, there is no major trade agreement on the horizon. Japanese diplomats have not signed any deal with the U.S., signaling that American trade proposals may still be deemed ‘unacceptable’ by several nations.

- Uncertainty surrounding Federal Reserve policy is also weighing on stocks. The U.S. dollar (USDIDX) has dropped to its lowest level since March 2022, after Donald Trump threatened that he is willing—and able—to fire Fed Chair Jerome Powell.

- Today, commercial lines casualty and property insurance company, W R Berkley (WRB.US) is the largest companies that will report earnings. Comerica (CMA.US) reported better than expected results, shares of regional banking company are up almost 11% in US pre-market.

Tomorrow GE Aerospace, RTX Corp and Lockheed Martin will report earnings before the market open. After the US session, Tesla, Intuitive Machines and SAP will report. Chinese CATL launched new generation of batteries for Chinese EV models, and market may see this fact as further pressure on Tesla business.

Start investing today or test a free demo

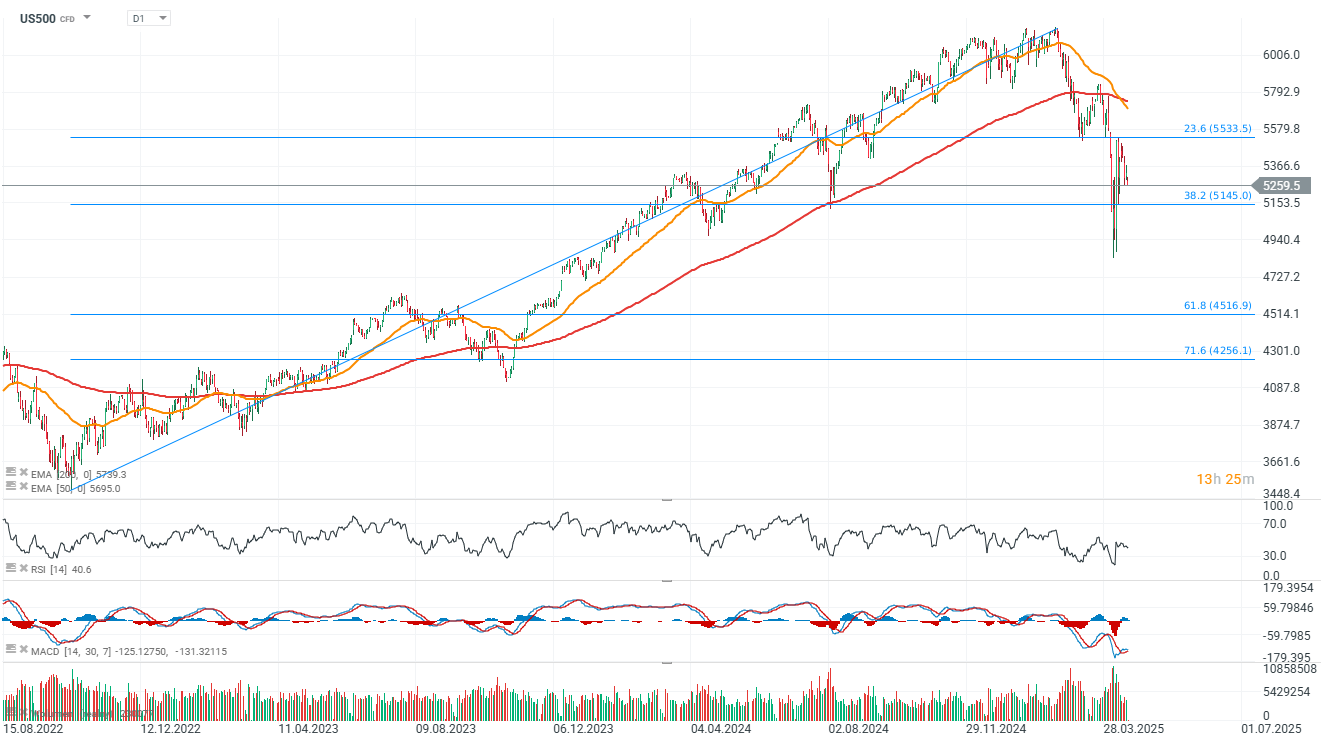

Create account Try a demo Download mobile app Download mobile appUS500 (D1 interval)

Source: xStation5