Ford Motor (F.US) recorded a strong decline in operating profit in 2Q24 despite an increase in sales. The main reason turned out to be higher-than-expected warranty costs, which particularly affected the company's largest segment, Ford Blue. This translated into an erosion of profitability and, as a result, a strong sell-off for the carmaker. The company is losing more than 13% in pre-opening trading.

Source: xStation

Source: xStation

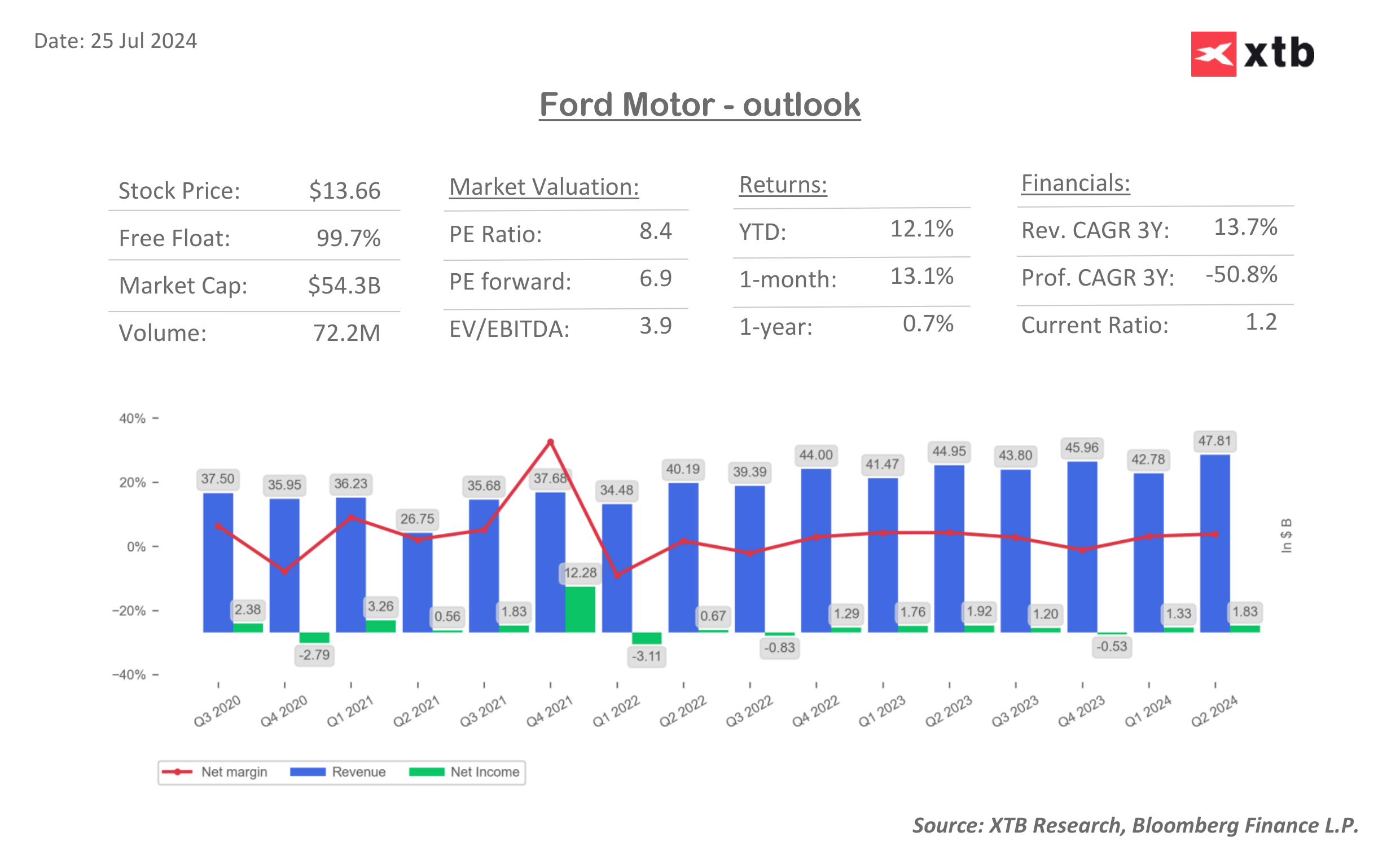

The company reported a 6.2% year-on-year increase in revenue to $47.8 billion. The strongest contributor to the growth was the Ford Pro segment, with sales of $17 billion, up 9% y/y. Ford Blue, a segment that consists of internal combustion engine cars, also posted a y/y increase to $26.7 billion (+7% y/y). In this case, however, sales were not connected with improved margins, as the company's EBIT in this segment fell to $1.17 billion (-50% y/y). Such a strong decline in profitability is due to large warranty costs, which are currently weighing most heavily on the company's profitability. On top of that, the electric car segment (Ford Model E) turned out to be much weaker than expected, both at the revenue level (-40% y/y) and at the margin level itself (the segment generated a loss of -$1.14 billion). This resulted in a final adjusted operating profit of $2.8 billion, down -26% y/y (against a forecast of $3.73 billion).

Source: XTB Research, Bloomberg Finance L.P.

A strong growth in warranty costs, a decline in sales in the electric car segment, along with the operating loss generated by the segment as a result of a tight EV market, contributed to surprisingly low adjusted earnings per share of only $0.47 (-35% y/y) in 2Q24 versus an estimate of $0.67.

2Q24 RESULTS

- Total revenue $47.8 billion, +6.2% y/y

- Ford Blue revenue $26.7 billion, est. $25.63 billion

- Ford Model e revenue $1.1 billion, est. $1.31 billion

- Ford Pro revenue $17.0 billion, est. $16.48 billion

- Adjusted EBIT $2.8 billion, -26% y/y, est. $3.73 billion

- Adjusted EBIT margin 5.8% vs. 8.4% y/y, est. 7.99%

- Ford Blue EBIT $1.17 billion, est. $2.43 billion

- Ford Model e EBIT loss: -$1.14 billion, est. loss -$1.38 billion

- Ford Pro EBIT $2.56 billion, est. $2.57 billion

- Adjusted EPS $0.47, est. $0.67

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street